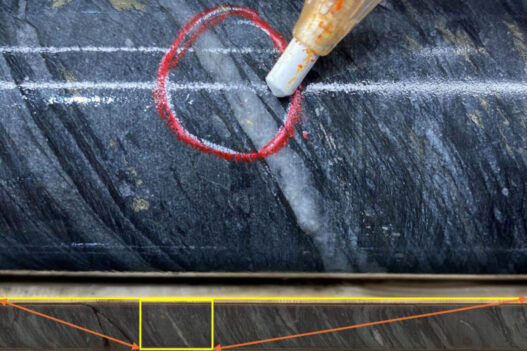

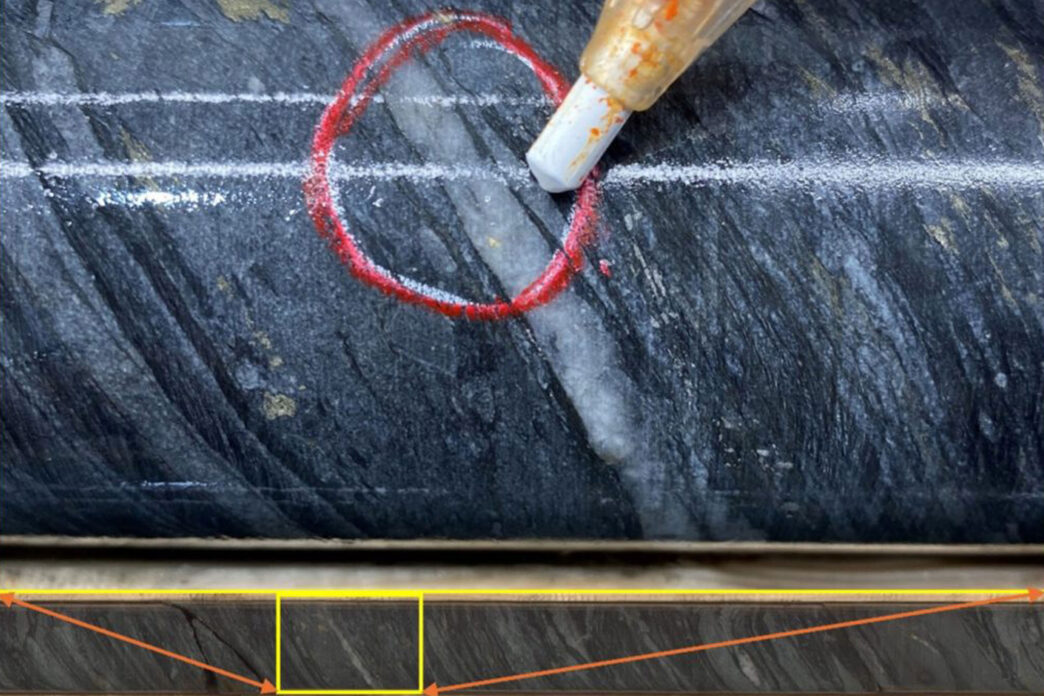

The first glance at the core says everything.

A pale quartz vein cuts through the dark, banded host rock – the kind of structural contrast geologists love – and within the red circle lies what every explorer hopes to see: Specks of visible gold shimmering back under the core shack lights. It’s the unmistakable signature of a living gold system – and at N2, it has now appeared over a remarkably long interval.

Formation Metals Inc. (CSE: FOMO) has delivered what could be the most consequential technical update in the company’s history.

Yesterday’s announcement confirms the interception of visible gold (VG) in 2 of the first 13 drill holes, including within a 30.8 metre mineralized interval – a scale and intensity of mineralization that immediately gets investor attention, as assays could confirm something genuinely rare: Long intervals of high-grade gold, not just narrow centimetre-scale spikes.

Importantly, this VG is not from the RJ Zone, the area drilled by Agnico-Eagle in 2008 where they hit ultra-high-grade but very narrow intervals such as 51 g/t gold over just 0.8 m. Instead, today’s VG comes from the A Zone, a shallower and far more laterally extensive part of the system – a zone historically known for continuity, not narrow flashes.

This distinction matters. It means the high-grade potential at N2 is not confined to isolated shoots – it may be embedded within a much broader, more predictable structural corridor.

Now, with gold trading at roughly 5 times its 2008 levels, FOMO has returned to N2 with a fully funded, significantly larger and far more modern drill program designed to chase what really matters: Broad, continuous zones of high-grade mineralization that can meaningfully scale ounces.

Geologically, yesterday’s results are an early but meaningful sign that N2 may host both size and grade – a powerful combination in a 4,000 USD gold world.

Visible Gold: A Clear Indicator of High-Grade Potential

Formation has now confirmed VG in:

- Hole N2-25-001: VG within a 4.5 m pyrite-rich quartz-carbonate veined interval.

- Hole N2-25-013: VG within an exceptional 30.8 m mineralized interval, located in the heart of the A Zone’s primary gold-bearing corridor.

In both cases, mineralization matches the historic fabric of N2’s gold system: Pyrite-rich, quartz-carbonate veining, strong structural controls, and broad sulphide-associated intervals.

“We are very thrilled with the findings of our maiden drill program at N2 to-date. The identification of visible gold in these holes demonstrates there is very strong high-grade potential at N2. N2-2025-013 in particular, located within the primary gold-bearing corridor of the “A” zone, shows that there is strong potential for high-grade zones within the bulk tonnage resource.”

CEO Deepak Varshney in yesterday's news-release

A Fully Funded 30,000 m Program Targeting Million-Ounce Growth

FOMO is undertaking a multi-phase 30,000 metre drill program, with Phase 1 (10,000 m) underway since September 25.

The core focus areas include:

1. The A Zone

- Historical resource: ~522,900 oz @ 1.52 g/t gold.

- Only 35% of strike drilled.

- More than 3.1 km undrilled .

- Known for predictable, shallow, low-variability gold mineralization.

- Now upgraded with the discovery of VG across 30.8 m.

2. The RJ Zone

- Historical resource: ~61,100 oz @ 7.82 g/t gold.

- Historical intercepts include:

- 0.8 m @ 51 g/t

- 3.5 m @ 16.5 g/t gold

- Only 900 m drilled out of a >4.75 km strike length.

3. Additional high-grade structural corridors

Across the A-RJ-Central system, the company is targeting new auriferous trends and bulk-tonnage expansions with district-scale upside.

With 13.7 million CAD in working capital, no debt, and 8.1 million CAD in provincial tax-backed exploration credits, the entire program is fully financed, allowing FOMO to drill aggressively without dilution pressure.

A Historic Resource Already in Place and Ready to Grow

The N2 Project hosts a global historic resource of:

- ~810,000 oz @ 1.4 g/t gold in 4 zones (A, East, RJ-East, Central).

- ~61,000 oz @ 7.82 g/t gold in the high-grade RJ Zone.

- Total: ~871,000 ounces of gold

The VG in Hole 013 (A Zone) suggests the historic bulk-tonnage modelling may have underestimated the presence of high-grade domains. Multiple targets identified by Balmoral (now Wallbridge) between 2010-2018 remain undrilled.

Timing, Grade, and Scale

The last time N2 was drilled (2008), gold traded at around 800 USD/oz. Today, gold is above 4,000 USD/oz at a time when global majors are hunting for:

- shallow deposits

- scalable ounces

- predictable geometry

- tier-1 jurisdictions

FOMO is positioning N2 to meet that demand:

- near-surface system

- multi-million-ounce potential

- Quebec (premium mining jurisdiction)

- fully funded through major milestones

“With nearly fourteen million in working capital and 30,000 metres fully funded, Formation is in a strong position to execute on our goal of developing N2 into a near-surface multi-million-ounce deposit. With gold breaking $4,000, over 5 times the price in 2008 when Agnico last drilled the project, we believe that the timing is perfect for N2 and look forward to sharing further updates int he coming weeks.”

CEO Deepak Varshney in yesterday's news-release

Base Metal Upside: An Emerging Secondary Value Stream

Recent re-evaluation of historic assays revealed elevated copper and zinc values within gold-bearing intervals:

- Copper: 200-4,750 ppm (up to 0.475% copper)

- Zinc: 203-6,700 ppm (up to 0.67% zinc)

These align with the structural and geological setting of Matagami’s prolific VMS corridor, suggesting polymetallic potential alongside gold.

Next Steps: Assays Pending, A Potential Catalyst Moment

Assays from the VG-bearing holes are now awaited and could provide the strongest technical validation yet of N2’s ability to host:

- high-grade zones

- large-volume bulk tonnage

- multiple stacked mineralized structures

- extensive expansion potential along strike and at depth

Investors can expect ongoing drill results, updated models, and structural interpretation through the coming weeks and months.

Bottom Line

Yesterday’s announcement of the discovery of visible gold, especially within a 30.8 m interval, marks a pivotal moment for N2.

The combination of:

- a historically defined 871,000 oz resource,

- a fully funded 30,000 m program,

- a dramatically improved gold price environment,

- new high-grade indications within broad mineralized envelopes,

- multi-kilometre strike extensions still untested,

- and a strong treasury with zero debt

sets the stage for what could become one of Quebec’s most significant new gold growth stories.

The assays will reveal the scale, but the geology is already speaking loudly.

Company Details

Formation Metals Inc.

#1245 – 300 Granville Street

Vancouver, BC, V6C 1V4 Canada

Phone: +1 778 899 1780

Email: info@formationmetalsinc.com

www.formationmetalsinc.com

CUSIP: 34638F / ISIN: CA34638F1053

Shares Issued & Outstanding: 94,002,458

Canada Symbol (CSE): FOMO

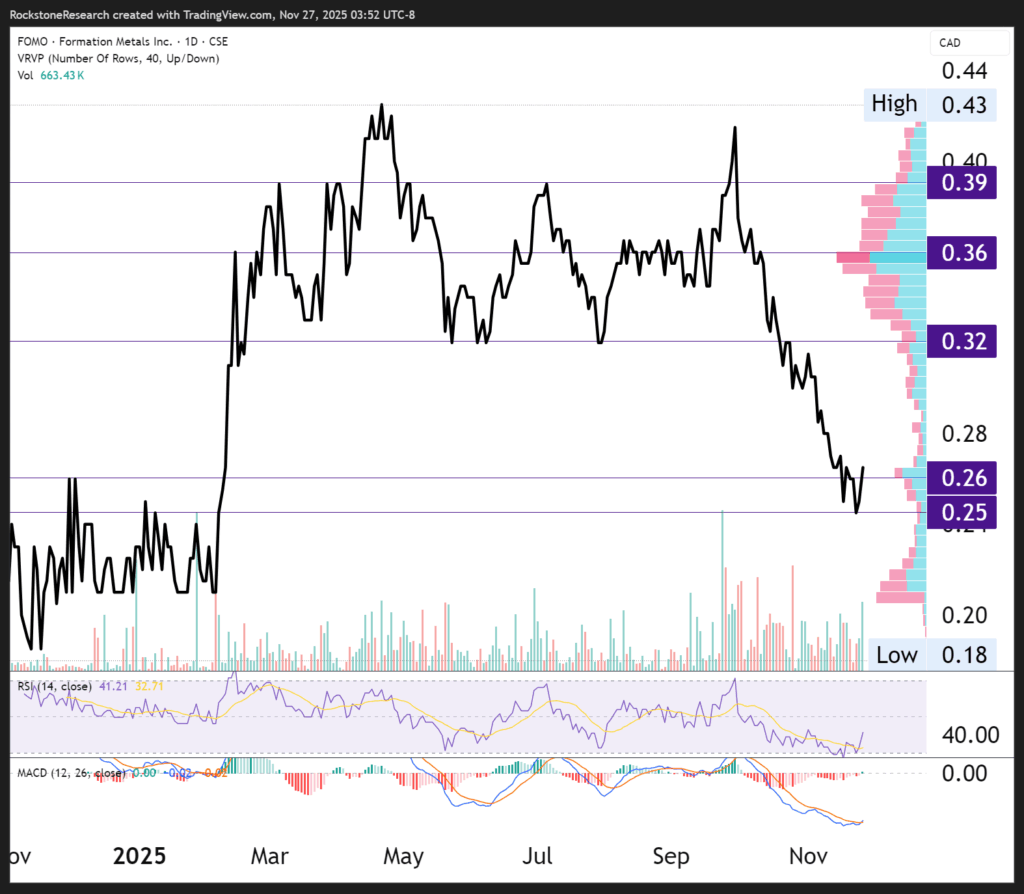

Current Price: 0.265 CAD (11/26/2025)

Market Capitalization: 25 Million CAD

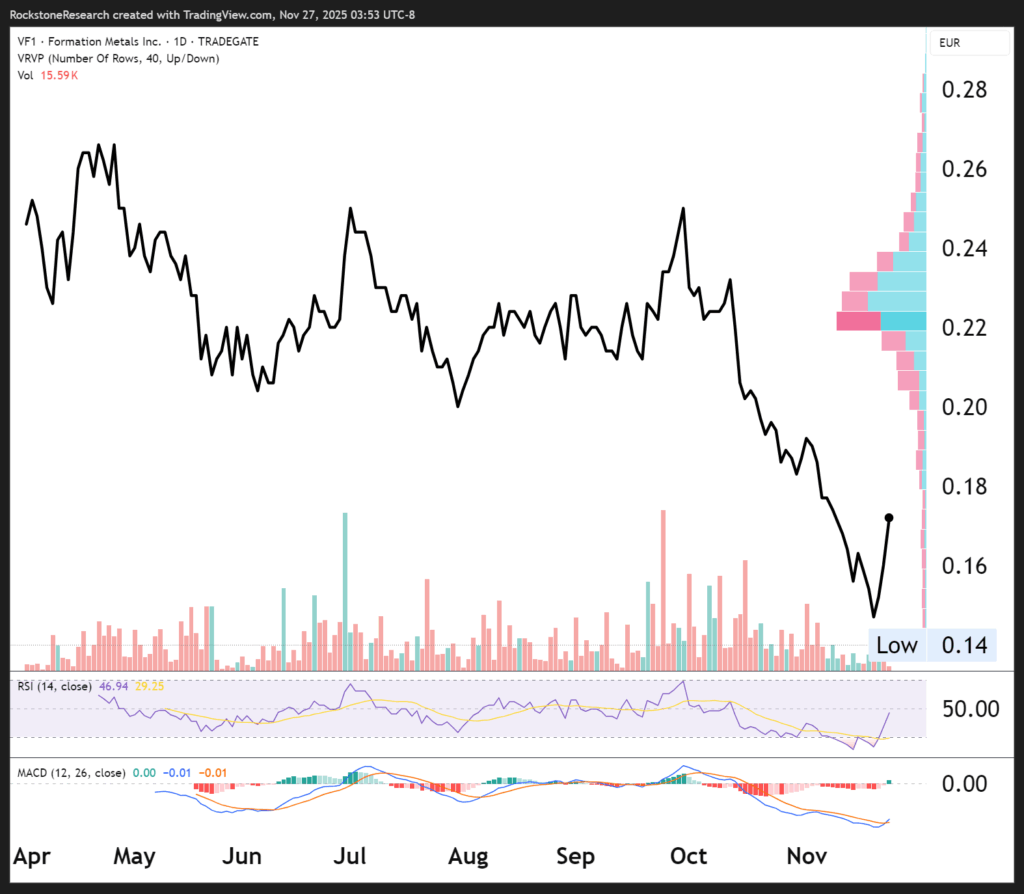

Germany Symbol / WKN: VF1/ A3D492

Current Price: 0.172 EUR (11/27/2025)

Market Capitalization: 16 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Formation Metals Inc. (“FOMO“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the FOMO‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward-looking include that assays could confirm long intervals of high-grade gold mineralization; that today’s results indicate N2 may host both size and grade; that the presence of visible gold may reflect high-grade domains within broader bulk-tonnage zones; that the discovery of visible gold may demonstrate strong high-grade potential at the N2 Project; that the A Zone may contain additional high-grade structures not identified in historical modelling; that FOMO’s 30,000-metre drill program may lead to the expansion of the historical resource; that only 35% of the A Zone strike has been drilled and the remaining 3.1 km may contain additional mineralization; that the RJ Zone’s 4.75 km of undrilled strike may host extensions of high-grade gold; that additional high-grade structural corridors may exist across the A-RJ-Central system; that the fully funded exploration program allows the company to drill aggressively without dilution pressure; that multiple undrilled targets identified between 2010 and 2018 may yield new mineralized zones; that gold trading at significantly higher prices than in 2008 may enhance the economic potential of the N2 Project; that FOMO is positioning N2 as a near-surface system with multi-million-ounce potential; that the timing may be ideal for advancing N2 in the current gold price environment; that elevated copper and zinc values suggest potential for polymetallic mineralization; that tightening copper and zinc markets may support stronger long-term pricing; that assays from the VG-bearing holes may validate N2’s potential to host high-grade, large-volume mineralized zones; that drilling, modelling, and structural interpretation in the coming weeks may provide additional catalysts; that the combination of fully funded drilling, a historical resource, strong gold prices, and untested strike length may set the stage for significant project advancement; that the assays will reveal the scale of mineralization; that N2 could become one of Quebec’s most significant emerging gold growth stories. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Key risks and uncertainties include, but are not limited to: Permitting and Regulatory Approvals: The Company’s exploration and development activities are subject to obtaining and maintaining the necessary permits, licenses, and governmental approvals; delays or denials in permitting could materially impact planned exploration timelines and budgets; changes in federal or provincial regulations, environmental laws, or First Nations consultation requirements may increase costs or restrict activities. Exploration Risk: Mineral exploration is inherently speculative and involves significant uncertainty; the presence of visible gold does not guarantee high-grade assay results or economic mineralization; drill results may not replicate historical data; mineralized zones may be narrower, lower grade, or less continuous than anticipated; planned drill meters may not yield resource expansion. Resource Uncertainty: The N2 Project hosts historical (non–NI 43-101 compliant) resource estimates that may not be reliable; there is no guarantee that historical estimates will be verified or converted into current resources; verification drilling may reveal discrepancies that materially alter interpretations of grade, tonnage, or geometry. Geological Interpretation Risk: Geological models are conceptual in nature and based on limited data; new drilling may alter structural interpretations or invalidate exploration targets; mineralization may not extend along strike or at depth as projected; high-grade zones may be discontinuous or confined to isolated shoots. Assay and Sampling Risk: Pending assays may return lower-than-expected grades; visible gold can lead to sampling bias; coarse-gold effects may produce inconsistent results; laboratory delays or quality-control issues may affect timelines and result reliability. Commodity Price Risk: The economic viability of the N2 Project depends on sustained high gold prices; gold prices are volatile and influenced by macroeconomic factors beyond the Company’s control; declines in gold, copper, or zinc prices may negatively affect project economics, investor sentiment, and financing conditions. Financing and Liquidity Risk: Although the current drill programs are fully funded, the Company will require additional funding for future exploration, development, and resource drilling; capital markets may be unfavorable when funding is needed; equity financing may result in dilution; conditions may restrict access to capital. Operational Risk: Exploration activities involve logistical, technical, and operational challenges; drilling performance may be affected by weather conditions, equipment failures, labor shortages, or contractor performance; field activities may be delayed by seasonal factors typical to Quebec. Environmental Risk: Exploration and future development activities may encounter environmental liabilities; unforeseen environmental impacts could require mitigation, remediation, or operational adjustments; changes to environmental regulations may increase costs. First Nations and Community Relations: The Company must maintain positive relationships with local communities and Indigenous groups; failure to establish or maintain constructive partnerships could result in delays, restrictions, or additional consultation requirements. Title and Land Tenure Risk: Although believed to be in good standing, mineral titles may be subject to disputes, competing claims, or errors in historical record-keeping; changes to land access rules, protected areas, or overlapping rights (e.g., forestry, hunting, trapping) may restrict operations. Infrastructure and Logistics Risk: Remote access, limited regional infrastructure, and availability of services may affect exploration efficiency; reliance on third-party infrastructure (roads, mills, power) introduces risks outside the Company’s control. Market and Share Price Volatility: Junior exploration companies experience significant share price volatility unrelated to underlying fundamentals; market conditions, macroeconomic factors, and sector sentiment may impact valuation and liquidity. Personnel and Management Risk: The Company depends on a small team of experienced technical and financial personnel; loss of key personnel or difficulty attracting qualified staff could impede project advancement and operational effectiveness. Competition Risk: The mining sector is highly competitive; other companies with greater financial strength may compete for land, talent, equipment, contractors, or strategic partners, limiting Formation Metals’ ability to secure critical resources. Forward-Looking Statements Risk: Forward-looking information is subject to numerous assumptions and uncertainties; actual results may differ materially due to the risks described above and additional factors not presently known or considered material. Statements herein assume the availability of financing, successful permitting, exploration results that validate historical data, continued favorable commodity pricing, and supportive regulatory and social conditions. There can be no assurance that these assumptions will prove accurate. Caution to Readers: Forward-looking statements are not guarantees of future performance. Actual results may differ materially due to the risks and uncertainties described above and in the FOMO’s public disclosure. Readers should not place undue reliance on forward-looking information. Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on FOMO’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of FOMO’s projects is no guarantee for mineralization on the properties from FOMO, and all of FOMO’s projects are exploration projects. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment. So while the author of this report is not paid directly by Formation Metals Inc. (“FOMO“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of FOMO‘s stock prices. The author also owns equity of FOMO, and he also owns equity of Zimtu Capital Corp. and thus will benefit from volume and price appreciation of these stocks. FOMO pays Zimtu Capital Corp. to provide this report and other services. FOMO has signed an agreement with Zimtu Capital Corp. (TSX.V: ZC) (FSE: ZCT1) (“Zimtu”) whereby Zimtu will provide marketing services under its ZimtuADVANTAGE program, effective August 1, 2025, for an initial term of 12 months at a cost of $12,500 per month. The program is designed to provide opportunities, guidance, marketing and assistance. Services include investor presentations, email marketing, lead generation campaigns, blog posts, digital campaigns, social media management, Rockstone Research reports & distribution, video news releases and related marketing & awareness activities. Zimtu is based in Vancouver, at Suite 1450 – 789 West Pender Street, Vancouver, BC V6C 1H2. Zimtu may be reached at 604.681.1568, or info@zimtu.com. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Formation Metals Inc., Tradingview, Stockwatch, and the public domain.