Every great mining story begins with a first drill hole. Yet the truly exceptional ones don’t stop there.

For Tocvan Ventures Corp., that defining moment has arrived – but with a crucial difference: While most juniors are just drilling, Tocvan is drilling and building at the same time.

A New Chapter Begins

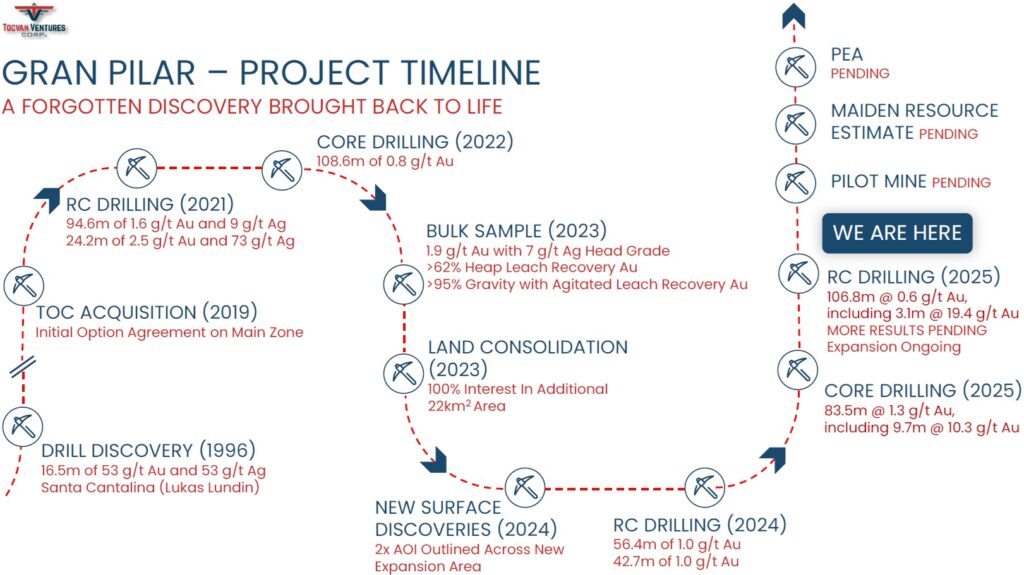

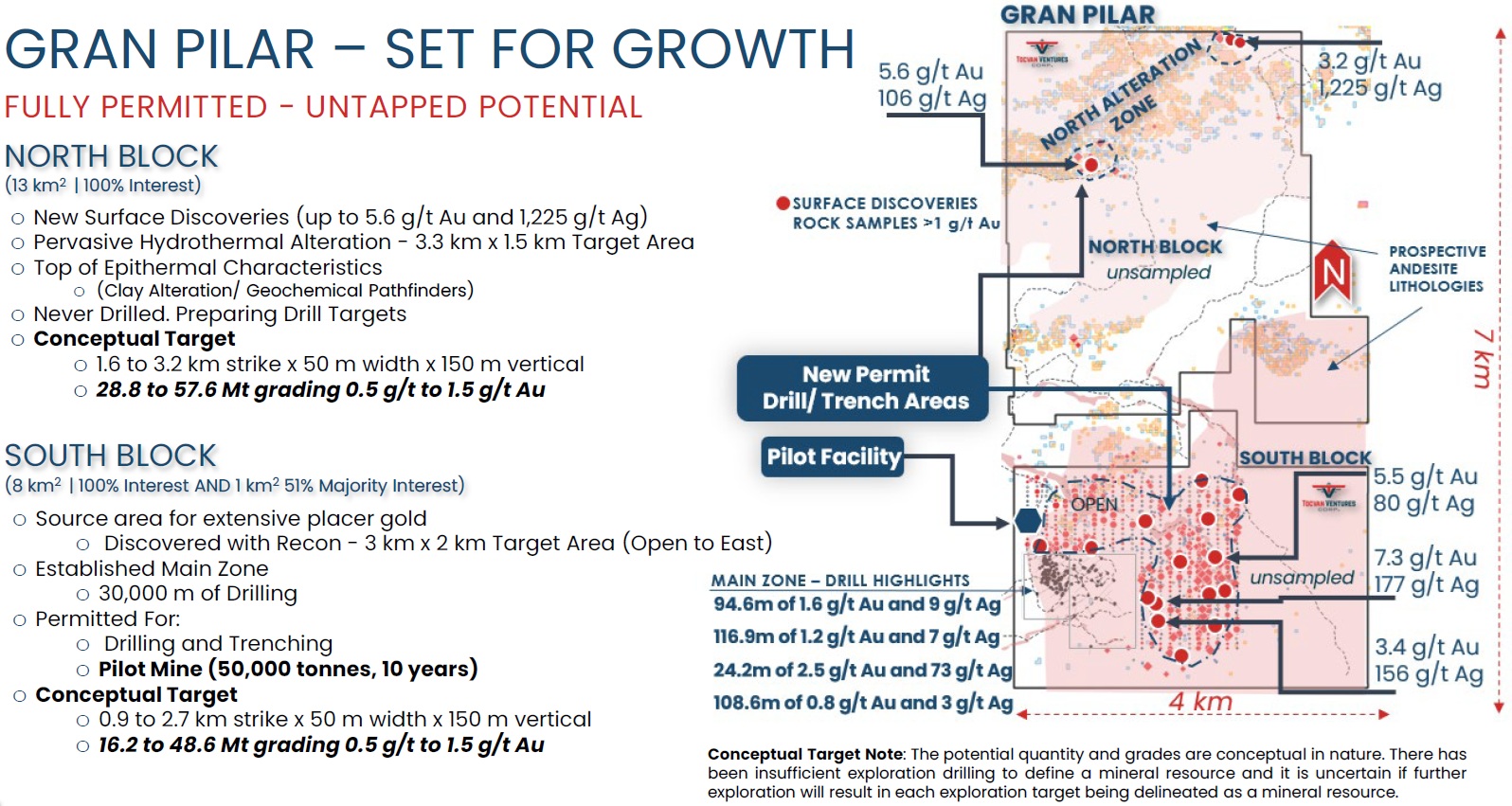

As the company today started its maiden drill program at the North Block of its 100%-controlled Gran Pilar Gold-Silver Project in Sonora, Mexico, preparations are already underway for pilot-scale gold and silver production on site.

The rigs are now turning across an extensive, several-kilometer-long alteration corridor (a geological fingerprint of major epithermal systems) while earthworks and infrastructure advance for the company’s fully permitted pilot mine facility.

This dual-track approach – discovery and development in parallel – sets Tocvan apart from the typical exploration narrative. It’s the culmination of years of methodical groundwork that has transformed the company from early-stage explorer to near-term producer.

Today, Tocvan holds all the components that signal a coming success:

- A large, drilled-out Main Zone proving the model.

- Expanding discoveries across both South and North Blocks.

- A permitted pilot mine ready for construction and commissioning.

- Strong community and government support in mining-friendly Sonora.

- And a backdrop of record-high gold prices.

Tocvan has entered the most exciting phase of its history: Where exploration meets production, and where each drill hole and each tonne of leached rock brings the company closer to unlocking the full potential of Gran Pilar.

“We are thrilled with the early progress of our maiden drill program at the North Block, which represents a significant step in unlocking the full potential of the Greater Pilar system. The integration of geophysical surveys, surface mapping, and these new target discoveries has refined our approach, and we anticipate meaningful results that could expand our resource base. Combined with advancements on the South Block, including trenching and pilot mine preparations, Gran Pilar is positioning Tocvan for near-term production and long-term growth.”

Brodie Sutherland, CEO of Tocvan Ventures Corp., in today's news-release

The North Block: Pure Discovery Potential

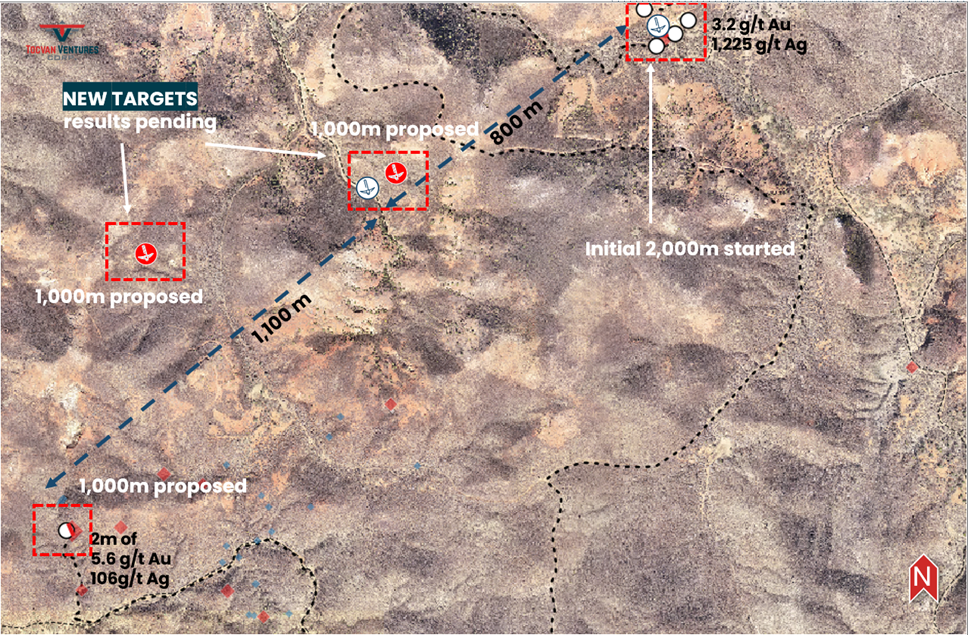

6 km north of the Main Zone lies the North Block, a 3.2 × 1.5 km alteration system riddled with ancient mine workings and high-grade surface samples:

- March 2024: 3.2 g/t Au, 1,225 g/t Ag, 0.42% Cu, >20% Pb, 3.4% Zn

- October 2023: 5.6 g/t Au, 106 g/t Ag

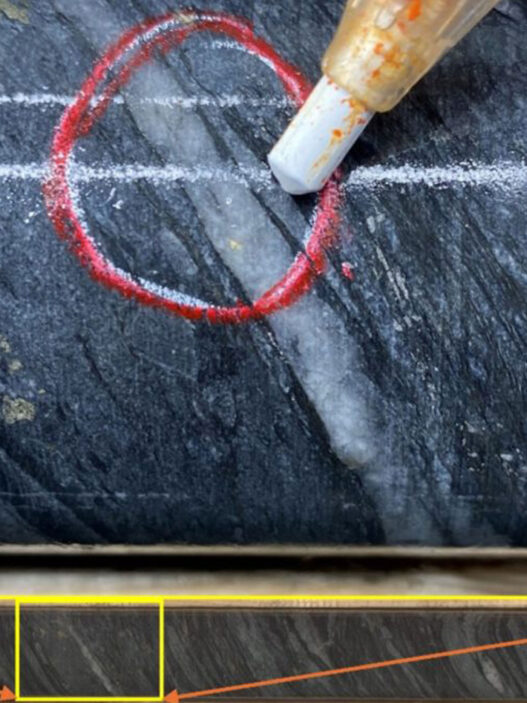

Most recently on October 23, Tocvan announced the discovery of 2 new mineralized targets featuring historic adits and silicified vein breccias. These targets align with previous high-grade results, including a high-grade sample (3.2 g/t Au and 1,225 g/t Ag) found 800 m northeast, and a 2 m chip sample of 5.6 g/t Au and 106 g/t Ag 1,100 m southwest. None of these new targets have been drilled – until now.

“This exciting discovery of two new targets with extensive historic workings in previously unmapped areas represents a major advancement in our understanding of the North Block’s potential. These findings not only validate our exploration model but also open up new avenues for resource potential. We are accelerating follow-up work, including trenching and drilling, to delineate these targets and integrate them into our broader development strategy at Gran Pilar.”

Brodie Sutherland, CEO of Tocvan, in the news-release on October 23, 2025

With rigs finally turning, the North Block offers blue-sky potential to double or triple the project’s mineralization footprint.

The South Block: Expansion and Pilot Production

The South Block represents both expansion potential and immediate production readiness.

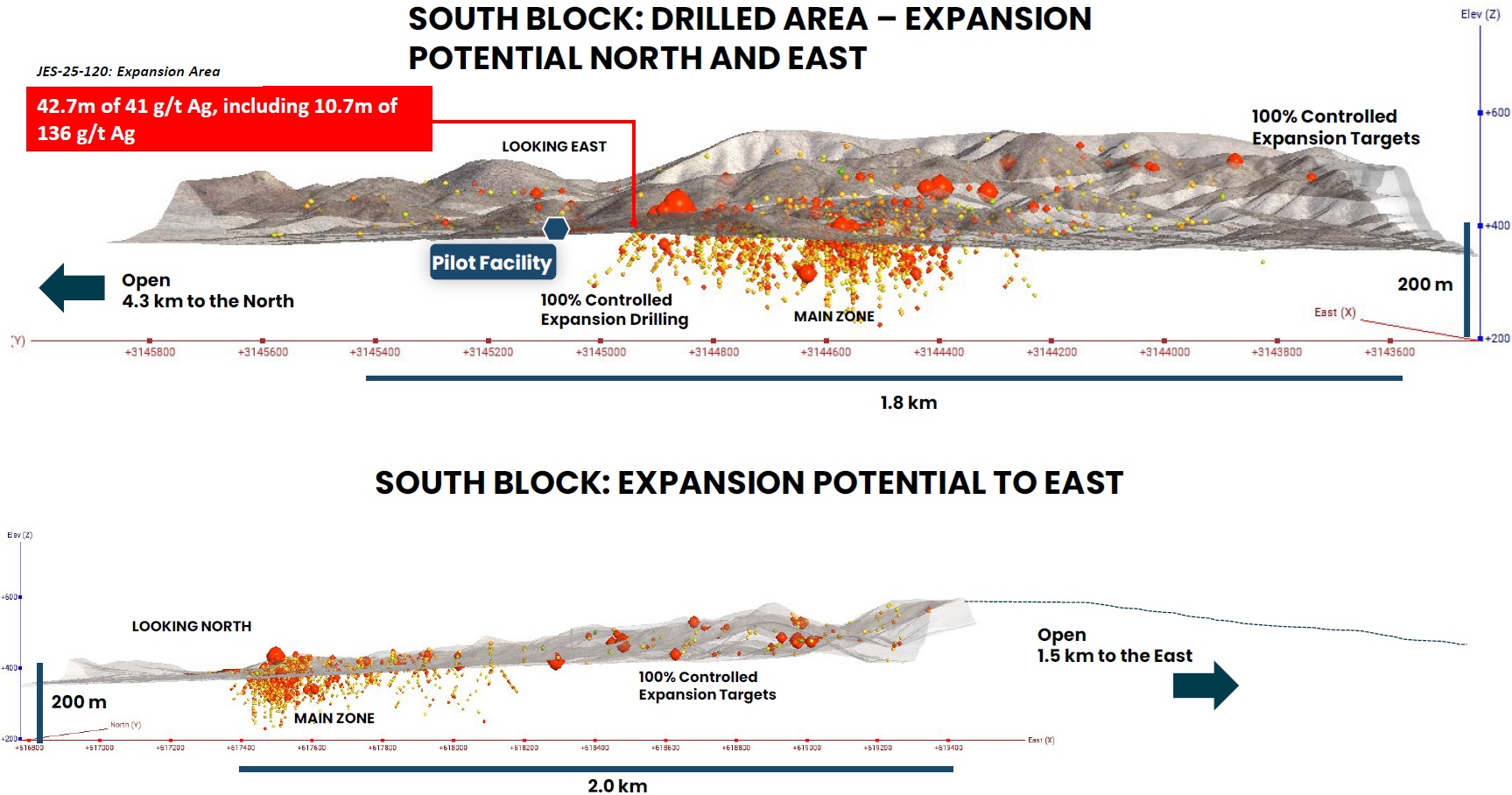

A maiden drill program in early 2025 returned strong results:

- February 2025: 106.8 m @ 0.61 g/t Au, incl. 19.8 m @ 3.06 g/t Au (from surface), incl. 3.1 m @ 19.39 g/t Au (from 12.2 m).

- May 2025: 41.2 m @ 1.02 g/t Au (from 33.6 m), incl. 6.1 m @ 5.43 g/t Au + 39.4 g/t Ag, incl. 1.53 m @ 15.85 g/t Au + 140.5 g/t Ag (from 44.23 m).

- June 2025: Discovery of the broadest silver zone to-date, drilling 42.7 m @ 44.7 g/t Ag (from surface), incl. 10.7 m @ 136.5 g/t Ag (from 32 m).

With drilling underway at the North Block, Tocvan plans to shift to the South Block next, targeting follow-up holes on these strong gold and silver zones that have already demonstrated strong continuity and scale.

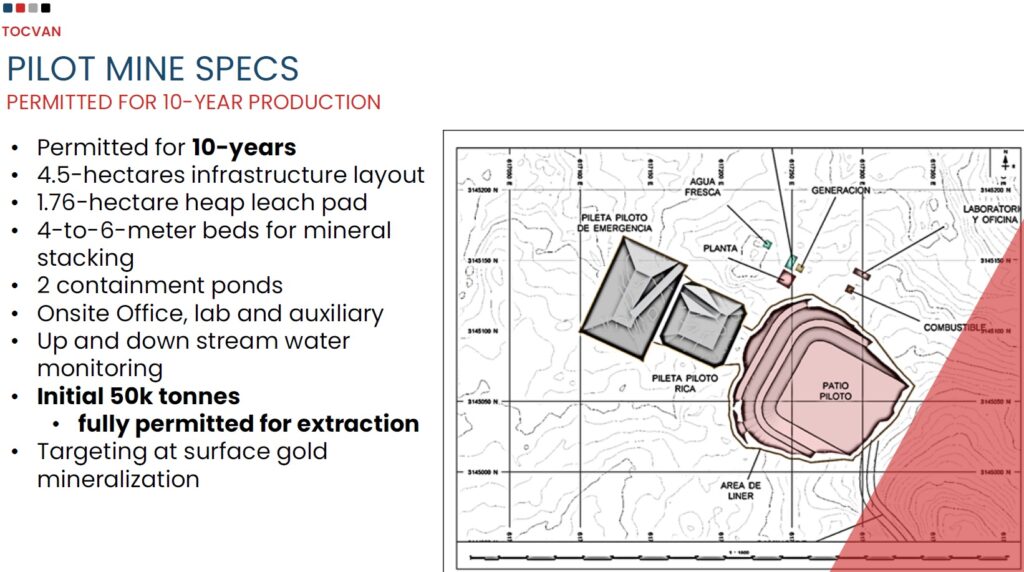

Here in the South Block, Tocvan is constructing its pilot heap-leach facility, fully permitted for 10 years and designed to process 50,000 tonnes of material annually. The 1.76 hectare leaching pad, solutions and contingency ponds will employ a 60-90 day cyanide leach cycle.

This facility will generate crucial operational data (and possibly first gold) validating Gran Pilar’s economics while de-risking full-scale development.

From Exploration to Production: The Tocvan Evolution

Tocvan’s strategy in Mexico has always been clear: Build value by advancing simple, scalable, near-surface gold systems in a mining-friendly jurisdiction, while at the same time keeping a very tight share structure in firm hands.

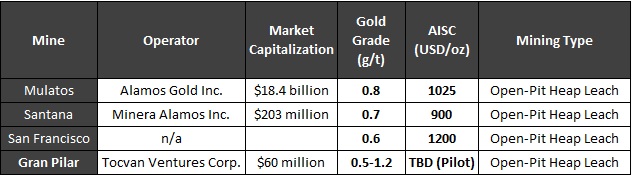

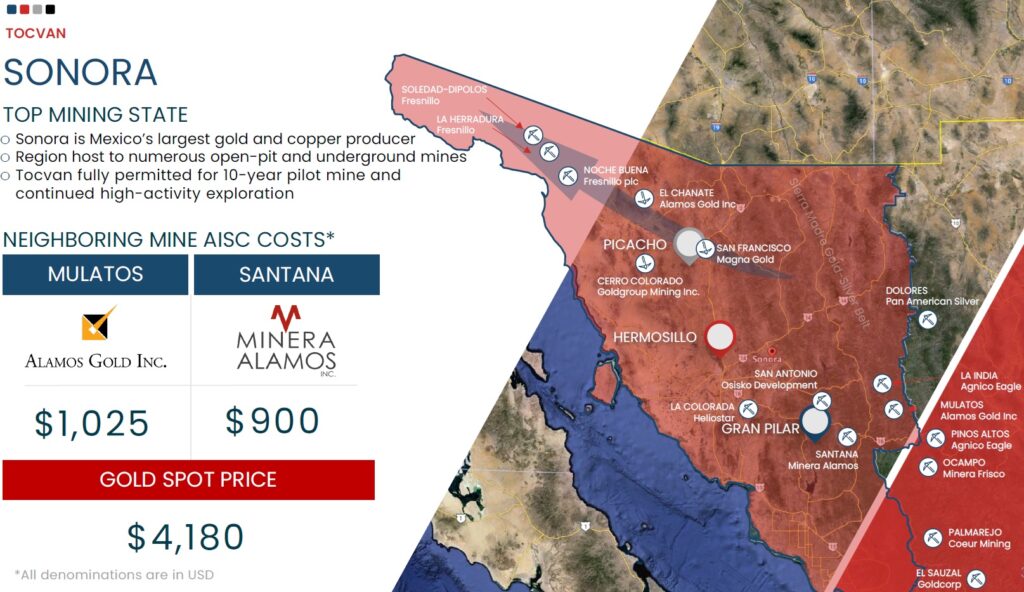

Located within trucking distance of Hermosillo, Gran Pilar sits in a district that already hosts multiple open-pit heap-leach operations such as Mulatos, Santana, and San Francisco. Proof that Tocvan is in the right neighborhood.

- Over 30,000 m of drilling confirmed thick, continuous gold mineralization across the Main Zone on the small Pilar Property, with recent highlights such as:

- March 2025: Tocvan drilled 83.45 m @ 1.27 g/t Au (from 14.1 m), incl. 9.72 m @ 10.31 g/t Au (from 87.83 m), incl. 1.6 m @ 60.6 g/t Au – the highest gold grade since the discovery of the Main Zone (16.5 m @ 53 g/t Au; historic).

- May 2024: At North Hill (300 m northeast of Main Zone), Tocvan drilled 42.7 m @ 0.96 g/t Au (from 22.88 m), incl. 3.05 m @ 10.9 g/t Au (from 38.13 m).

- 2023: A bulk sample with material from the Main Zone achieved 62% heap-leach gold recovery and up to 99% gold recovery in agitated-leach tests. The head grade was calculated at 1.9 g/t Au (extracted grade calculated at 1.2 g/t Au).

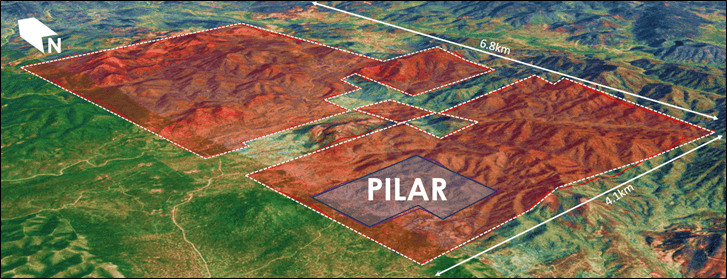

- October 2023: By consolidating full ownership of 22 km² of highly prospective ground surrounding the 1 km² Pilar Property, Tocvan has transformed its footprint and quickly confirmed the broader potential of the district through strong surface sampling and drilling results.

Now, the company is targeting completion of 3,000-5,000 m of drilling by the end of Q4 2025 across both the North and South Blocks, whereas the North Block is being drilled for the very first time.

Armed with permits for more than 30,000 m of new drilling and a 10 year pilot facility, Tocvan is moving decisively toward new discoveries and first gold production.

The Main Zone: Proven Foundation for Growth

For years, the Main Zone on the original Pilar Property served as Tocvan’s geological backbone: An open-pitable oxide gold-silver system where mineralization literally begins at surface. This is where Tocvan first proved the model, drilling wide intercepts, such as most recently:

- 97.35 m @ 0.65 g/t Au (from surface), incl. 66 m @ 0.95 g/t Au (from surface) (March 19, 2025)

- 64.9 m @ 1.2 g/t Au (from surface), incl. 3 m @ 21.58 g/t Au (from 8.3 m) (March 26, 2025)

Within these thick, continuous zones occur high-grade shoots confirming the robust character of the mineralized system.

Consistent near-surface mineralization like this is the hallmark of successful open-pit heap-leach mines across Sonora.

However, while the Main Zone remains an important technical foundation, it is part of a 51/49 joint venture with Colibri Resource Corp., meaning Tocvan holds a majority but not full ownership.

In 2023, Tocvan expanded and consolidated the surrounding 22 km² land package into what is now the Gran Pilar Project: An area that fully envelops the Pilar Property and hosts newly discovered, high-grade surface samples and near-surface drill intercepts on ground 100% owned by Tocvan.

With these new discoveries, Tocvan’s operational and strategic focus naturally shifted from the limited Main Zone area to the far larger and fully owned Gran Pilar property. The scale, grade, and geological potential at Gran Pilar far exceed the boundaries of the original joint-venture ground.

As a result, Tocvan’s upcoming pilot mine facility (fully permitted and under development) is not located on the Pilar JV ground, but rather on Tocvan’s 100%-controlled Gran Pilar property. Feed material for the pilot operation may come directly from the newly discovered mineralized zones within Gran Pilar, not from the Main Zone JV area.

In essence, the Main Zone provided proof of concept – Gran Pilar represents the future. Tocvan’s ownership, exploration freedom, and development potential at Gran Pilar now define the company’s growth trajectory.

Understanding the Grade: 1 g/t Gold Matters

Many investors instinctively chase “bonanza grades,” overlooking the quiet power of large, low-grade deposits. In open-pit heap-leach mining, grade is only one piece of the economic puzzle.

Across Sonora:

These operations thrive because they move large volumes of rock at low cost and recover gold efficiently through heap leaching, a proven, low-capex method ideal for near-surface oxide deposits like Gran Pilar.

Unlike traditional milling, heap leach facilities are simple to build and operate, relying on gravity and chemistry rather than complex infrastructure. The result: Low strip ratios, minimal energy use, and rapid payback once leaching begins.

Tocvan’s metallurgical tests confirm that Gran Pilar fits this model perfectly, combining scalability with cost efficiency. This positions the project to generate strong margins even at conservative metal prices and exceptional leverage in a rising gold market.

Because heap-leach operations remain profitable across virtually any price environment, they are highly sought after by major and mid-tier producers looking for low-risk, high-return assets.

Gran Pilar checks every box: A large, near-surface oxide gold-silver system in a proven mining district, the kind of “risk-off growth asset” majors target for acquisition as global gold supply tightens.

Sonora: A Mining Powerhouse Reawakens

Sonora is Mexico’s premier mining jurisdiction: A land of deserts, infrastructure, and 4 centuries of mining culture. Major producers such as Fresnillo, Alamos Gold, and Agnico Eagle operate successfully here.

Following a pause in 2023-2024, the Mexican government has returned to a pro-development stance, approving new permits and fast-tracking projects. Tocvan’s recent permits for 30,000 m of drilling and a 10 year pilot mine highlight that policy shift.

Roads, power lines, and water access are already in place. Local villages like Suaqui Grande provide a skilled workforce and strong support for responsible development.

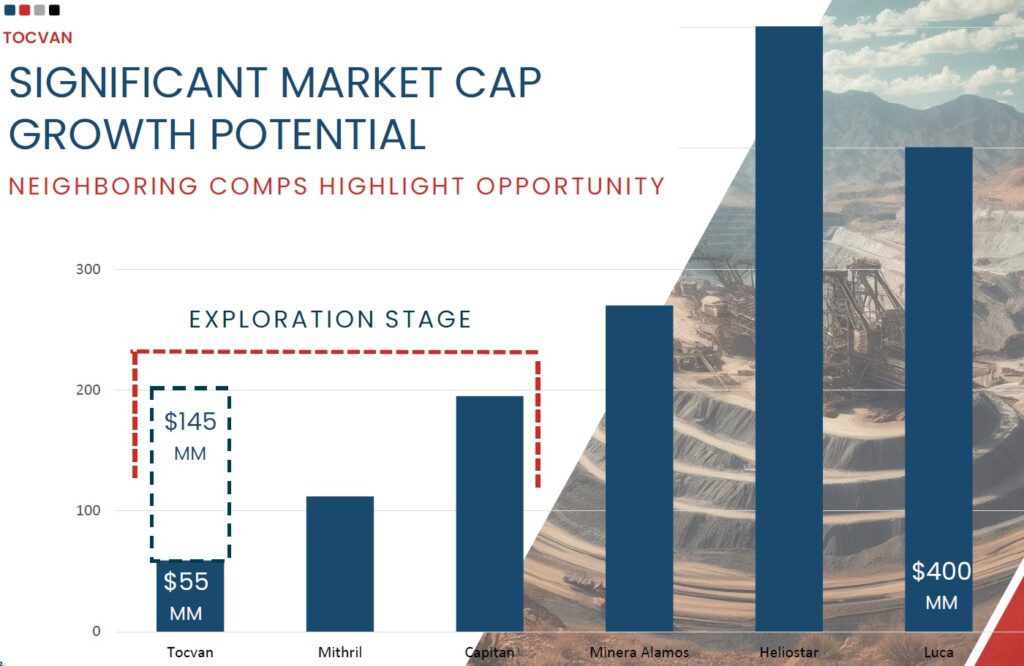

The Market Context: Timing Is Everything

With gold prices currently trading above $4,100 USD/oz, the economics of open-pit operations have never been stronger.

Tocvan’s timing is fortuitous: Its pilot mine will test production in a record price environment while exploration across the North Block adds blue-sky value.

A tight share structure (~66 million shares, no debt) means that each increment in asset value translates directly to shareholder leverage.

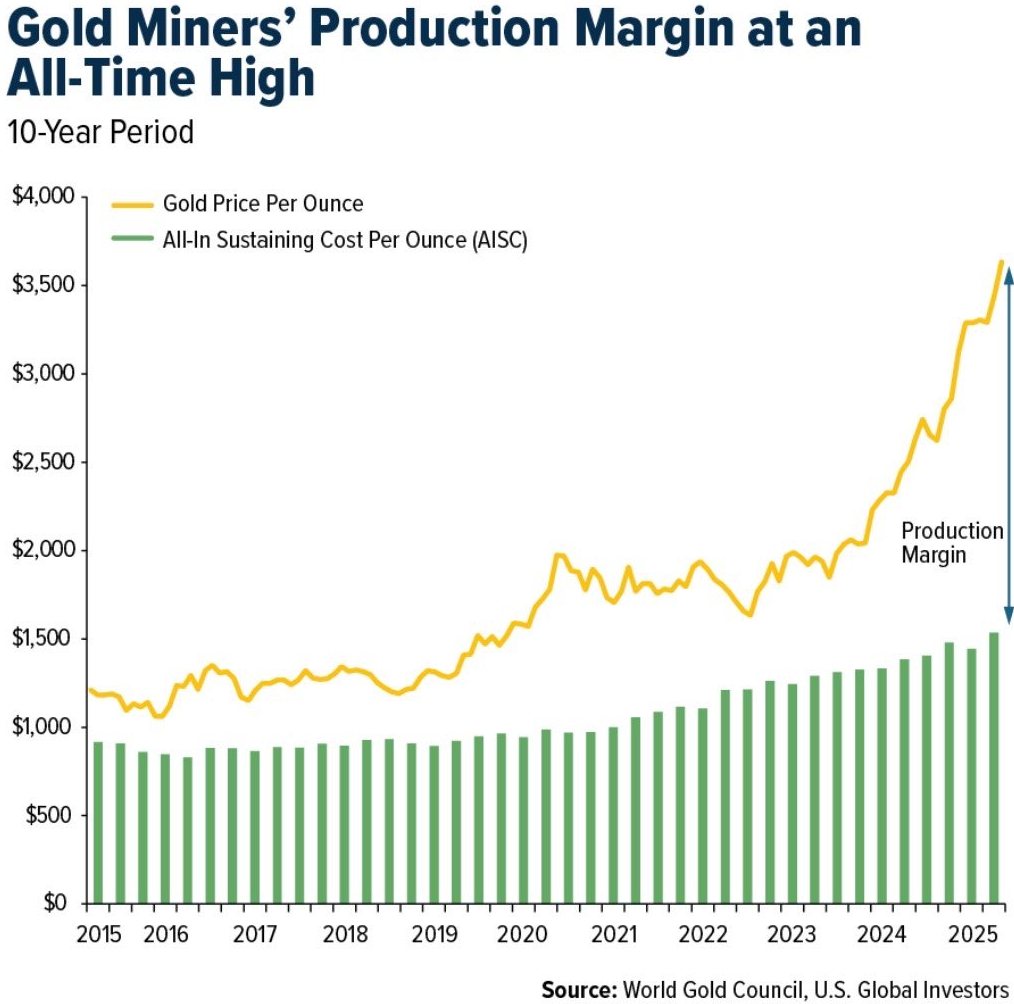

- The widening gap between production costs and market price highlights the strongest profitability the sector has ever seen, underscoring miners’ powerful leverage to rising gold.

- With margins at record levels, majors are well-positioned to pursue M&A, acquiring defined ounces in the ground across stable jurisdictions. This not only secures future production pipelines but also allows them to replace depleting reserves, strengthen balance sheets, and capitalize on favorable market sentiment.

- For investors, it points to an impending wave of M&A, where quality exploration and development assets are likely to emerge as prime takeover targets. Tocvan is well positioned in Sonora, Mexico – one of the world’s most prolific and mining-friendly gold regions.

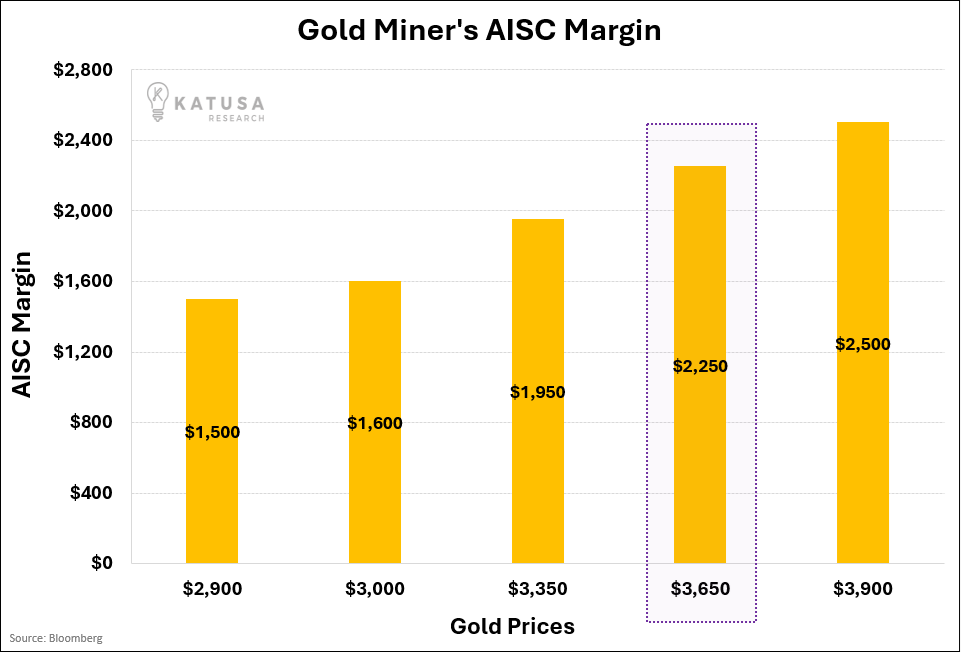

“This is what operational leverage looks like. Gold miners are literally printing money: ️

Gold at $2,900 = $1,500 profit per oz

Gold at $3,650 = $2,250 profit per oz

Their margins just went up 50% while gold rose 26%.“

(Katusa Research on September 14, 2025)

- With a current gold price at $4,000 USD/oz, the estimated AISC margin of ~$2,600 USD/oz underscores record-level profitability and cash flow potential for producers, assuming operating costs remain steady.

- Miners’ margins expand ~1.5-2× faster than the gold price. Above chart highlights how AISC margins surge with rising gold, showcasing miners’ powerful operating leverage. A 10% increase in gold delivers about a 16% lift in margins. At lower prices, margins can nearly double the pace of gold gains, while at higher levels the effect remains strong, though somewhat moderated.

Unfolding a Company-Making Discovery

Gran Pilar displays all the traits of a major system: Large alteration footprint, consistent mineralization, high recoveries, and district-scale potential.

The South Block is poised for cash-flow through the pilot mine while the North Block offers untapped discovery potential. Together they form the foundation for Tocvan’s evolution from junior to producer.

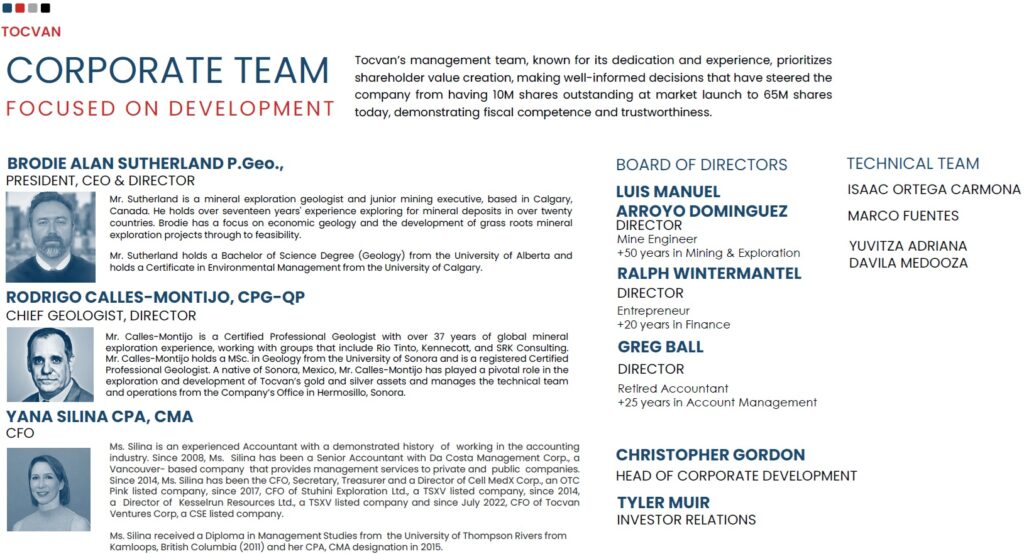

A Company Built by Builders

Leadership matters.

- Brodie A. Sutherland, P.Geo., CEO: 17 years of international experience from grass-roots to feasibility.

- Rodrigo Calles-Montijo, CPG, Chief Geologist: 37 years in exploration, Sonora native, former Rio Tinto and SRK Consulting.

- Supported by a board seasoned in finance, accounting, and engineering, Tocvan combines technical rigor with business discipline.

This is a team that builds, not just drills.

Bottom Line

Tocvan has reached a rare inflection point. The company has successfully transitioned from explorer to developer while preserving the upside of a discovery story.

Gran Pilar is not just another project. It is a district-scale system with multiple centers of mineralization and a clear path to production.

The market often undervalues bulk-tonnage deposits because grades appear modest, yet history shows that it’s these systems (with size, simplicity, and recoveries) that become the region’s longest-lived mines.

With drills turning in the North Block and a pilot mine on track for 2025-2026, Tocvan enters its defining chapter.

Upcoming assay results, resource estimates, and the first gold pour could propel Tocvan into a new phase of recognition within the gold-silver sector.

Tocvan stands out as one of the most compelling and fast-advancing gold-silver stories unfolding in the Americas today.

Company Details

Tocvan Ventures Corp.

Suite 1150 Iveagh House

707 – 7th Avenue S.W.

Calgary, Alberta, Canada T2P 3H6

Phone: +1 403 668 7855

Email: bsutherland@tocvan.ca (Brodie Sutherland)

www.tocvan.com

ISIN: CA88900N1050

Shares Issued & Outstanding: 66,084,571

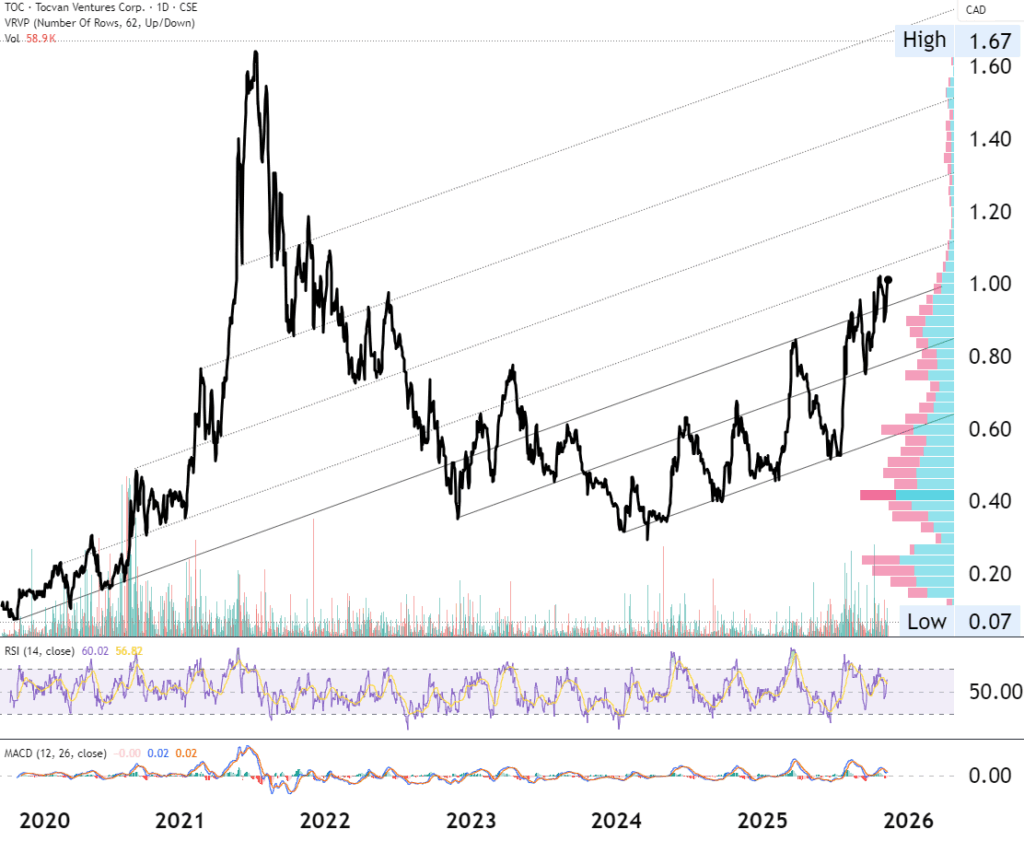

Canada Symbol (CSE): TOC

Current Price: 1 CAD (11/10/2025)

Market Capitalization: 66 million CAD

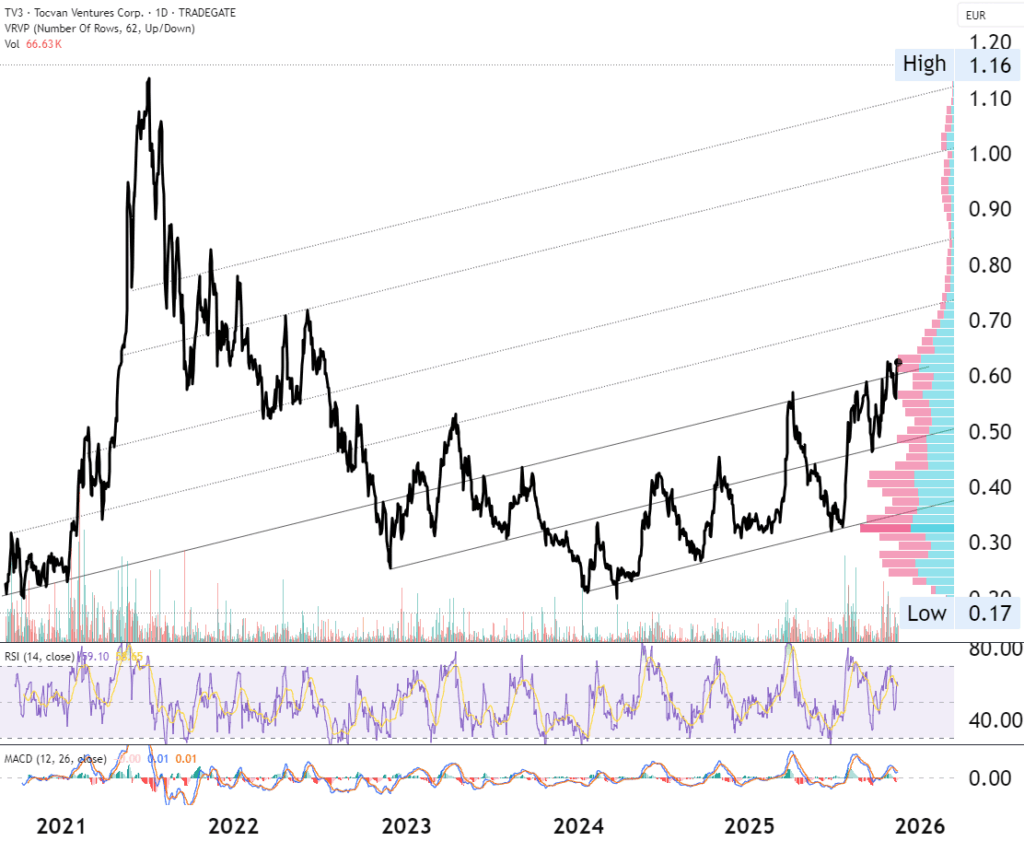

Germany Symbol / WKN (Tradegate): TV3 / A2PE64

Current Price: 0.614 EUR (11/10/2025)

Market Capitalization: 41 million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Forward-Looking Information: Rockstone Research and Tocvan Ventures Corp. (“Tocvan”) expressly point out that all forward-looking information contained in this report does not represent a guarantee of future results or performance. Actual results may differ materially from those projected. Readers are referred to Tocvan’s public filings, available on SEDAR+ at www.sedarplus.ca, for a more detailed discussion of risk factors and their potential impact. All statements in this report that are not historical facts should be considered forward-looking statements. A significant portion of this report consists of projections and assumptions. Forward-looking statements in this report include, but are not limited to, statements regarding Tocvan’s exploration, development, and production plans at the Gran Pilar Gold-Silver Project in Sonora, Mexico. These statements relate specifically to, among other things: The scope, timing, and objectives of the ongoing and planned 3,000-5,000 m drill program across the North and South Blocks; the expectation that drilling at the North Block will result in the discovery of new gold-silver zones and potentially expand the known mineralized footprint of the Gran Pilar system; the advancement, construction, and commissioning of the 50,000 tonne pilot heap-leach facility, including its design, operational parameters, and potential to yield early gold and silver production; anticipated metallurgical recoveries based on test results of up to 99% Au and 97% Ag and their application to pilot-scale and future full-scale operations; the potential to outline additional resources, define a large-scale open-pitable deposit, and demonstrate district-scale continuity of mineralization across the greater Gran Pilar area; Tocvan’s ability to leverage pilot mine data to de-risk commercial development and support long-term production planning; the expected economic advantages of heap-leach processing, including low capital intensity, scalability, and profitability under various metal-price scenarios; Tocvan’s timeline toward initial gold production, resource estimation, and future feasibility or expansion studies; the continuation of community engagement, government relations, and permitting success within the pro-mining jurisdiction of Sonora; assumptions regarding gold and silver prices, exchange rates, operating costs, and the availability of financing to support exploration and development programs; and Tocvan’s ability to create shareholder value through discovery, production, and potential strategic partnerships or acquisitions. Such statements involve known and unknown risks, uncertainties, and other factors that could cause actual results or events to differ materially from those anticipated in the forward-looking statements. Risks and uncertainties include, but are not limited to: Exploration and Discovery Risks: The Gran Pilar Gold-Silver Project and related Tocvan properties remain subject to the inherent uncertainty of exploration. Drilling, sampling, and geophysical programs may not confirm mineralization of sufficient grade, thickness, or continuity to justify further development. Mineralization encountered in surface sampling may not persist at depth or laterally. Geological and Resource Risks: The geological characteristics of Gran Pilar may differ from current interpretations. Structural complexity, faulting, or oxidation depth could affect grade distribution and tonnage estimates. Even if mineral resources are ultimately defined, they may not prove economically viable for open-pit mining. Metallurgical and Processing Risks: While metallurgical tests have returned high recoveries (up to 99% Au and 97% Ag), these laboratory results may not be reproducible at pilot or commercial scale. Heap-leach kinetics, reagent consumption, or permeability of crushed material could differ materially from expectations, impacting recovery, costs, or design. Pilot Mine and Development Risks: Construction, commissioning, and operation of the 50 000 tonne pilot heap-leach facility may encounter delays, cost overruns, or technical difficulties. Actual recoveries, throughput, or cash-flow may vary from projections. Scaling pilot data to commercial operations may introduce unforeseen engineering or metallurgical issues. Permitting and Environmental Risks: Although permits have been obtained for drilling and pilot production, future expansion or long-term operations may require additional environmental or governmental approvals that could be delayed, conditioned, or denied. Environmental incidents, stricter regulations, or stakeholder opposition could result in fines, suspension, or project deferral. Operational and Infrastructure Risks: Field operations are subject to logistical constraints, equipment failure, supply-chain interruptions, or adverse weather conditions. Access, power, water, and reagent availability are critical for heap-leach performance. Infrastructure development or maintenance failures could materially affect schedules and costs. Financing and Liquidity Risks: Tocvan will require continued access to equity or debt financing to fund exploration, development, and pilot operations. Market volatility, limited trading liquidity, or reduced investor appetite for junior issuers could impair the company’s ability to raise capital on acceptable terms or at all. Commodity-Price and Market Risks: Project economics depend heavily on gold and silver prices. Sustained declines in metal prices could render the Gran Pilar Project uneconomic or delay advancement. Conversely, inflationary pressures on fuel, consumables, and labor could erode margins even in a strong gold market. Political and Regulatory Risks: Changes in Mexican mining policy, taxation, export rules, or permitting regimes could impact Tocvan’s operations. Shifts in political priorities, administrative delays, or enforcement practices may alter the timing, cost, or feasibility of exploration and development activities. Community and Social-License Risks: Ongoing community relations are essential to maintaining Tocvan’s social license to operate. Any breakdown in communication, local opposition, or disputes over land access could lead to work stoppages, reputational damage, or loss of permits. Human-Capital and Contractor Risks: Tocvan’s success depends on retaining qualified management, technical staff, and local contractors. Labor shortages, health or safety incidents, or loss of key personnel could delay exploration or development. Currency, Inflation, and Macroeconomic Risks: Fluctuations between the Canadian Dollar (CAD), US Dollar (USD), and Mexican Peso may affect capital and operating costs. Inflation, interest-rate changes, or global economic downturns could weaken project economics and investor demand for precious-metal equities. Comparability Risks: While Tocvan references successful heap-leach gold operations elsewhere in Sonora for context, such examples may not be directly comparable in geology, metallurgy, or economics. Results at neighboring mines should not be interpreted as evidence of similar outcomes at Gran Pilar. Environmental, ESG, and Sustainability Risks: Evolving environmental, social, and governance (ESG) standards may increase compliance costs or restrict financing from certain institutions. Failure to meet ESG expectations could limit partnerships or investment interest. Timing and Execution Risks: Milestones such as drilling, permitting, pilot construction, or initial production may take longer than anticipated. Delays could affect Tocvan’s ability to achieve projected development or cash-flow targets. Force Majeure and Natural-Event Risks: Extreme weather, flooding, drought, earthquakes, wildfires, pandemics, or other uncontrollable events could disrupt operations, logistics, or infrastructure in Sonora. Third-Party and Counterparty Risks: Reliance on contractors, laboratories, suppliers, or potential joint-venture partners entails exposure to performance, solvency, or reliability risks. Failure by third parties to fulfill obligations could affect timelines or data quality. Information and Data Risks: Certain geological, market, and technical information in this report is derived from public sources believed reliable but has not been independently verified by Rockstone or the author. No representation is made as to its completeness or accuracy. Trading and Liquidity Risks: Shares of small-cap issuers such as Tocvan often involve significant volatility, limited liquidity, and wide bid-ask spreads. Investors should be prepared to bear the risk of price fluctuation and potential loss of capital. Caution to Readers: Forward-looking statements are not guarantees of future performance. Actual results may differ materially due to the risks and uncertainties described above and in Tocvan’s public filings. Readers should not place undue reliance on forward-looking information. Mineralization, grades, and recoveries described herein are illustrative only; results from other deposits in Sonora are not necessarily indicative of those at Gran Pilar. Surface sampling results indicate exploration potential but may not represent grades encountered in future drilling or production. Neither Rockstone nor the author assumes any obligation to update the statements contained herein, except as required by law.

Disclosure of Interests and Legal Notice: Nothing in this report should be construed as an invitation to buy or sell securities. Rockstone, its owners, and the author of this report are not registered broker-dealers or financial advisors. Before investing in securities, you should always consult your financial advisor and a registered broker-dealer. Never make an investment decision based solely on online or printed reports, including reports from Rockstone – particularly when it comes to small, thinly traded companies. The author of this report, Stephan Bogner, received compensation from Tocvan Ventures Corp. in the amount of 19,000 CAD for a period of 3 months. In addition, he holds securities of Tocvan and will therefore also profit from increased trading volume and share price appreciation. This represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Tocvan at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. All information is current as of the date of publication and is subject to change without notice. Liability for financial losses resulting from investments made on the basis of this report is excluded. The views of Rockstone and the author regarding the companies presented in this report reflect solely their own assessments and are based on information from public sources deemed reliable. Rockstone and the author have not conducted independent due diligence. Neither Rockstone nor the author guarantees the accuracy, completeness, or usefulness of the content, nor its suitability for any particular purpose. There is likewise no guarantee that the companies mentioned will perform as expected, or that comparisons with other companies will prove valid. Please read the full disclaimer carefully. If you do not agree with it, do not use this website or report. By using the website or this report, you agree to the disclaimer, regardless of whether you have read it in full. The information provided is of a general and educational nature. Data, tables, figures, and images, unless otherwise indicated or linked, originate from Stockwatch.com, Tocvan Ventures Corp., and publicly available sources.