Homerun Resources Inc. is delivering on a vision that only a few years ago seemed out of reach: Creating Brazil’s first fully integrated solar glass supply chain.

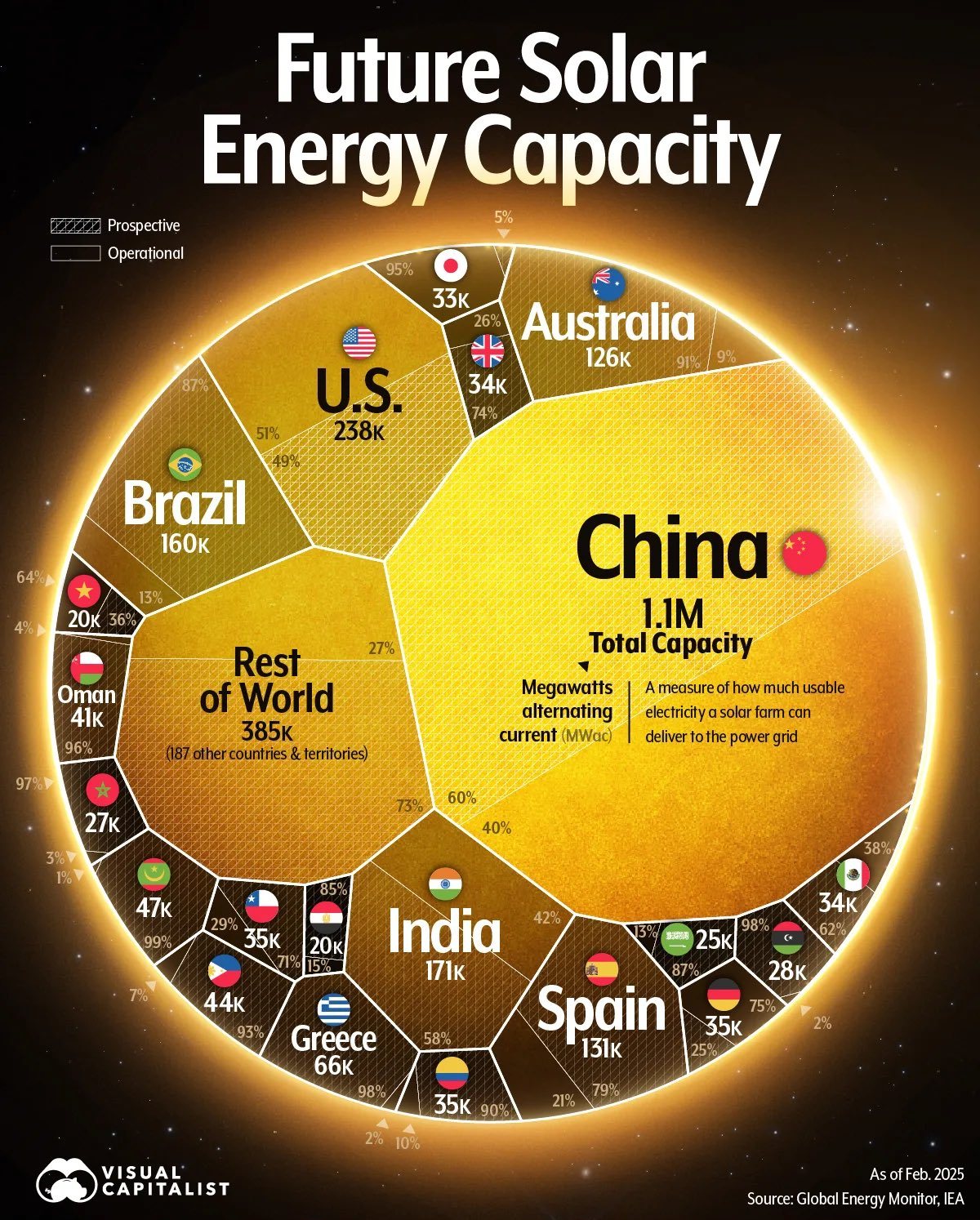

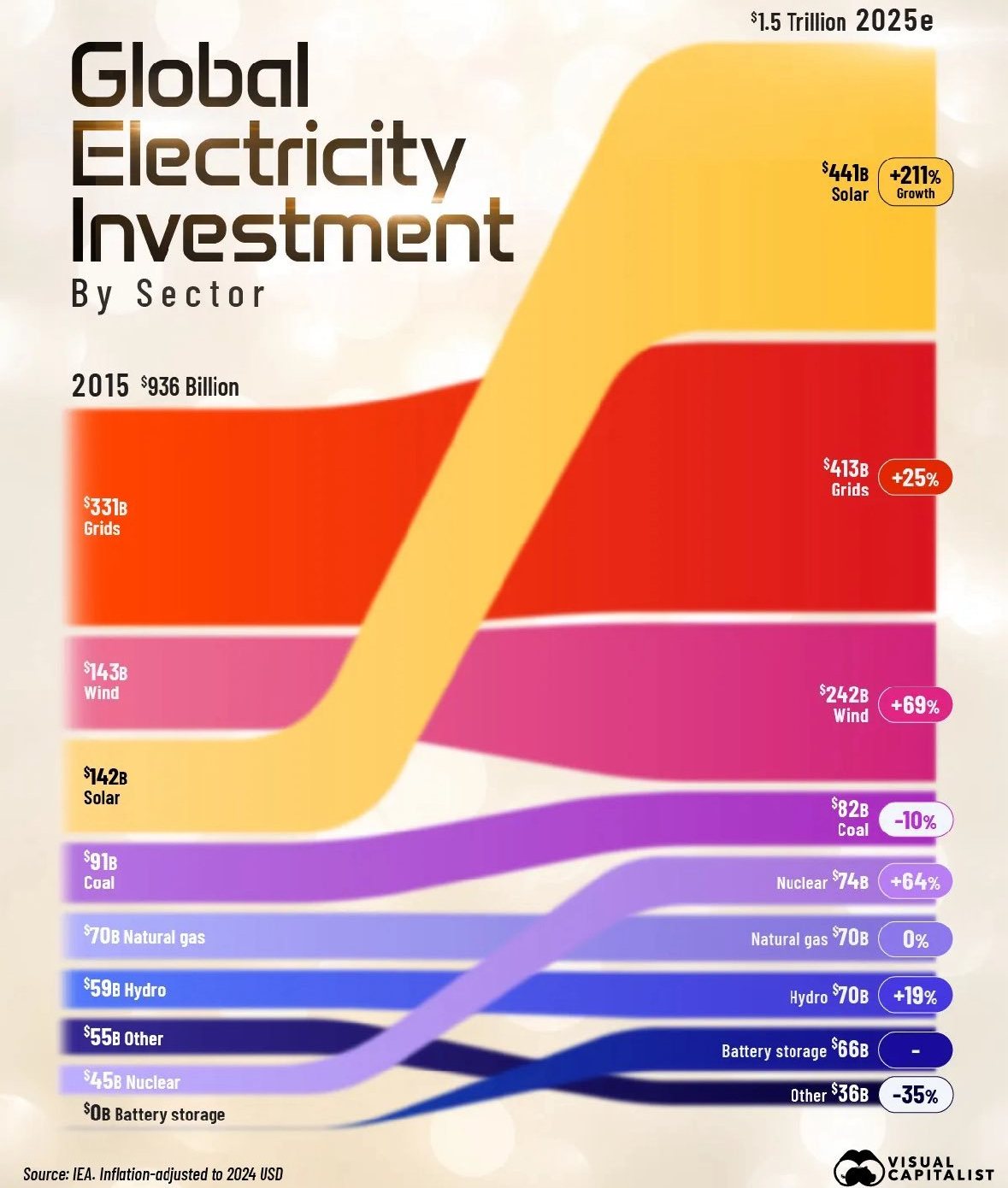

With control of Santa Maria Eterna, one of the world’s purest and largest silica sand districts, and a solar glass plant now advancing through a full Bankable Feasibility Study (BFS), Homerun is positioned at the heart of a global solar investment wave worth nearly half a trillion dollars.

This rare combination of scale, purity, and vertical integration gives Homerun a decisive competitive advantage over peers in Australia, Canada, or elsewhere, who face higher impurities, more complex permitting, and far greater CAPEX requirements.

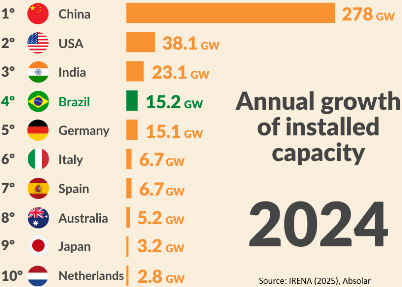

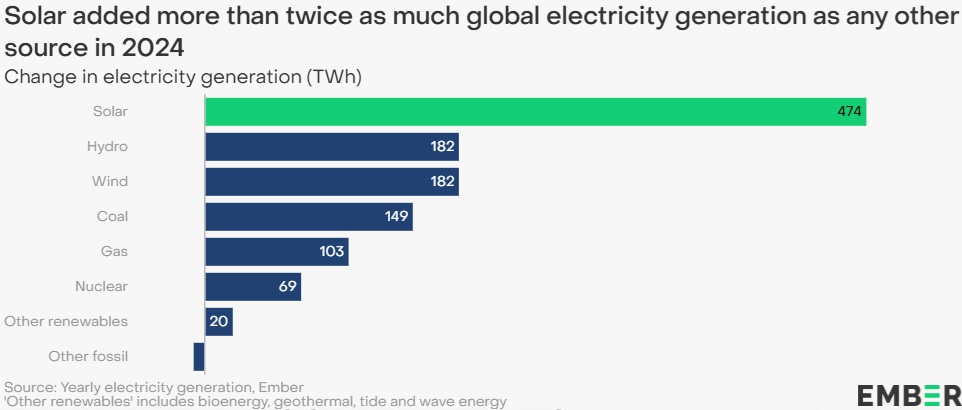

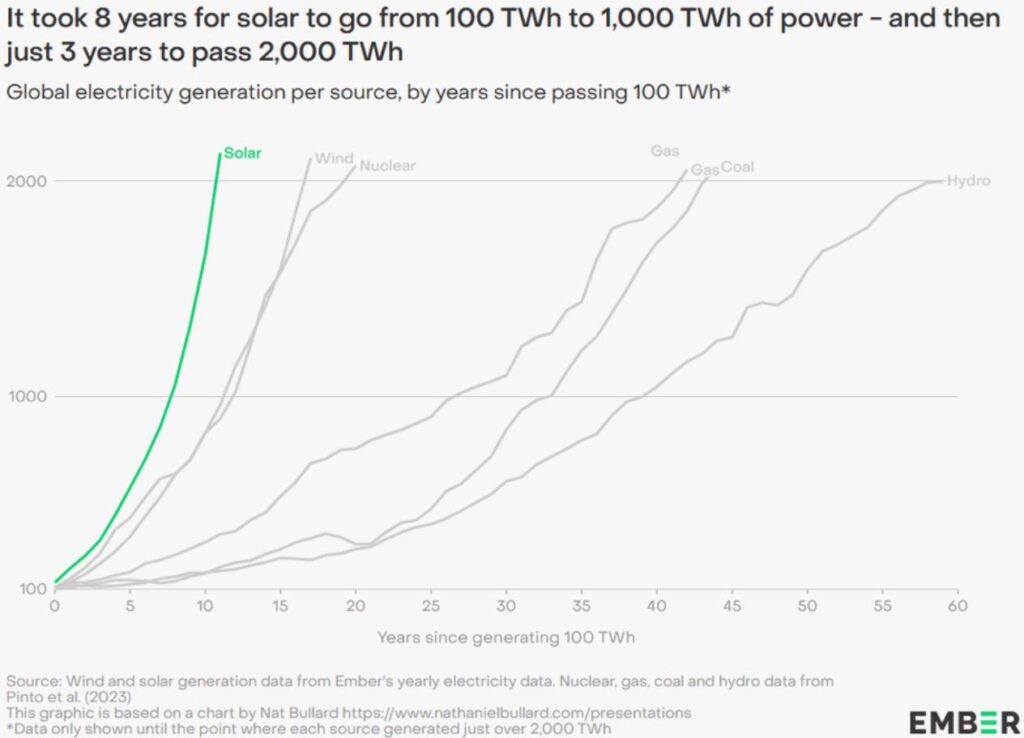

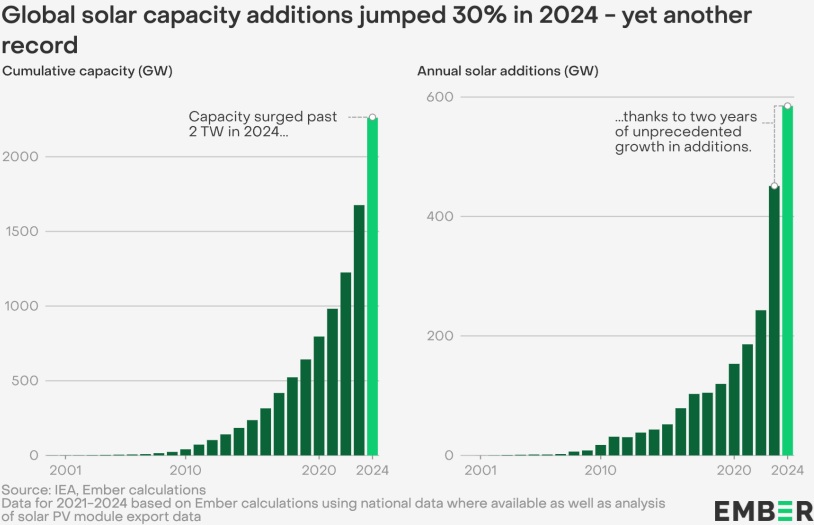

The global energy transition is accelerating, and solar is leading the charge. In 2025, global investment in the solar sector is expected to surpass 450 billion USD, making it the single largest category of power generation spending worldwide.

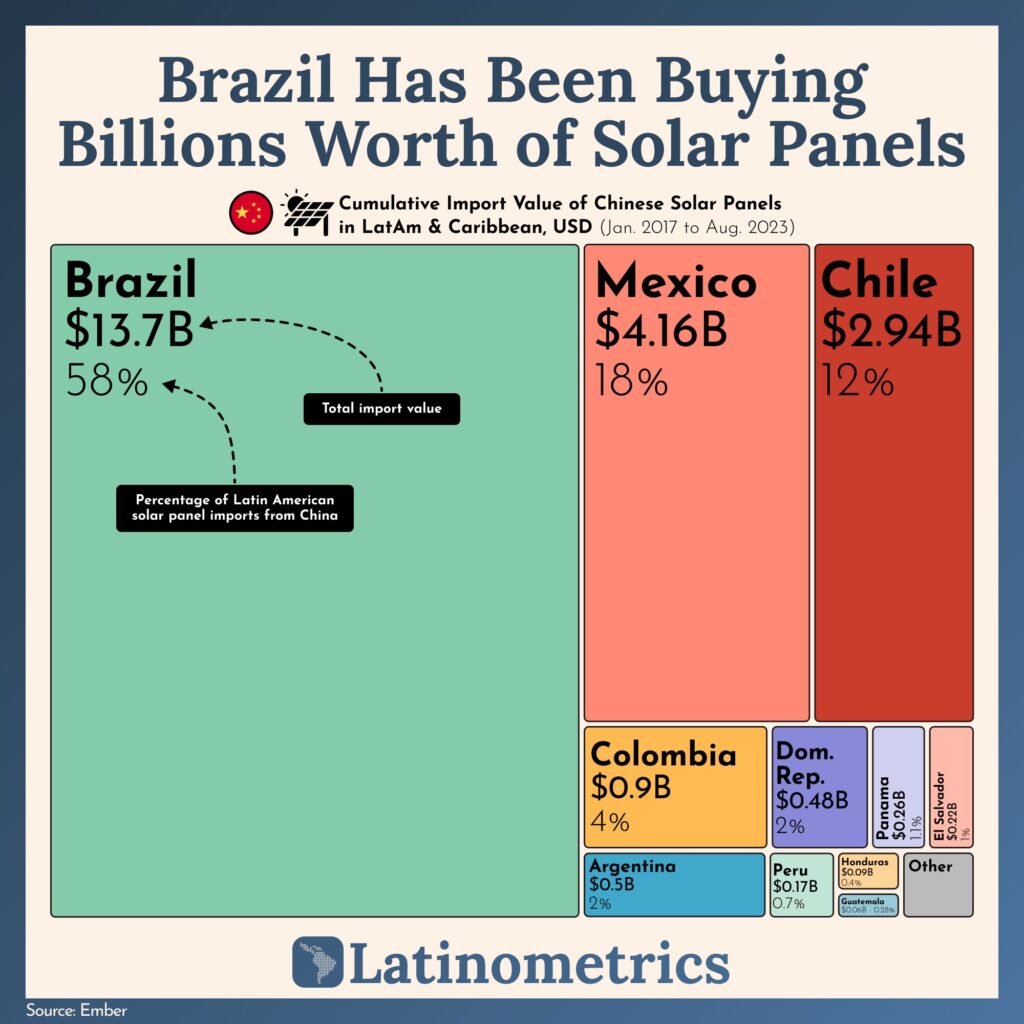

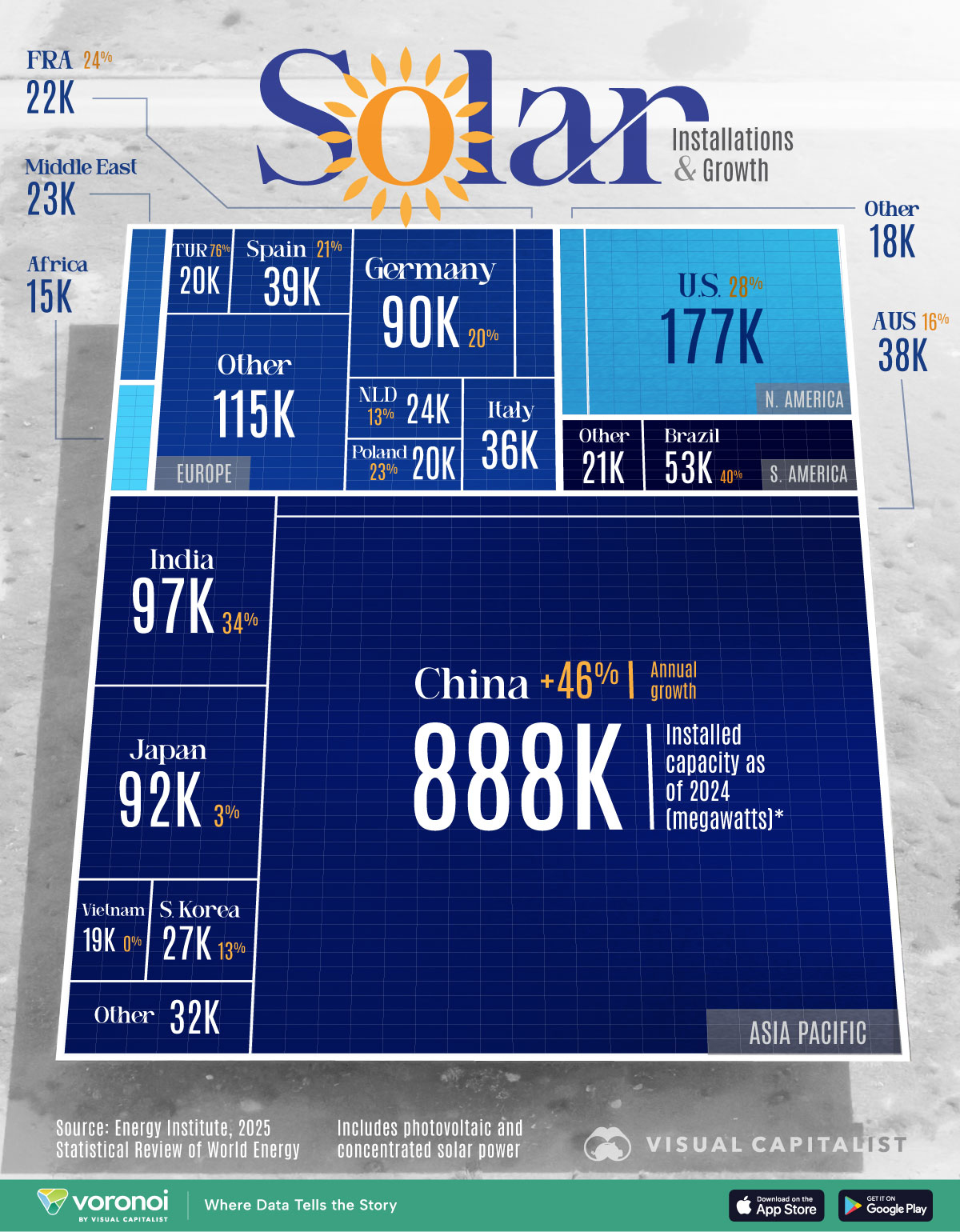

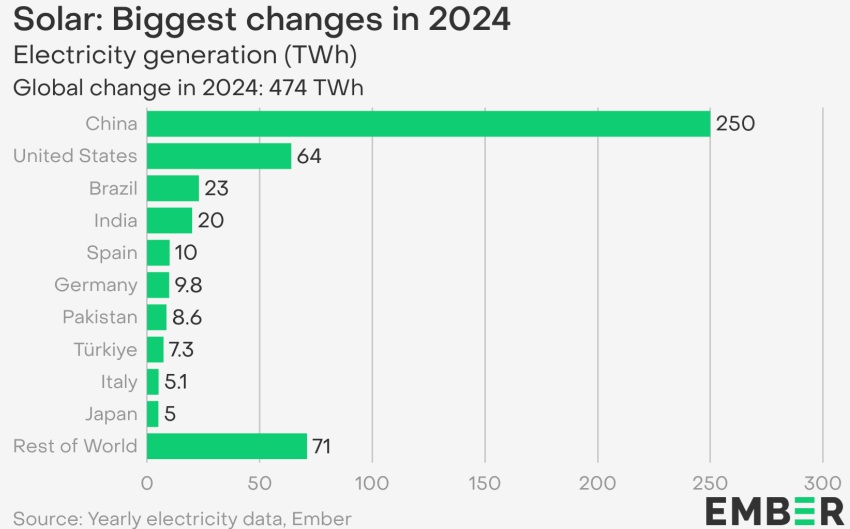

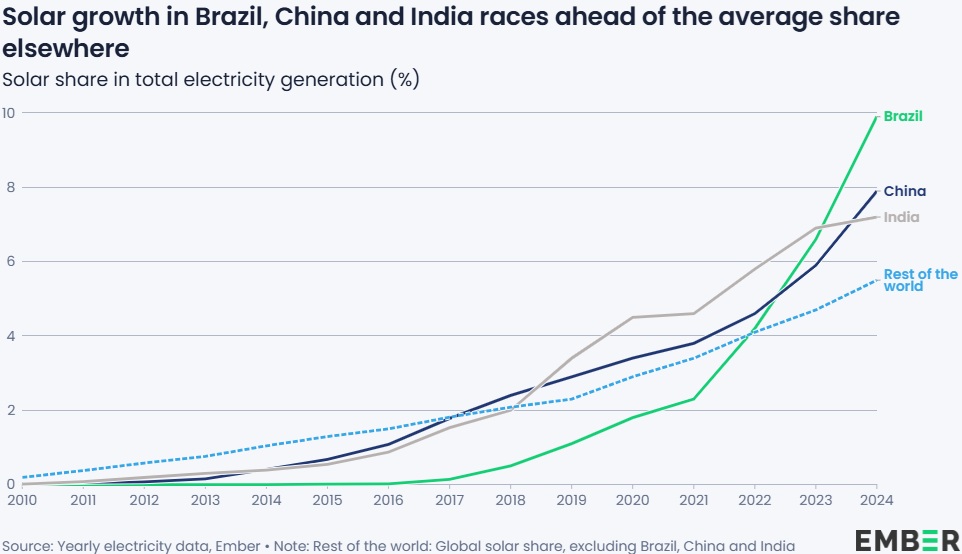

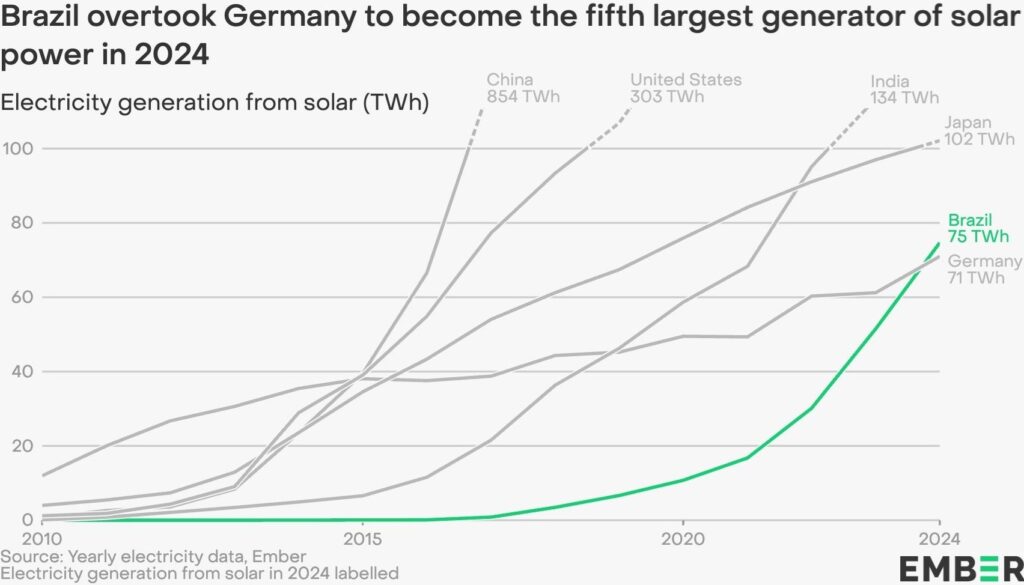

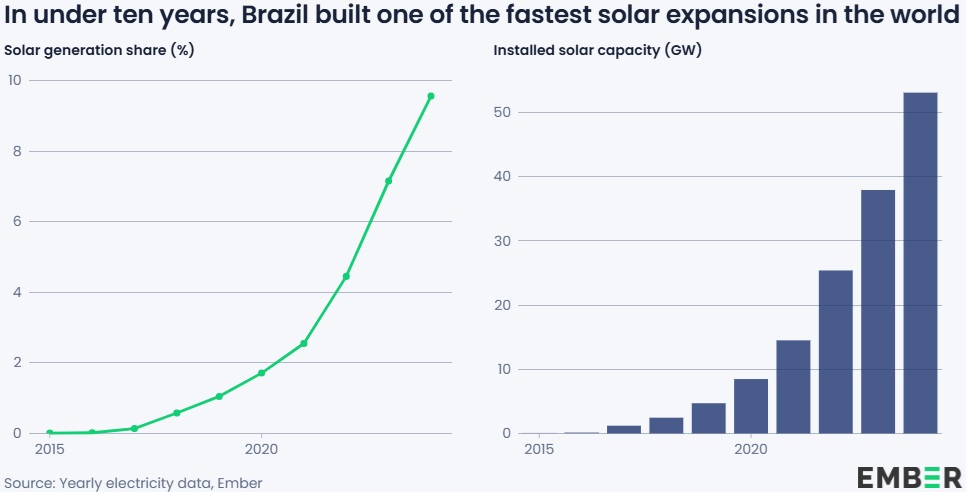

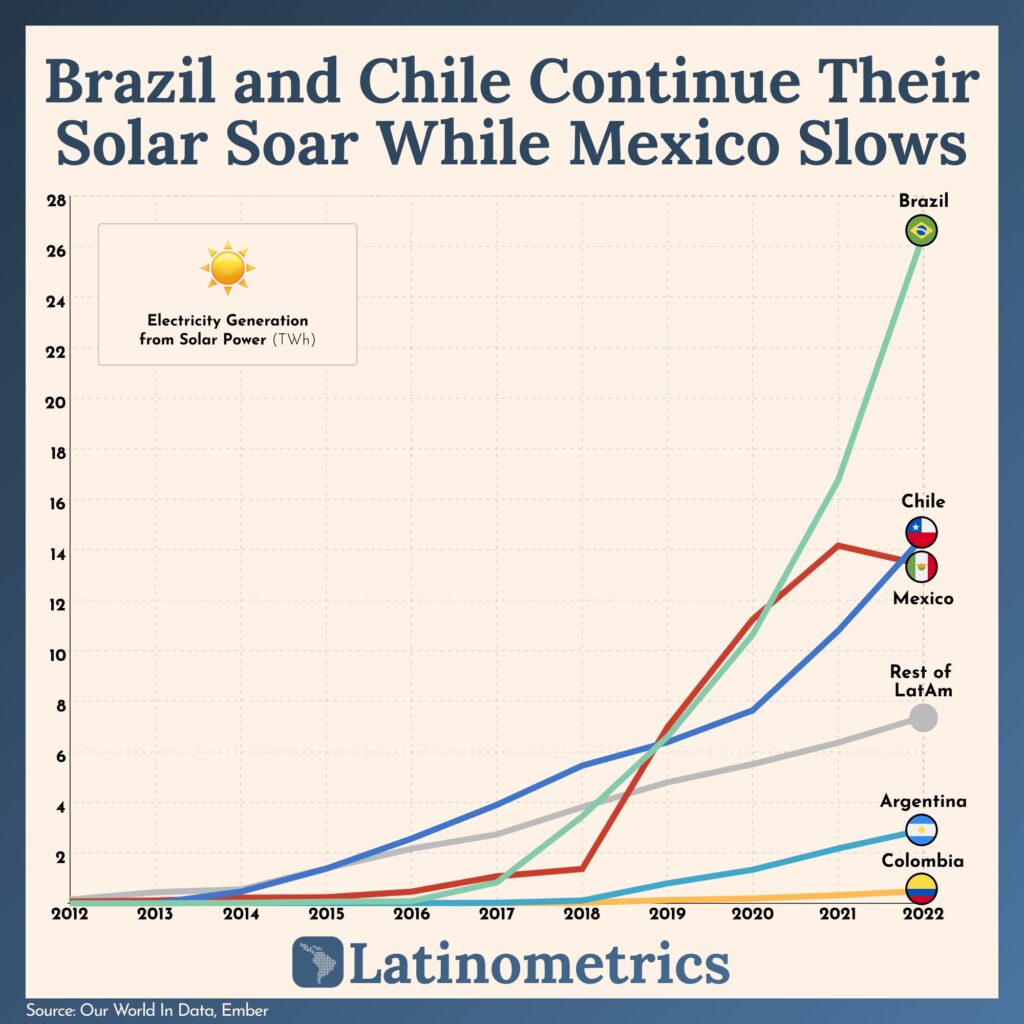

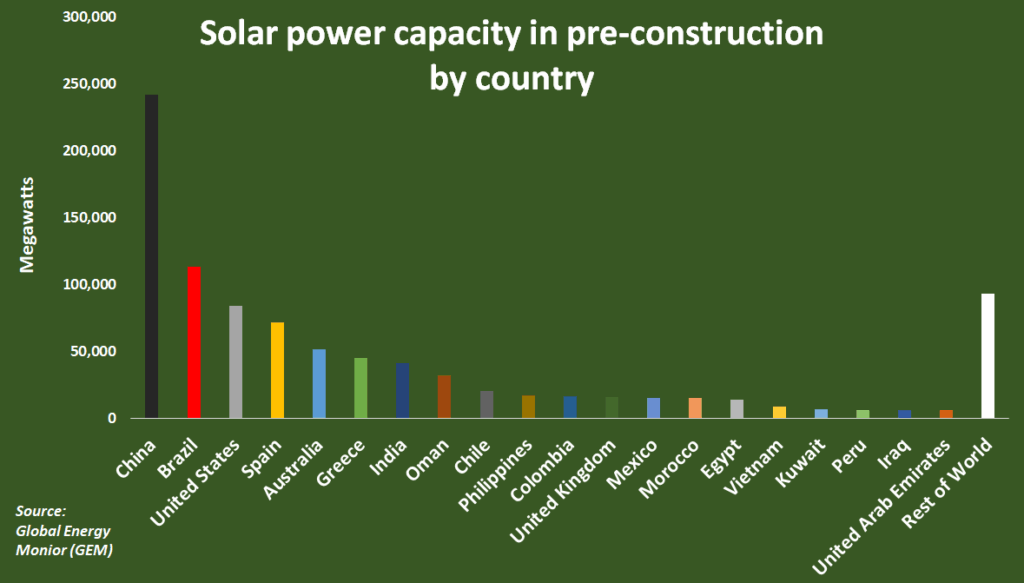

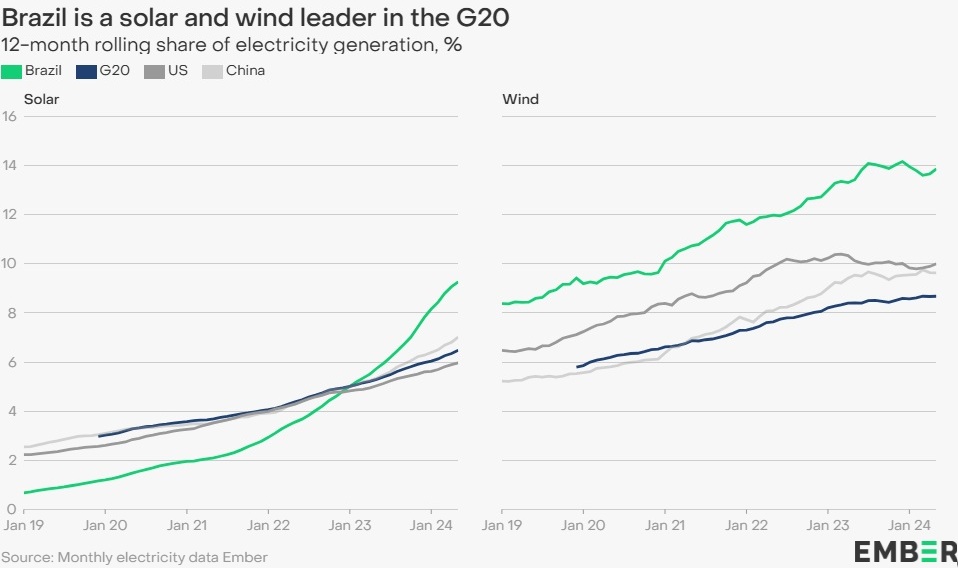

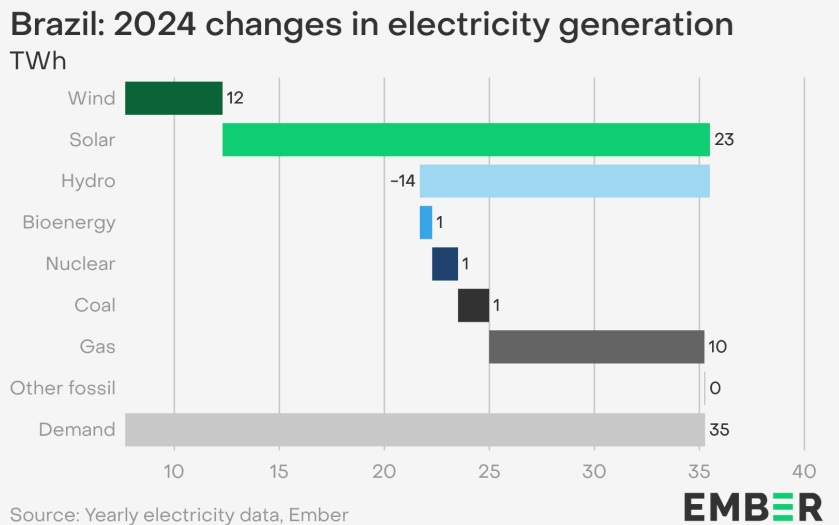

Brazil has emerged as one of the fastest-growing solar markets on the planet. Already one of the world‘s largest solar power nations and recording a 40% growth rate in 2024, Brazil also holds 113 GW of projects in pre-construction – second only to China. Yet despite this surge, Brazil still imports virtually all of its solar modules, including the glass.

Homerun is changing that.

Having consolidated and secured control of the Santa Maria Eterna Silica Sand District – one of the world’s largest and purest silica resources – and with a BFS underway for its solar glass plant in Bahia, Homerun is building the cornerstone of Brazil’s solar independence and positioning itself as the crucial bridge between geology, policy, and demand.

For investors, the take-away is clear: Brazil’s solar boom requires domestic supply, and Homerun holds the key resource while moving strategically to build the downstream facility and execute the vision that will anchor the industry.

Homerun Resources Inc. has taken critical steps toward reshaping Brazil’s solar supply chain – with global implications. Over the past 10 weeks, the company has delivered a sequence of milestones that signal accelerating momentum and disciplined execution:

- Signed a binding LOI to acquire the Pedreiras Concession: Completing consolidation of the Santa Maria Eterna Silica Sand District under Homerun’s full control.

- Expanded the offtake agreement with Brasil Fotovoltaico Ltda. to 180,000 tpa: Bringing total announced offtakes to 300,000 tpa, with discussions now exceeding the plant’s planned 365,000 tpa nameplate capacity.

- Confirmed 100% antimony-free solar glass capability: Santa Maria Eterna’s ultra-pure silica enables solar glass production entirely without antimony – a powerful advantage as global antimony prices spike and supply tightens. Conventional solar glass producers rely on antimony to offset impurities in lower-quality silica.

- Launched the Bankable Feasibility Study (BFS): The gateway to construction and major project financing is now underway. Homerun has engaged DTEC PMP GmbH (one of Germany’s leading engineering and project-management firms) to deliver the BFS for its antimony-free solar glass plant in Bahia. Completion is targeted for Q1 2026.

- Engaged Minerali Industriali Engineering (MIE) of Italy: Adding one of the world’s most experienced silica-processing engineering groups to the BFS sends a clear signal: The project’s technical and commercial potential is real, scalable, and investment-grade.

- Received conditional approval on 6 million CAD yesterday, and progressing to close the full 9 million CAD financing: Strengthening the balance sheet, de-risking development, and reinforcing market confidence, while advancing capital for BFS completion.

Taken together, these milestones create a bankable framework capable of supporting substantial project financing for Brazil’s first domestic solar glass plant. They demonstrate resource quality, commercial uptake, engineering competence, and financial commitment – the key criteria evaluated by banks, strategic investors, and development institutions.

What began as an early-stage concept is now rapidly evolving into a structured, finance-ready industrial project. Homerun has assembled the technical work, partnerships, capital, and offtake visibility required to move from planning into construction and, ultimately, full industrial operation.

“We won‘t allow what happened in the last century to happen again, where Brazil exports raw minerals and then buys products with very high added value. We want to add value in Brazil.”

Luiz Inácio Lula da Silva, Brazil‘s 39th President

“The Santa Maria Eterna Silica Deposit is the most unique silica sand deposit in the world. Congratulations to Homerun, for being the first organization in 40 years to develop a strategy to extract value by bringing the end-use to the Deposit.”

Thibault Van Stratum, former CEO of Sibelco Asia (www.sibelco.com)

Santa Maria Eterna Is Exceptional

In 2023, a Rockstone Report first highlighted the extraordinary qualities of Santa Maria Eterna’s silica sands: Measured grades averaging 99.88% SiO₂ with just 48 ppm Fe, reduced to as low as 2.4 ppm Fe through simple washing and scrubbing. This purity is nearly unrivaled – and no longer theoretical. Independent testing has confirmed that Santa Maria Eterna’s silica can produce solar glass entirely without added antimony compounds. Purity this high meets the world’s most demanding specifications without toxic additives or further refining. The result is a decisive environmental, cost, and regulatory advantage that positions Homerun at the forefront of next-generation, ESG-compliant solar glass manufacturing. For comparison:

- Many Australian deposits require acid-leaching just to reach the ~120 ppm Fe limit for solar glass – an expensive and environmentally heavy process. Even then, silica at this purity still needs antimony added during melting to clear remaining impurities.

- Some Canadian projects have faced strong opposition due to environmental and cultural concerns, with impurity levels requiring chemical processing to reach specification.

- Even the legendary Spruce Pine Quartz District in North Carolina, producing ultra-high-purity quartz for semiconductors, remains tightly controlled by a handful of companies and is not positioned for solar glass supply.

Santa Maria Eterna is different. It offers >200 million tonnes of exceptionally pure, homogenous silica sand in a fully permitted mining district with proximity to deepwater ports and well-developed infrastructure. The result is a geological endowment that dramatically reduces CAPEX and OPEX for downstream processing while aligning with ESG principles – a critical differentiator in today’s financing landscape and a decisive advantage for long-term investors seeking sustainable growth.

District Consolidation Matters

With the recent agreement to acquire the Pedreiras Concession, Homerun now effectively controls the entire Santa Maria Eterna District. This goes far beyond land acquisition:

- Supply certainty: Consolidation removes market competition and guarantees long-life feedstock for Homerun’s solar glass plant.

- Pricing power: With no competing operators inside the district, Homerun can negotiate offtakes from a position of strength.

- Bankability: Lenders and government financiers such as BNDES require assurance of uninterrupted, large-scale resource supply before committing to major CAPEX syndicates. District consolidation provides that assurance.

Homerun’s strategy has been remarkably capital-efficient: The 3 CBPM lease acquisitions – together covering >200 million tonnes of silica – were achieved for just 2.1 million USD, a fraction of the implied value when compared against downstream glass pricing of 750 USD/t FOB announced in the latest offtake update.

Offtakes: The Key To Financing

Of equal importance is Homerun’s success in lining up offtake agreements. The latest agreement with BRFV, when combined with other announced deals, covers nearly the entire output of the planned Belmonte solar glass plant. This matters because:

- Bankable Feasibility Studies (BFS) are built on proving both technical feasibility and market demand. By pre-selling capacity through domestic industry counterparties, Homerun can de-risk the BFS.

- Project finance syndicates, from commercial banks to development banks like BNDES, require clear visibility on long-term revenue streams before releasing capital. Offtakes provide that critical visibility.

- Government support: Brazil’s policy framework is actively encouraging domestic solar manufacturing through import tariffs and credit support. With confirmed offtakes, Homerun is perfectly aligned with national industrial strategy.

In short, Homerun is putting the puzzle together: Resource consolidation, permitting, plant engineering, utilities and logistics, and offtakes – all critical BFS inputs that unlock the next phase of government-backed and institutional financing.

Global Context: Homerun’s Competitive Edge

While Australia and Canada dominate the headlines for high-purity silica projects, they remain plagued by environmental opposition, slow permitting, higher impurities, and higher CAPEX. Many require acid leaching, sparking ESG red flags and driving processing costs into the hundreds of millions. Their timelines stretch years, often decades, before commercial readiness. By contrast, Homerun offers:

- A massive, consolidated >200 million tonnes district-scale supply base, already permitted for extraction.

- Ultra-high purity silica sand with impurities reduced to industry-best levels through benign methods.

- This unique chemistry also allows solar glass production without the use of antimony, a toxic additive still common in global manufacturing – a powerful ESG differentiator.

- Proximity to port and infrastructure in an investment-friendly jurisdiction eager to attract green industry.

- Integration into a downstream solar glass plant that meets Brazil’s urgent need to localize supply chains.

The result is a combination of geology, logistics, and policy alignment that is exceptionally rare and difficult to replicate anywhere in the world.

The Road Ahead

Homerun is not merely another silica sand developer. It is building a vertically integrated platform – from sand to solar glass – designed to capture Brazil’s surging solar demand and to position itself as a critical supplier in the global energy transition.

The recent consolidation of Santa Maria Eterna, the engagement of MIE Italy, the appointment of DTEC Germany to lead the BFS, and the conditional approval with the process underway to close a 9 million CAD financing are more than corporate milestones. They are the cornerstones of bankability – the point at which spreadsheets turn into shovels, financing flows, and construction shifts from concept to reality.

With an antimony-free glass production capability, consolidated resources, institutional-grade engineering partners, the ongoing financing process for the BFS, and expanding offtake commitments, Homerun now controls every critical ingredient needed to advance Brazil’s first fully bankable solar glass project.

As CEO Brian Leeners put it: “With complete district control secured through acquisition and supply agreements, we are now positioned to unlock the full potential of Santa Maria Eterna.”

In a sector where most players are still fighting regulators, financiers, and chemistry itself, Homerun has already solved the hardest part of the puzzle. The next piece is CAPEX financing – and with the latest news-releases, that picture just became much clearer.

Brazil’s Solar Opportunity: From Imports To Sovereignty

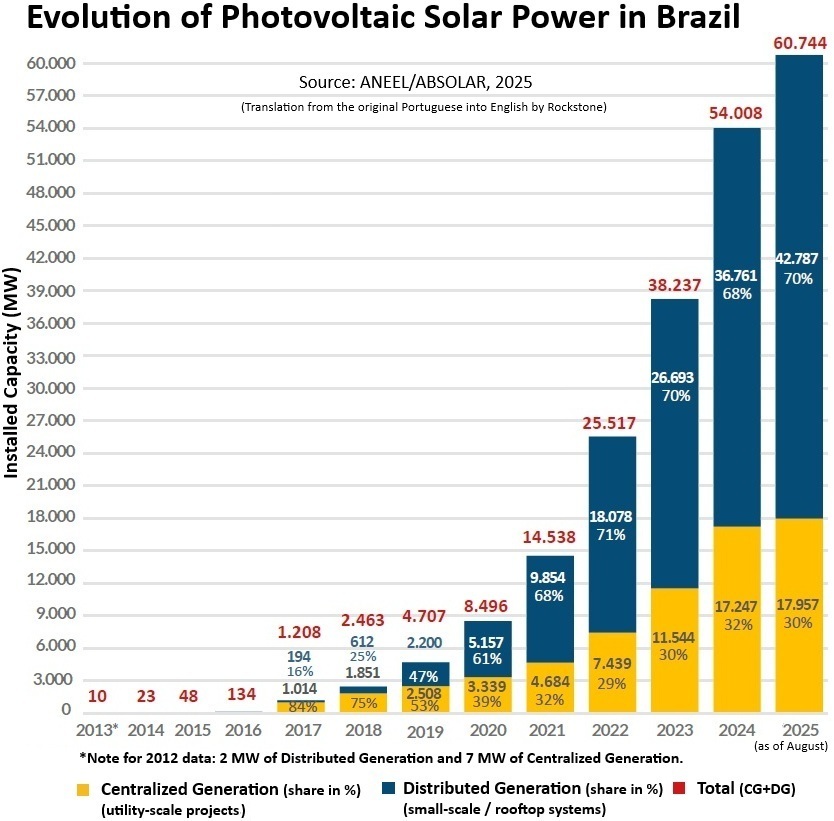

Brazil has quietly become a global solar powerhouse. In 2024, the country passed Germany to take the #3 spot worldwide for annual solar module installations, trailing only China and the United States. Solar already accounts for more than 15% of Brazil’s power matrix and is projected to reach 50% by 2050 according to Absolar, the national solar association.

Yet this growth has been built almost entirely on imports. The vast majority of solar modules installed in Brazil have been shipped in from Asia, creating a structural vulnerability: Billions of dollars of annual spending flow abroad, while domestic industry captures little of the value chain. Recognizing this, the Brazilian government has moved to tilt the playing field toward local manufacturing, most notably through newly increased tariffs on imported solar modules and through credit support programs managed by the national development bank BNDES.

This is precisely where Homerun fits in. By consolidating Brazil’s only large-scale, ultra-high-purity silica sand district at Santa Maria Eterna and building a solar glass plant in Bahia, Homerun is creating the first essential building block for a domestic, vertically integrated solar industry. Instead of importing glass sheets (the heaviest, most fragile, and most costly module component), Brazilian manufacturers will be able to source locally, at global specifications, and at globally competitive pricing. By aligning its project directly with government policy, Homerun is positioned not just as a supplier, but as a strategic partner in Brazil’s transition from a solar importer to a solar manufacturing hub.

“In the last six years, Latin America has imported $26B – or almost twice the GDP of Nicaragua – worth of solar panels from China, the world‘s leader in producing and selling them... Brazil alone accounts for 58% of all Chinese solar panel exports to Latin America, an estimated $14B since 2017... Evidently, the region‘s biggest country would import the most panels, but it does so disproportionately to its size – roughly one-third of LatAm‘s population.“

https://x.com/LatamData/status/1744732274124530080

Brazil’s Solar Boom: Recent Data And The Import Reality

- As of March 2025, Brazil’s installed PV solar capacity passed 55 GW – more than doubling over the previous few years.

- Brazil ranked #6 globally in cumulative solar PV capacity at the end of 2024, with about 66.7 GW installed.

- For 2025, Brazil is projected to add 19.2 GW of new PV capacity. This is roughly comparable to 2024’s additions (~18.9 GW), indicating continued strong growth.

- Installed solar farms: As of February 2024, Brazil had around 3,893 solar power plants. Projected development: 13 solar farms are under construction and 214 in the planning stages.

- Number of residential solar panel installations: Brazil has surpassed 2 million rooftop solar installations as of early 2023, with a significant portion being residential, marking a significant milestone in the country’s solar energy adoption. Projected installations: As of 2030, Brazil has potential to install more than 90 million rooftop PV systems.

- Yet roughly 99% of the solar modules installed in Brazil are imported, mainly from Asia. Local module assembly exists, but relies heavily on imported solar cells and other components such as glass.

- In 2024, Brazil increased tariffs on imported solar modules to 25% in order to protect local manufacturing of modules and motivate local value addition.

- Brazil’s government, via various policy changes, has revoked many tax breaks on imported panels and components, aiming to shift incentives toward domestic production, manufacturing jobs, and local supply chains.

So the picture is crystal clear (just like solar glass): Brazil’s solar capacity is surging, yet the country remains almost entirely reliant on imported modules. Now, government policy is flipping the script with tariffs, tax reforms, and new incentives to build value at home.

Investor take-away: As Brazil gears up for this unprecedented solar build-out, Homerun is right on time. By consolidating the ultra-pure Santa Maria Eterna Silica District and moving forward to build the nation’s first domestic solar glass plant, Homerun is positioned to become the cornerstone supplier for Brazil’s solar independence – capturing demand before the wave of new capacity goes live.

How Homerun Fits: A Brazilian Version Of China’s Blueprint

China became the undisputed leader in solar manufacturing by controlling its raw materials, vertically integrating production, and achieving industrial-scale manufacturing capacity supported by favorable government policy. Brazil is now setting up the same conditions – and Homerun is at the center of this shift. The company’s strategy is aligned with that proven playbook:

- Domestic high-purity silica resource control: By consolidating the Santa Maria Eterna District, Homerun has secured long-life, investment-grade feedstock. China’s dominance began the same way: Locking in its raw material inputs to lower cost, guarantee supply, and minimize long-term risk.

- Vertical integration: Homerun is not just mining sand, it is building a sizeable solar glass plant to supply local manufacturers. This reduces import dependency for the heaviest, most fragile and most costly component of solar modules. It also ensures supply stability, cost predictability and shorter logistics chains, mirroring China’s approach of securing every step of the value chain to drive efficiency and scale.

- Policy tailwinds in Brazil: With tariffs on imports, tax reforms and targeted BNDES financing, Brazil’s policy environment strongly favors local value-add, just as Chinese subsidies and protectionism supported its early industry. Brazil is now actively encouraging domestic manufacturing through a combination of fiscal incentives and infrastructure commitments.

- Scale and supply certainty: District consolidation ensures Homerun can cover its entire plant capacity with offtakes. China’s rise was powered by scale, and Brazil’s surge in demand is now providing that same momentum. Locked-in feedstock and growing commercial commitments give Homerun a degree of certainty rarely seen in early-stage industrial projects.

- ESG and cost advantages: Unlike projects in Australia or Canada, where impurities require acid leaching and high CAPEX, Homerun’s silica is naturally pure. That means lower costs, a dramatically smaller environmental footprint, quicker development timelines, and a financing edge – similar to China’s focus on cost reduction through process efficiency and resource control.

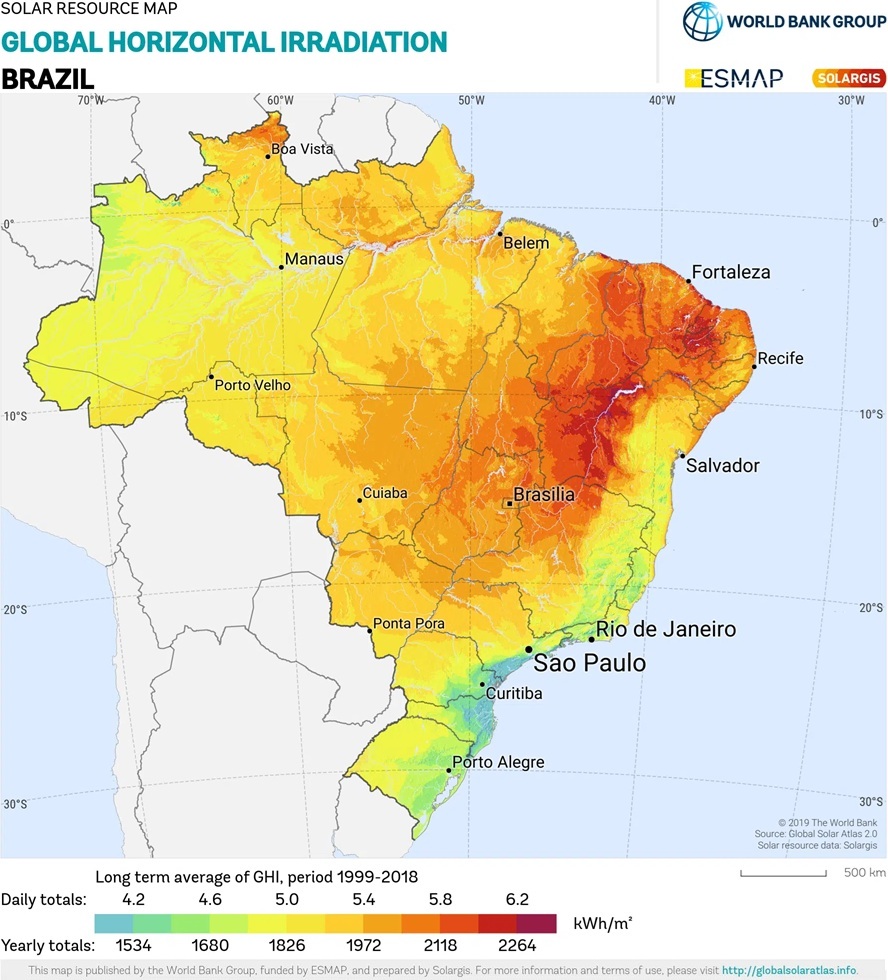

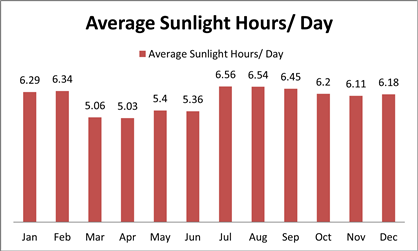

Brazil’s opportunity is clear: The country now ranks #6 globally for installed solar, grew 40% year-over-year in 2024 and has 113 GW of projects in pre-construction. With world-class irradiation, strong policy incentives, BNDES financing and Homerun’s control of one of the world’s purest silica districts, the building blocks are in place for Brazil to replicate China’s path to solar leadership.

Bottom Line

China showed that controlling resources, integrating the value chain, aligning policy and building massive manufacturing scale is the formula for global dominance. Brazil now holds the same winning formula, but with a critical advantage: Homerun’s ultra-pure silica enables antimony-free solar glass, offering a direct path to both cost leadership and ESG superiority while eliminating dependence on an increasingly restricted antimony supply chain that could disrupt global solar glass production.

- Brazil’s solar deployment is accelerating at record speed, yet the country remains almost entirely dependent on imported solar glass and components.

- The government is now rewriting the rules with tariffs, financing support and industrial policies to build value at home.

- Homerun is executing the very strategy that propelled China to the top of the solar world, but tailored to Brazil’s unique geology, domestic demand and powerful policy tailwinds.

What makes Homerun truly distinctive is its control of Santa Maria Eterna: One of the largest and purest silica sand districts worldwide, fully consolidated and permitted. This geological endowment gives Homerun a decisive edge over most other projects, which often face smaller scale, higher impurities, environmental opposition, or prohibitive CAPEX. And with recent testing confirming 100% antimony-free solar glass capability, the district’s competitive advantage has only grown stronger. By combining scale, purity, and strategic proximity to deepwater ports, Homerun is positioned to become the unrivaled supplier of solar glass feedstock in Brazil, and ultimately compete on the world stage.

To move from vision to execution, the company is building institutional-grade engineering capacity: MIE Italy, one of the world’s most experienced silica-processing engineering groups, is now engaged alongside DTEC PMP GmbH of Germany to deliver the BFS. And with 9 million CAD now conditionally approved and in the process of closing – providing the capital required to advance the BFS – Homerun is positioned to complete this pivotal step.

For investors, this combination creates a unique opportunity: A high-growth energy market with a clear government mandate, an urgent need for domestic supply chains and a company that already controls the critical raw material and downstream integration.

The scale of Santa Maria Eterna, combined with offtake-backed demand, industry-leading purity and a supportive financing environment, elevates Homerun from a participant to the key enabler of Brazil’s solar industrial revolution.

With Santa Maria Eterna secured, offtakes in place, antimony-free capability validated, world-class engineering partners engaged and a BFS with funding conditionally approved and now being finalized, Homerun is assembling the cornerstone for Brazil’s solar independence – and positioning itself as a first mover in one of the fastest-growing energy markets on the planet.

In sum, Homerun is uniquely placed to be a central piece of Brazil’s shift from solar importer to solar industrial powerhouse. China’s example shows it can be done – but it requires scale, raw material control, policy alignment, engineering excellence, strong offtakes, and well-structured financing. Homerun is putting together those pieces.

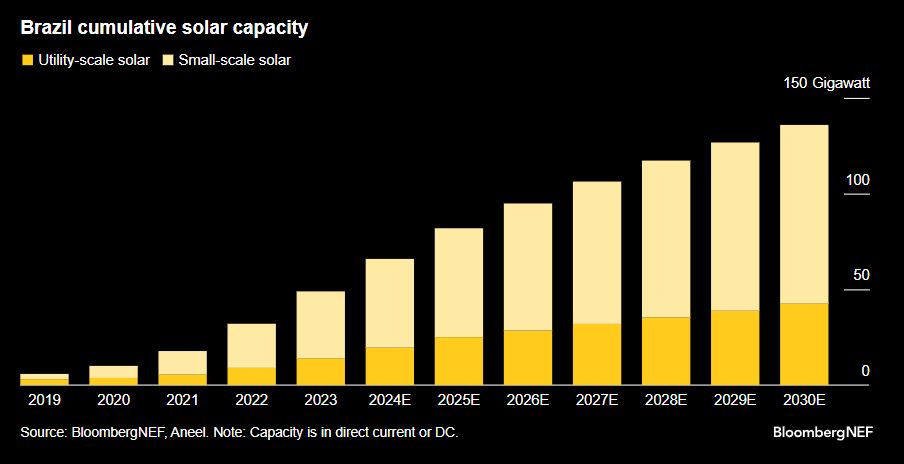

Brazil’s Solar Capacity Surges Past 60 GW (2025): In just 6 years, Brazil’s installed solar power has skyrocketed from under 5 GW in 2018 to over 60 GW by August 2025 – with utility-scale projects (yellow) now accounting for around 30% and distributed generation (blue) for around 70% of the total. Brazil is now the #6 solar market globally and growing at one of the fastest rates worldwide.

Investor take-away: Brazil’s unprecedented pace of solar deployment cannot be sustained in the long run without a reliable domestic supply of critical components such as solar glass. At present, nearly all of these materials are imported from abroad, creating structural vulnerabilities in both cost and supply security. By consolidating the ultra-pure Santa Maria Eterna Silica District and advancing a full Bankable Feasibility Study for a state-of-the-art solar glass facility in Bahia, Homerun is moving to close this gap. This integrated approach positions the company not only as a strategic enabler of Brazil’s solar independence, but also as a potential global player and long-term partner for manufacturers, policymakers, and investors seeking stable, scalable growth in the energy transition.

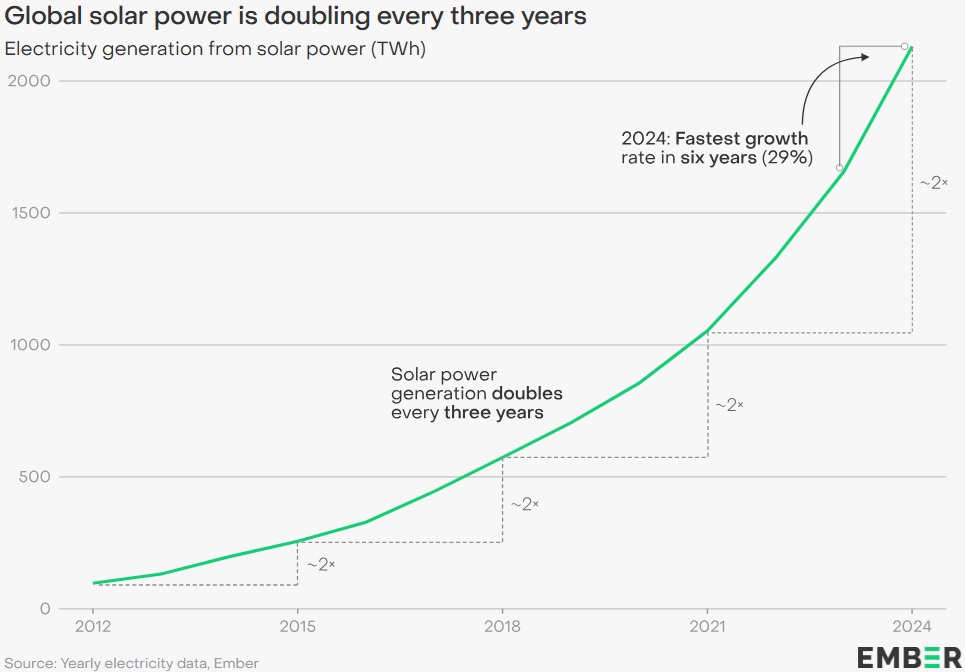

Solar’s Unstoppable Growth Curve: From 100 TWh to 2,000 TWh in just 11 years. This chart illustrates the unprecedented speed at which solar has scaled globally compared to every other power source in history. While coal, gas, hydro, and nuclear took decades to move from 100 TWh to 2,000 TWh of annual generation, solar achieved this leap in only 11 years – first adding 900 TWh in 8 years, and then doubling again in just 3. Now, solar is on track to surpass 3,000 TWh in less than 2 years.

Investor take-away: The world’s fastest-growing energy source depends critically on high-purity silica for solar glass. As Brazil races to expand its solar base, Homerun’s control of the ultra-pure Santa Maria Eterna District and its planned solar glass plant in Bahia place it directly in the slipstream of this global growth curve. The accelerating adoption of solar ensures that demand for reliable, ESG-friendly inputs like Homerun’s silica will not only persist but intensify – strengthening the company’s position as a timely strategic supplier in Brazil and, ultimately, a key player in the global solar market.

Company Details

Homerun Resources Inc.

#2110 – 650 West Georgia Street

Vancouver, BC, V6B 4N7 Canada

Phone: +1 844 727 5631

Email: info@homerunresources.com

www.homerunresources.com

ISIN: CA43758P1080 / CUSIP: 43758P

Shares Issued & Outstanding: 64,061,179

Canada Symbol (TSX.V): HMR

Current Price: 0.85 CAD (11/25/2025)

Market Capitalization: 55 Million CAD

Germany Ticker / WKN: 5ZE / A3CYRW

Current Price: 0.476 EUR (11/25/2025)

Market Capitalization: 31 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone Research and Homerun Resources Inc. (“Homerun“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun’s public filings for a more complete discussion of such risk factors and their potential effects, which may be accessed through its documents filed on SEDAR+ at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Forward-looking statements in this report include, but are not limited to, statements regarding Homerun’s plans to develop and finance a solar glass facility in Bahia, including the planned nameplate capacity of 365,000 tonnes per year and expectations that this capacity could be expanded or fully covered by offtake agreements; the timing, results, scope, and bankability of a Bankable Feasibility Study (BFS), including assumptions that confirmed offtakes, secured utilities, and consolidated resource control will enable large-scale project financing; the consolidation, development, and long-term potential of the Santa Maria Eterna Silica Sand District, including assumptions regarding its purity, homogeneity, resource size exceeding 200 million tonnes, and suitability as long-life feedstock; the ability to secure, expand, and maintain offtake agreements with Brazilian solar-module or solar-glass manufacturers, including expectations that contracted volumes could exceed initial plant capacity; the level and continuity of government policy support and financing, including assumptions that tariffs, tax reforms, credit programs from BNDES, or other incentives will continue to favor domestic solar manufacturing; anticipated capital and operating costs for mining, processing, and downstream glass production, including assumptions that Santa Maria Eterna’s purity will lower costs relative to other global silica projects; the ability to obtain project financing on favorable terms, including assumptions about participation from institutional investors, development banks, export-credit agencies, or commercial project-finance syndicates; expected growth in solar demand in Brazil and globally, including projections that Brazil could move from the sixth-largest solar market to a leading industrial hub with more than 113 GW of projects in pre-construction; Homerun’s potential role in enabling Brazil’s solar-industrial independence, including expectations of reducing import dependence, creating a domestic supply chain for solar glass, and becoming a cornerstone supplier to Brazil’s downstream solar industry; comparisons to China’s path to solar leadership, including expectations that Brazil could replicate aspects of China’s trajectory through resource control, vertical integration, and aligned industrial policy; and broader participation in the global energy transition, including statements that Homerun could become a competitive supplier of solar-glass feedstock and related energy-transition materials. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include, but are not limited to: Permitting and Approvals: Homerun may not obtain all necessary governmental, regulatory, contractual, board, shareholder, or third-party approvals in a timely manner or at all. Market Risks: Adequate buyers for Homerun’s silica, solar glass, or other products may not be secured; demand projections may not materialize. Technical Risks: The reduction of impurities in silica may not achieve levels required for advanced applications; mineral grades and quantities may not be as expected; historical data and drilling results may not be indicative of future economic viability. Geology and Resource Risks: The geological characteristics of the Santa Maria Eterna District may differ from current interpretations. Resource size, grade, and homogeneity may not match previous measurements or expectations, and the silica sand may prove unsuitable for solar glass or other intended products. Even if suitable, the material may not meet buyer specifications or achieve acceptance in commercial markets. Operational Risks: Difficulties in exploration, mining, construction, or processing could increase costs or cause delays; infrastructure challenges may hinder development. Financing Risks: Required capital expenditures for exploration, mine development, and downstream facilities may exceed estimates; financing may not be available on reasonable terms, or at all. Geopolitical and Regulatory Risks: Legislative, political, social, or economic developments in Brazil or other jurisdictions may hinder progress or add costs; agreements with governments, communities, or partners may not be reached. Human Capital Risks: Homerun may not be able to retain or attract key employees and technical partners needed to execute its strategy. Commodity Price Risks: Prices for silica, solar glass, or energy-transition materials may fluctuate and may not be sufficient to support profitable operations. Comparability Risks: What appear to be similarities with other successful projects may not be substantially comparable in geology, costs, or economics. Environmental and ESG Risks: Environmental opposition or stricter ESG requirements could delay or prevent development. Failure to comply with evolving sustainability standards could limit financing or offtake opportunities. Offtake and Counterparty Risks: Non-binding offtake agreements may not convert into binding contracts. Counterparties may fail to perform or may renegotiate terms under adverse market conditions. Currency and Macroeconomic Risks: Brazil’s currency fluctuations (Real vs. US Dollar) could affect CAPEX, OPEX, and financing. Inflation, interest rate shifts, or global economic downturns could weaken project economics. Timing Risks: Project milestones, BFS completion, and financing timelines may take longer than anticipated, leading to delays in construction and revenue generation. Force Majeure / Natural Events Risks: Extreme weather, droughts, flooding, earthquakes, pandemics, or other uncontrollable events could disrupt exploration, construction, logistics, or operations. Logistics and Infrastructure Risks: Project success relies on dependable access to ports, roads, utilities, and energy supply. Delays, failures, or cost overruns in infrastructure build-out could materially impact timelines and economics. Third-Party Information Risks: Certain information contained in this report, including market data, industry statistics, and third-party commentary, has been obtained from sources believed to be reliable but has not been independently verified. Rockstone and the author make no representation or warranty as to its accuracy, completeness, or reliability. Liquidity and Trading Risks: Securities of small-cap issuers such as Homerun often involve a high degree of risk and may be subject to volatility, limited trading liquidity, wide bid/ask spreads, and potential loss of invested capital. Investors should be prepared to bear the risk of illiquidity and price fluctuations. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. Past performance and comparisons to other companies or jurisdictions are provided for illustrative purposes only and should not be considered indicative of future results.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Homerun Resources Inc. On September 8, 2025, Homerun announced that the company “entered into an agreement with Rockstone Research to provide marketing services to the company”, and that “Rockstone Research is an arm’s-length marketing firm and has been engaged for an initial three-month term for total consideration of $25,000, which is payable up front. The company does not propose to issue any securities to Rockstone in consideration for the services to be provided to the company.” The author owns equity of Homerun and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Homerun (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Stockwatch.com, Tradingview.com, Homerun Resources Inc. and the public domain.