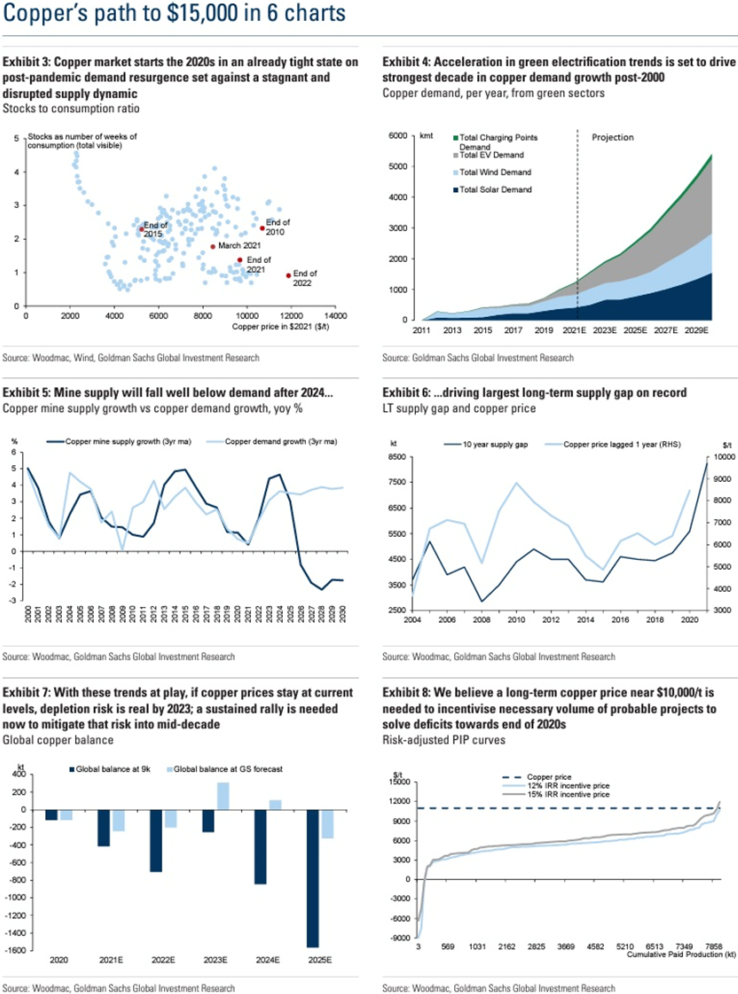

The threshold of $15,000 USD per ton seems to be the magic number for copper prices to incentivize new mine developments as supply is not keeping up with the strong demand growth.

Back in 2021, Goldman Sachs said that copper is “on a necessary path to $15,000“ and “the most probable path for copper price from here – that both avoids depletion risk and as well as a sharp surplus swing – is to trend into the mid-teens by mid-decade“.

Last month, billionaire mining magnate Robert Friedland reiterated that copper prices need to double to $15,000 USD to spur new copper supply. This month, CNBC reported on the optimistic forecasts of analysts from BMI, Bank of America and Citibank, with the latter projecting that copper prices could soar to $15,000 by next year.

Such a dramatic price escalation could be akin to rocket fuel for pure-play copper exploration stocks.

“Build your new house out of copper bricks, cover the copper with gypsum wallboard so you forget it’s in the walls. Ten years from now you’ll be able to tear down the house and buy a fleet of electric Lamborghinis with your profits.”

Robert Friedland

Copper Exploration vs. Copper Castle: Investing in copper exploration companies is like betting on the treasure hunters, while building a house out of copper bricks is like trying to live in the treasure chest itself.

Regulatory Riddles: Copper exploration and mining companies deal with regulations, sure. But try getting a permit for a copper house. “Yes, Mr. Inspector, the walls are metal. No, I‘m not building a giant microwave.“

Liquidity Laughs: Selling stocks in copper companies? Easy-peasy. In contrast, liquidating a house made of copper bricks would require dismantling and selling the copper, which is labor-intensive and might not fetch market prices. Selling your copper house? Picture trying to explain to potential buyers, “Yes, the walls are real copper. No, I‘m not a time-traveling alchemist. Yes, the WIFI is terrible.“

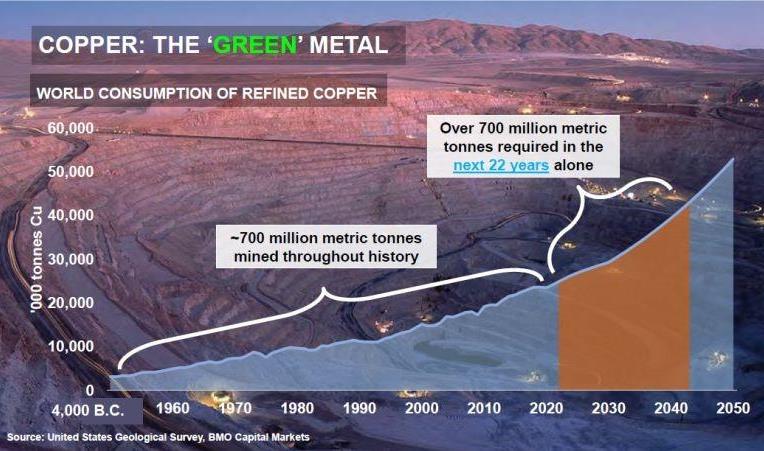

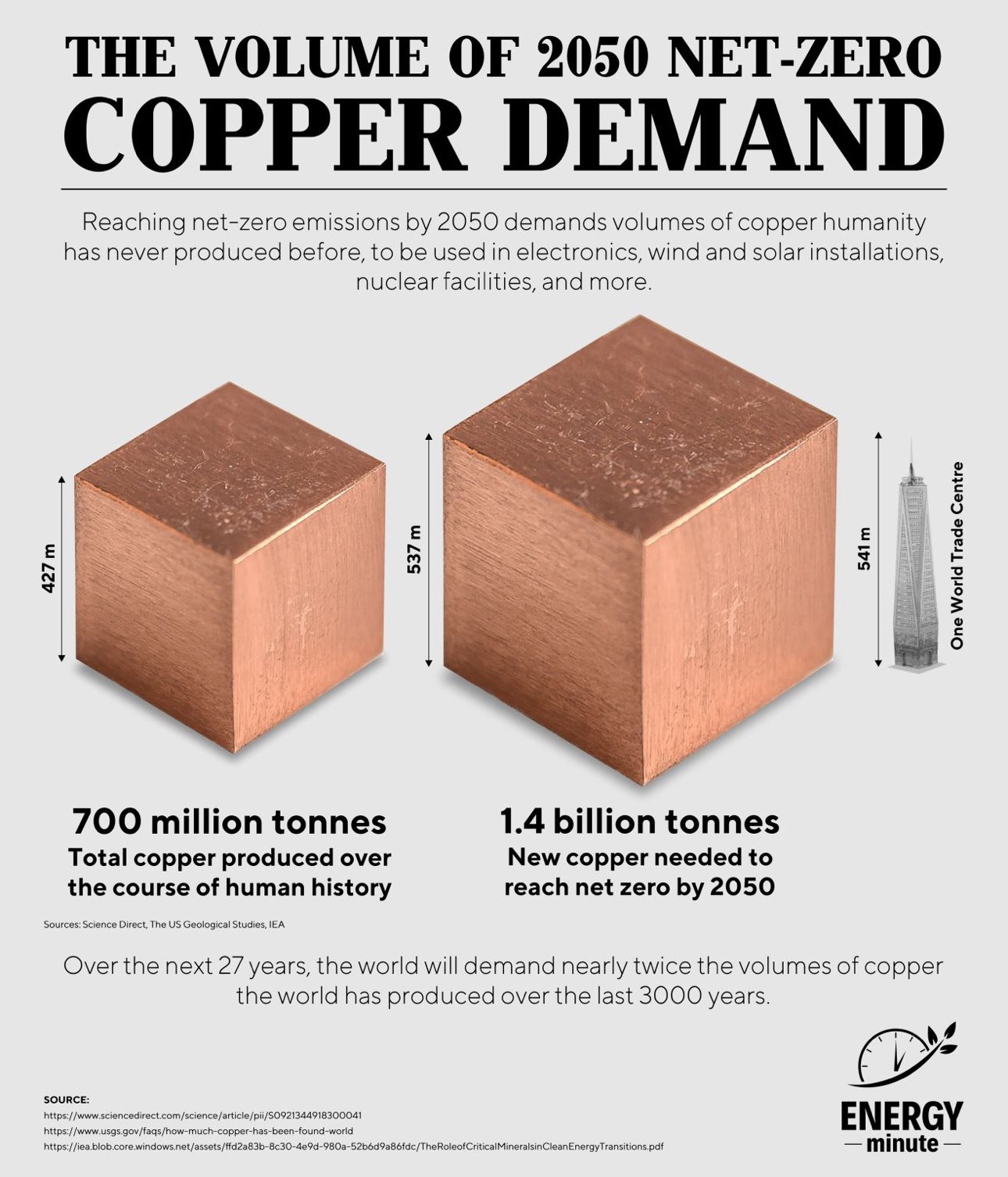

The copper industry is facing a critical situation as the supply is dwindling while the demand remains high, possibly leading to dramatic future shortages.

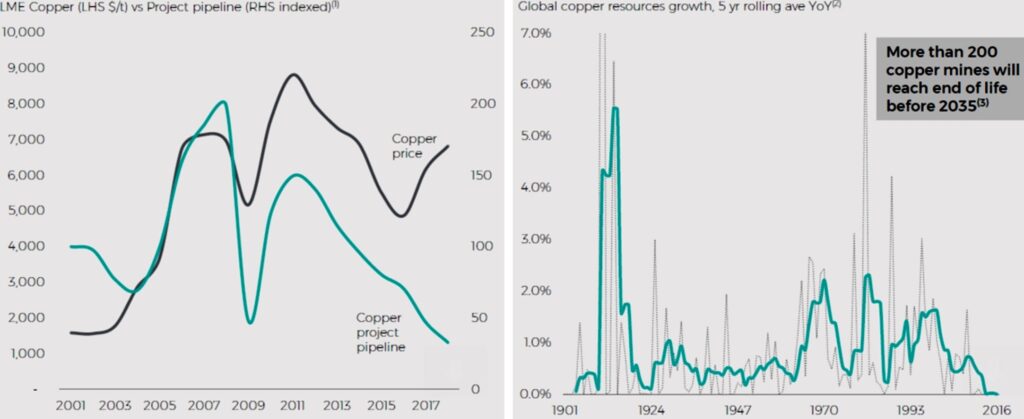

Aging Copper Mines: Most of the top copper mines are very old. The average age of the top 10 copper mines is about 95 years. This is significant because older mines typically have less production capacity and are closer to being depleted. A large number of copper mines are expected to stop production by 2035. This means that a substantial portion of the current supply will disappear in the next few years.

Lack of New Projects: Despite the rising copper prices, which usually encourages investment in new mining projects, there hasn‘t been a corresponding increase in the development of new copper mines. The situation is such that the number of new copper mining projects is not growing in response to the higher copper prices, which means that the price is still too low.

Stagnant Copper Resources: There‘s virtually no growth in new copper resources being discovered or developed. The chart shows that the increase in the amount of copper available for future mining is almost 0%. This indicates that not enough new sources of copper are being found to replace the old mines.

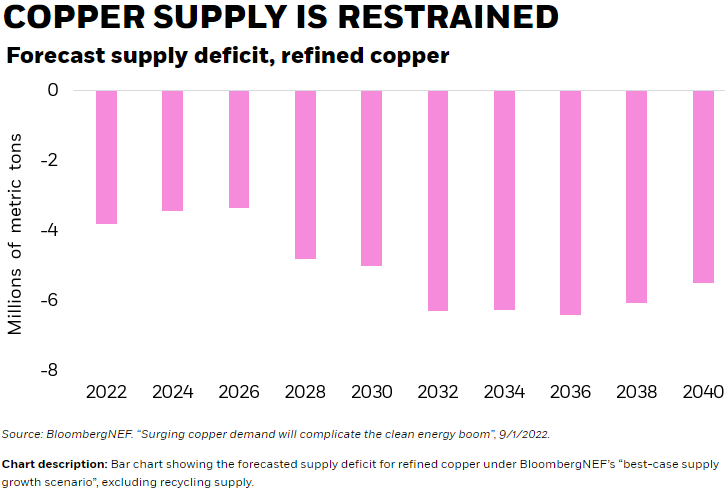

Impending Supply-Demand Issue: All these factors lead to a problem in the copper market. As the supply of copper from mines diminishes and no significant new sources are being added, we‘re heading towards a supply-demand crunch. Only higher copper prices appear to be the solution to stimulate exploration and development of new copper supply.

“Where are we going to find the copper? Copper is already facing major supply challenges, including strikes, resource nationalism, global warming (droughts, water shortages), declining ore grades, depleted orebodies, a lack of new mines, and regulatory delays in building new ones. Moreover, the current copper price is too low to incentivize new mines... It is likely going to take a major out-of-stock event for the copper market to re-calibrate supply and demand with a price that both avoids depletion risk and a sharp surplus swing. Goldman Sachs forecasted in 2021 that the copper price (in tonnes) will reach the mid-teens by mid-decade. I’d say that’s on track. And it may not be a gradual uptick but a sudden increase. That will be an unpleasant surprise to end users...“

“A copper bug asks ‘who got copper’?“, December 2023: www.mining.com/web/a-copper-bug-asks-who-got-copper

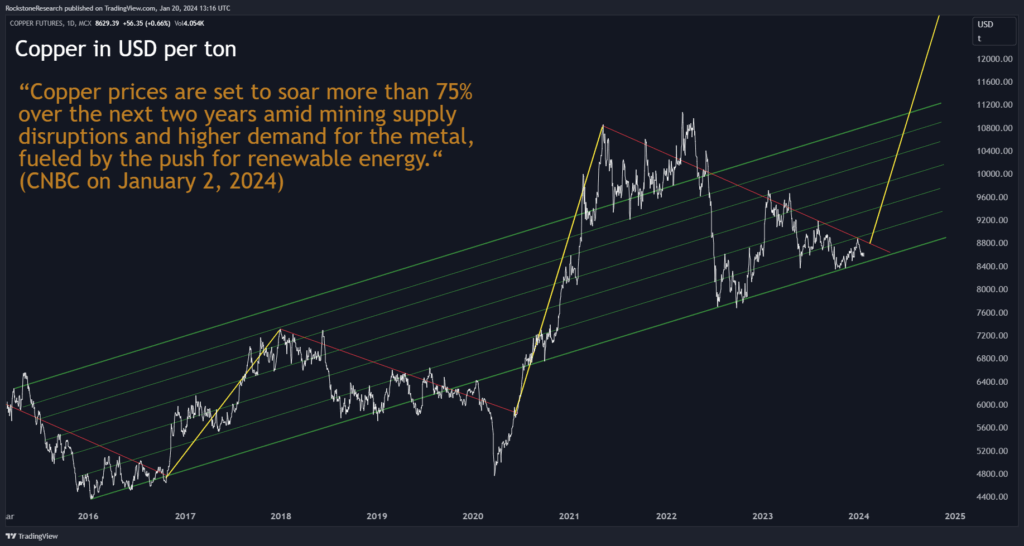

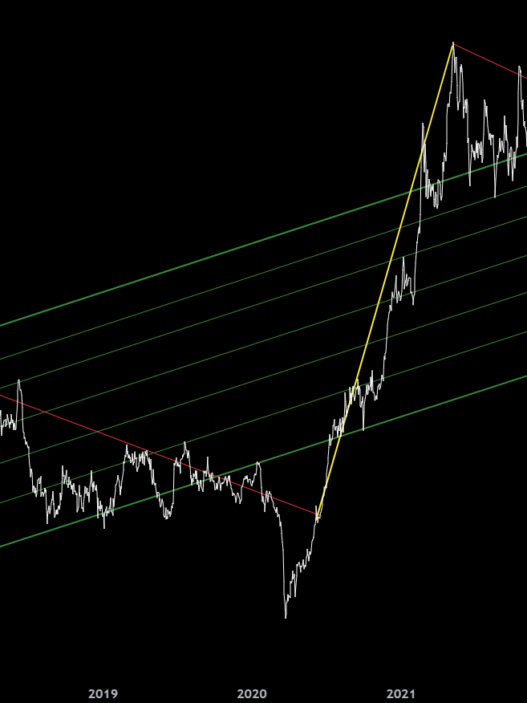

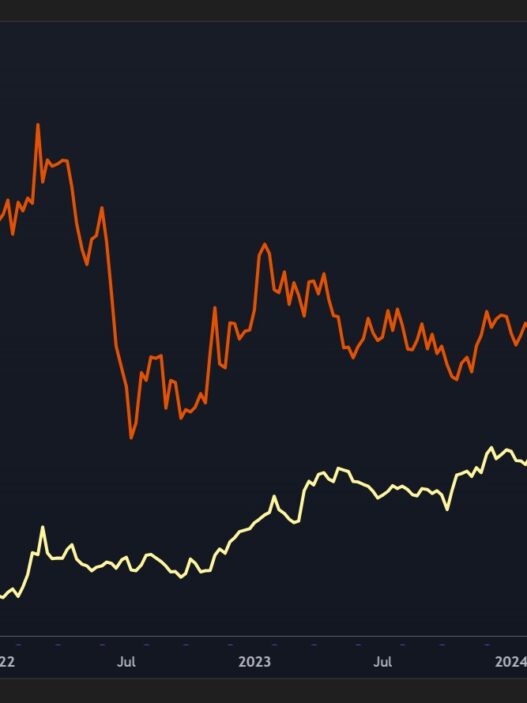

Copper emerged as the top-performing industrial metal in 2023, maintaining its lead despite experiencing some setbacks in the latter half of the year. Looking ahead to 2024, market analysts anticipate a significant surge in copper prices, positioning this vibrant red metal to potentially surpass the performance of other commodities once more. This optimistic outlook acts as a powerful catalyst, fueling the momentum of stocks in the copper exploration sector.

Recently on January 2, CNBC noted in its article “Copper could skyrocket over 75% to record highs by 2025 – brace for deficits, analysts say“:

“Copper is headed for a price spurt over the next two years, as mining supply disruptions coincide with higher demand for the metal… Rising demand driven by the green energy transition and a likely decline in the U.S. dollar in the second half of 2024 will push copper prices higher, according to a report by BMI, a Fitch Solutions research unit… In a December [Citibank] report, the investment bank forecast that the higher renewable energy targets would boost copper demand by extra 4.2 million tons by 2030. This would potentially push copper prices to $15,000 a ton in 2025, the report added… Other analysts see a bullish run for copper due to mining disruptions, with Goldman Sachs expecting a deficit of over half a million tons in 2024… The winners of the copper rush will be mainly Chile and Peru, BMI estimates.“

Last December, billionaire mining magnate Robert Friedland said in a Bloomberg interview that copper prices need to nearly double to $15,000 USD/t to prompt mining companies to build new mines to meet the rising demand. Last summer, Friedland warned of a “copper train wreck“ if supply won‘t keep up with demand, stating that copper prices could jump 10-fold. “When metals are required, the prices go crazy and nobody’s willing to sell them,” Friedland noted. “We’re heading into that sort of situation.”

Excerpts from “The investment opportunity for copper“ (June 2023):

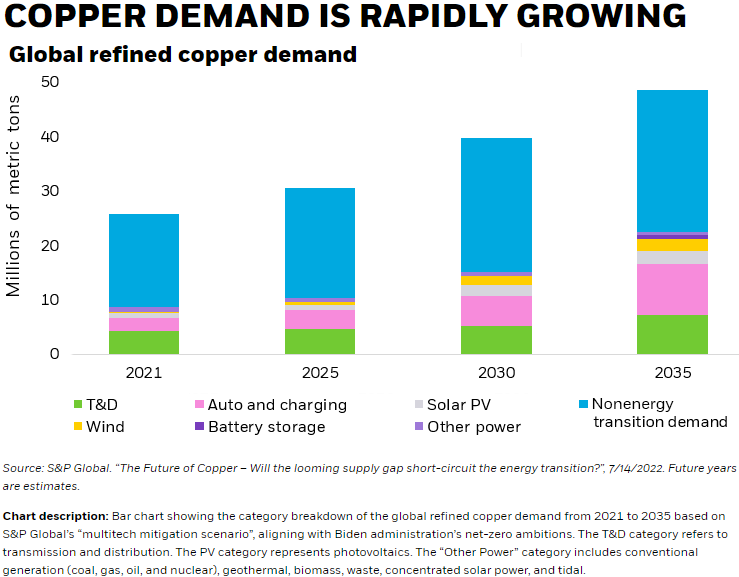

“Copper is the wiring that connects the present to the future. Global demand for copper is expected to double by 2035 driven not only by traditional sources of demand such as construction and infrastructure, but also by the adoption of new technologies that support a transition to a low-carbon economy, including electric vehicles, solar panels, and wind turbines… As the world electrifies, urbanizes, and grows wealthier, demand for copper will be challenging to meet, potentially bolstering the price of the metal…

Just as copper tools helped ancient civilizations emerge from the Stone Age, copper wiring plays a critical role in the world’s transition to a low-carbon economy. Copper is used in electric vehicles (EVs) and power grids, as well as in traditional infrastructure such as telecom wiring, plumbing and HVAC. Consequently, there is a secular demand surge for copper – driven not just by a low-carbon transition, but also the megatrends of rapid urbanization and emerging global wealth. As the “metal of electrification,” copper connects the past and future – generating exciting potential opportunities for investors…

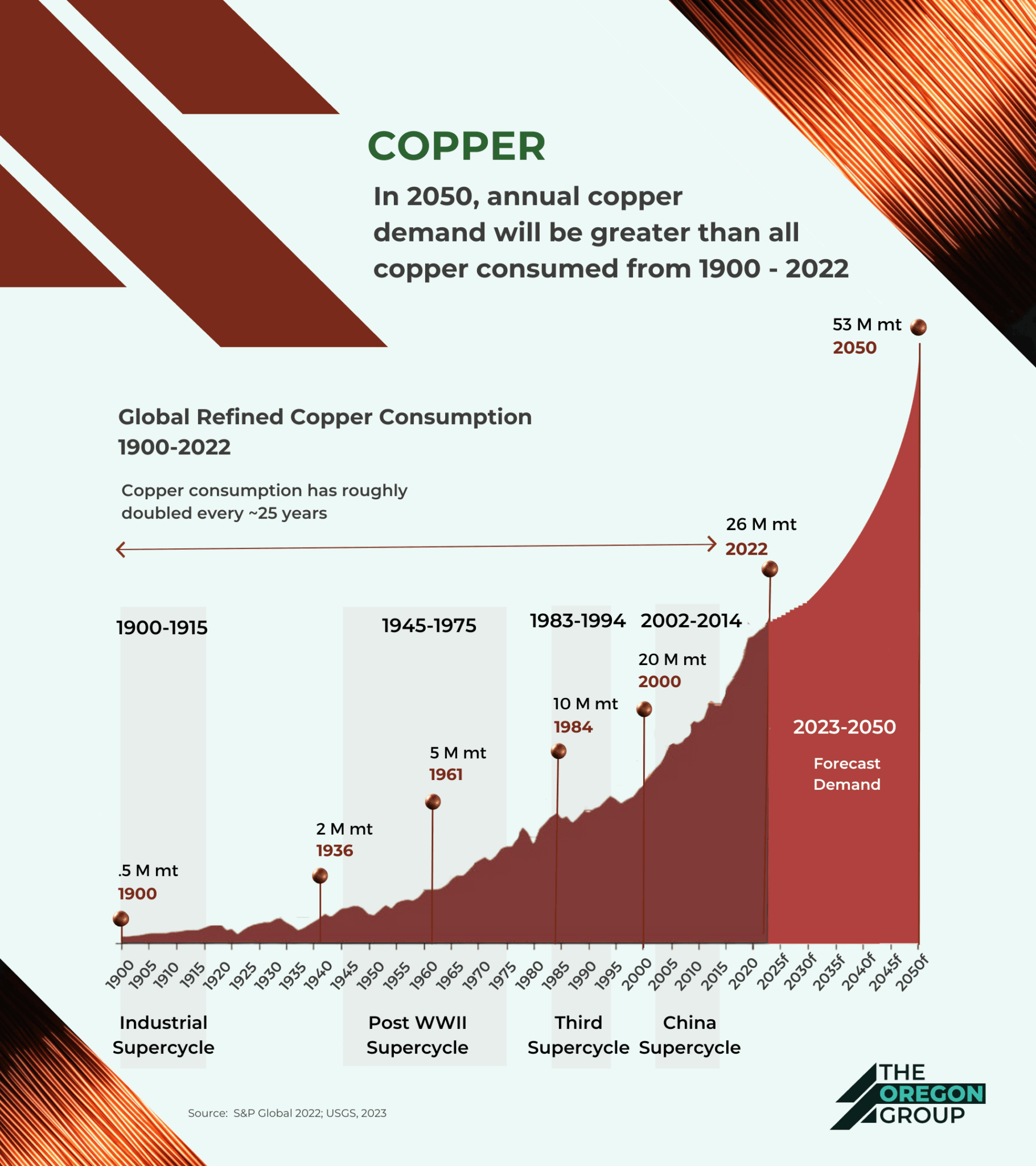

Demand for copper is forecast to grow from 25 million tons today to 53 million by 2050, driven by three key factors:

First, the electrification of transport, is projected to have the largest impact on copper demand. EVs require nearly 2.5x the amount of copper used in internal combustion engine (ICE) vehicles across electric motors, batteries, and charging infrastructure, and EV sales are projected to grow 35% in 2023.

Second, copper demand from power grids is projected to grow nearly 5x by 2050. Thanks to its unmatched conductivity and corrosion resistance, copper is used extensively in power distribution and transformers, particularly underground and subsea lines, and is needed to upgrade aging transmission infrastructure.

Third, the shift toward renewable power generation technologies such as solar and offshore wind – which require 2x and 5x more copper, respectively, per megawatt of capacity vs. gas and coal –should further increase demand.

In addition, the growing demand from building construction, appliances, electrical equipment, and cell phones, is still projected to account for 58% of copper usage by 2035.

As emerging markets continue to grow wealthier, and urban populations expand, copper is crucial to meet the demands of a growing middle class for electronics as well as the building needs of a rapidly urbanizing world…

Copper – a soft, red-colored metal – is extracted alongside rock from copper-rich ore deposits in underground or open-pit mines. The world has approximately 870 million tons of untapped copper deposits. By the early 2030s, demand could outstrip the current supply by more than 6 million tons per year for two key reasons:

First, geographic concentration risk for copper production is high. Chile and Peru alone account for 40% of output. These countries possess some of the world’s richest copper reserves and best-established mining operations. However, political instability, labor disputes and economic challenges in the region periodically disrupt supply and lead to shortages and price fluctuations.

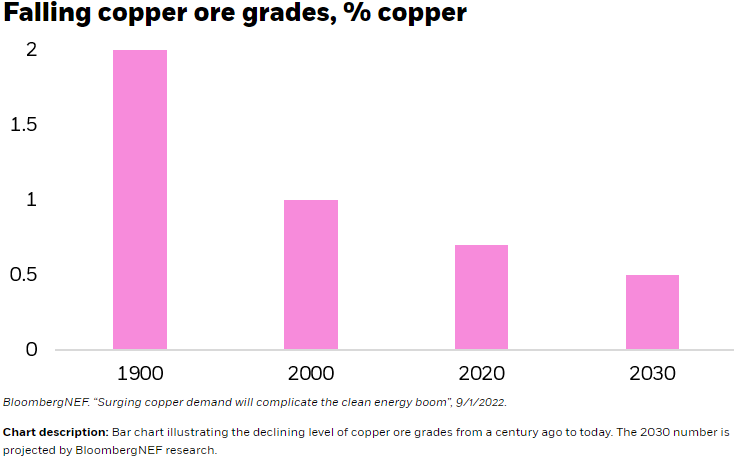

Second, existing copper mines are approaching production peaks. As high-grade ores become depleted, mining operations extract lower grades. Miners must now use grades of 0.5% copper (a measure of how much copper is present in rock) – a quarter the concentration of a century ago. As a result, more rock needs to be processed to extract the same amount of copper, raising extraction costs.

As a result of these constraints, global copper output in 2022 was 21.8 million tons, rising only 1 million tons over the previous three years and is expected to peak by the mid-2020s…”

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell commodities. The author holds physical gold and silver, stored in Central Switzerland through Elementum International AG. The author does not hold any direct interests or financial instruments related to other commodities or companies mentioned in this article. All views and forecasts reflect the state of knowledge at the time of publication and are subject to change. There is no guarantee that future developments will unfold as described. Investing in commodities involves risks. Consultation with a licensed financial advisor is strongly recommended.