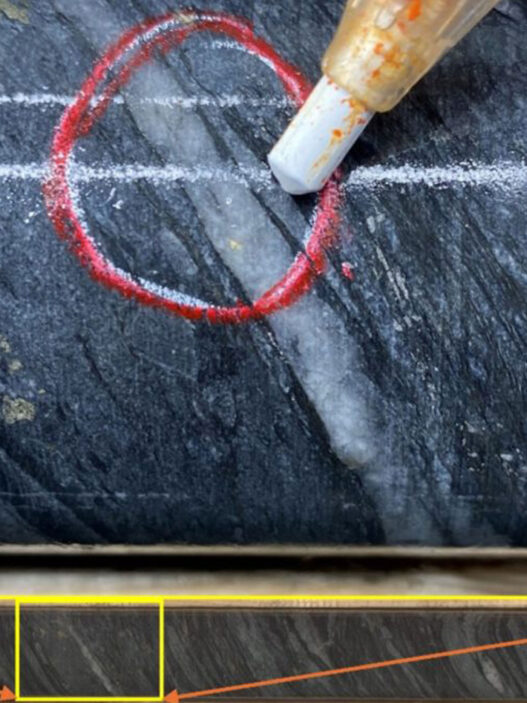

Example of mineralization from Kitimat‘s Jeannette Zone – a silicified andesite hosting sparkling disseminations and veinlets of pyrite and chalcopyrite, evidence of the copper-gold system exposed at surface. Such textures mark the near-surface expression of a much larger porphyry system at depth. (Photo: J. Hanson, October 2020)

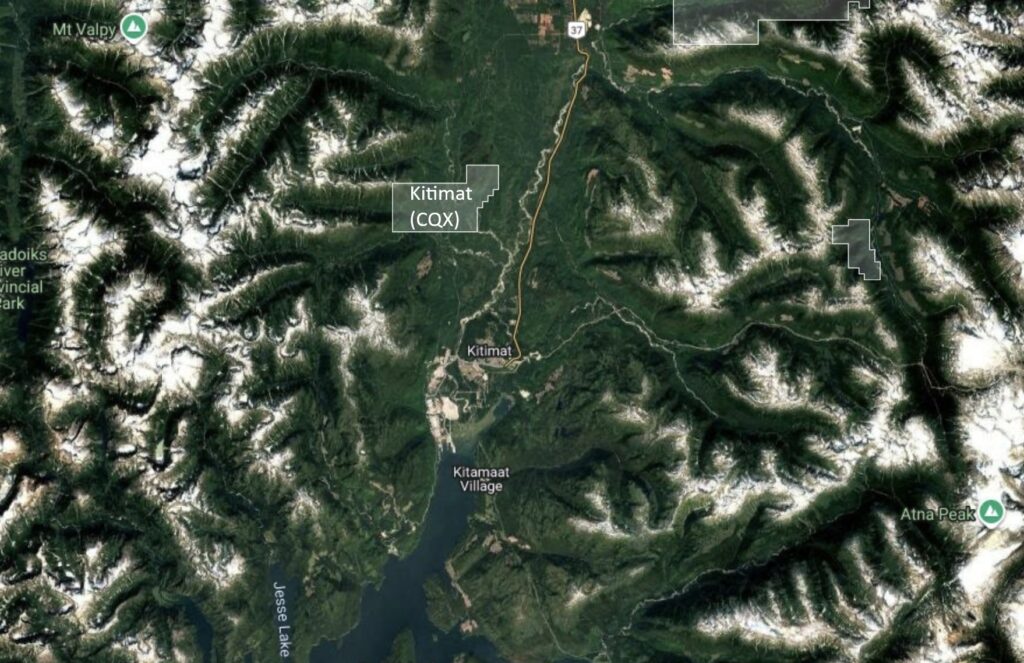

Copper Quest’s latest acquisition of the Kitimat Copper-Gold Project marks a strategic leap forward in its mission to build a portfolio of discovery-stage assets across North America’s best copper belts. Located just 10 km from tidewater, rail, and hydroelectric power, the project delivers infrastructure advantages that few explorers enjoy today.

Historical drilling at Kitimat defined broad, near-surface intercepts up to 117 m averaging 0.54% copper and 1.03 g/t gold – grades and widths increasingly rare in modern exploration. Such results point to the potential for a larger porphyry system at depth, precisely the type of opportunity sought by major copper producers facing global supply shortages.

With copper prices near record highs and deficits forecast for years to come, Copper Quest offers shareholders leveraged exposure to the metal that powers electrification, data-center expansion, and the energy transition.

Kitimat adds another cornerstone asset to a portfolio designed for growth when the world needs copper the most.

Strategic Location and Infrastructure Advantage

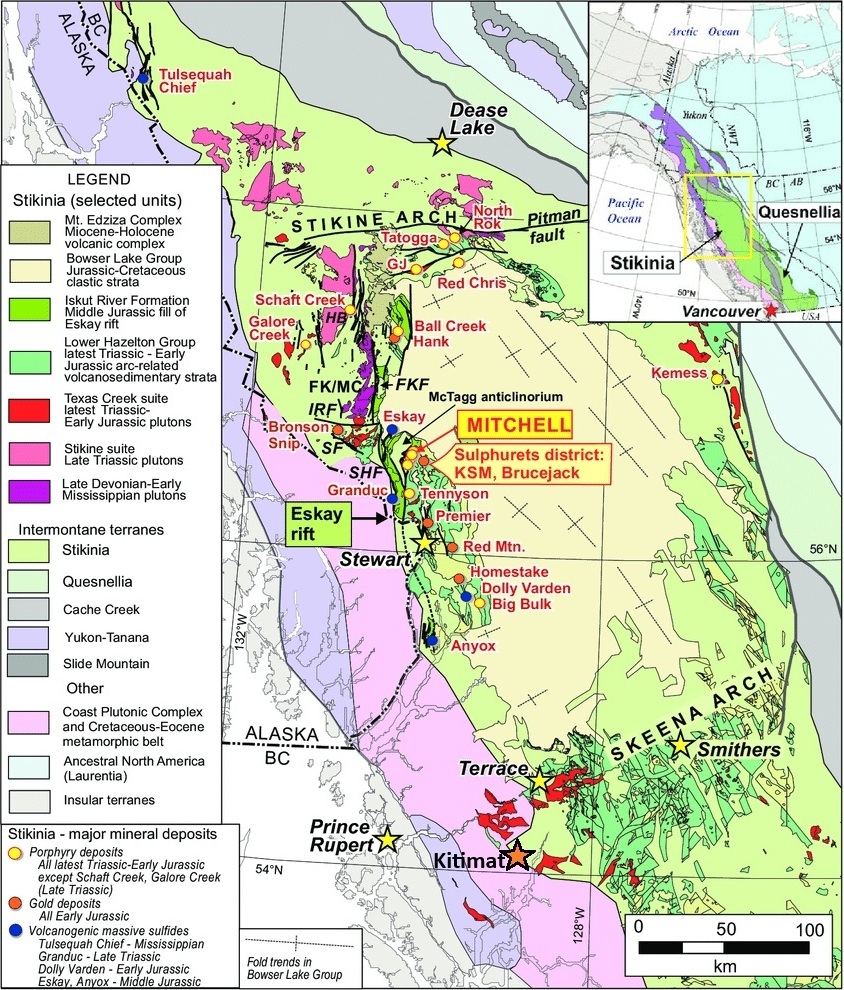

- The 2,954-hectare Kitimat Copper-Gold Project lies within the Skeena Mining Division of northwestern British Columbia, a region renowned for hosting major porphyry copper-gold systems.

- The property is road-accessible year-round via an established network of logging and exploration roads extending from Kitimat.

- Within a 10 km radius are tidewater, rail, and hydroelectric transmission lines – an infrastructure setting rarely matched among early-stage exploration projects in western Canada.

Geological Setting

A principal target area has already been delineated:

The Jeannette Copper-Gold Zone: A broad, near-surface mineralized system interpreted as a low-level intermediate- to low-sulfidation epithermal expression of a larger copper-gold porphyry system.

According to the NI 43-101 Technical Report on the Kitimat Project, prepared by Jeremy Hanson, P.Geo. (December 2020):

- Copper-gold mineralization occurs as chalcopyrite-pyrite veinlets, quartz-sulfide vein fill, and disseminations within intensely silicified zones.

- Copper and gold occur together over broad continuous intervals, highlighted by 117 m grading 0.54% copper and 1.03 g/t gold in drill hole J-2010-07.

- While pyrite is the dominant sulfide near surface, indicating a low-temperature epithermal environment, the alteration style and system geometry suggest potential for a higher-temperature, chalcopyrite-rich porphyry core at depth.

Jeannette Zone: Core of the Kitimat Project

- At the Jeannette Zone, mineralization is exposed in a historic trench along a silicified, northeast-striking shear zone that hosts a 20-30 cm interval of semi-massive pyrite and chalcopyrite developed parallel to the structure.

- Assay results from government surveys confirmed grades of 4.75% copper and 15.4 g/t silver (Nelson 2009).

- The host metadacite to metarhyolite rocks were once interpreted as part of a VMS (volcanogenic massive-sulfide) environment (Belik 1987), but subsequent work and the Technical Report by Jeremy Hanson (2020)identified a much broader footprint of quartz-sericite-pyrite alteration, now recognized as an epithermal expression of a larger porphyry copper-gold system (Ritchie 2019).

“The geological footprint at Jeannette clearly indicates the upper portions of a copper-gold porphyry. Mineralization begins at surface and remains open to expansion at depth.”

Jeremy Hanson, P.Geo., in the NI 43-101 Technical Report on the Kitimat Project (December 2020)

Historical Exploration and Drilling

Exploration of the Jeannette Zone spans more than 5 decades, highlighted by Decade Resources Ltd.’s 2010 drilling campaign that defined extensive, continuous copper-gold mineralization from surface to 130 m depth:

- Hole J7: 117.07 m @ 0.54% copper and 1.03 g/t gold (from 1.52 m)

- Hole J1: 103.65 m @ 0.55% copper and 1 g/t gold (from 9.15 m)

- Hole J2: 107.01 m @ 0.45% copper and 0.8 g/t gold (from 6.10 m)

- Hole J8: 112.2 m @ 0.33% copper and 0.41 g/t gold (from 11.89 m)

These long, near-surface intercepts demonstrate a robust mineralized envelope with grades commonly exceeding 1 g/t gold equivalent.

The mineralization remains open at depth and laterally across the Jeannette alteration system.

A 2020 verification program by Hanson (ALS Canada Ltd.) successfully reproduced these results, confirming up to 7.8 g/t gold and 4.6% copper in individual 3 m sub-intervals.

Acquisition Terms

Under the definitive agreement, Copper Quest has until January 5, 2026, to complete due diligence. Upon satisfactory review, the company will issue 2 million common shares to vendor Bernie Kreft (a veteran prospector and former Discovery Channel Yukon Gold personality) as full consideration. The property carries a 2.5% NSR royalty, of which 40% may be repurchased for $1 million. Copper Quest retains a right of first refusal on any subsequent sale of the remaining royalty interest. A finder’s fee is payable.

“The addition of the Kitimat Copper-Gold Project demonstrates Copper Quest’s continued effort to add shareholder value through the acquisition of critical mineral projects. This project is ideally located with exceptional infrastructure, in a proven geological belt known for hosting major copper-gold systems. The strong historical drill results from the Jeannette zone speak to the potential of a larger near-surface mineralized system. We look forward to advancing this asset as part of our growing copper-gold portfolio.”

Brian Thurston, CEO of Copper Quest, in the news-release on October 30, 2025

Next Steps

Copper Quest plans to leverage artificial-intelligence (AI) analysis to integrate historic drill, geochemical, and geophysical data into a 3-D geological model, improving targeting precision across the Jeannette Zone.

Fieldwork under consideration includes:

- Ground magnetics and induced polarization (IP) surveys;

- Seismic to better define subsurface structure and mineralization trends;

- Follow-up drilling to test deeper and lateral extensions of the mineralized system.

These initiatives align with recommendations in the 2020 Technical Report, which proposed a 2-phase program comprising ~$112,000 in geophysics followed by 3,000 m of core drilling (~$900,000 budget).

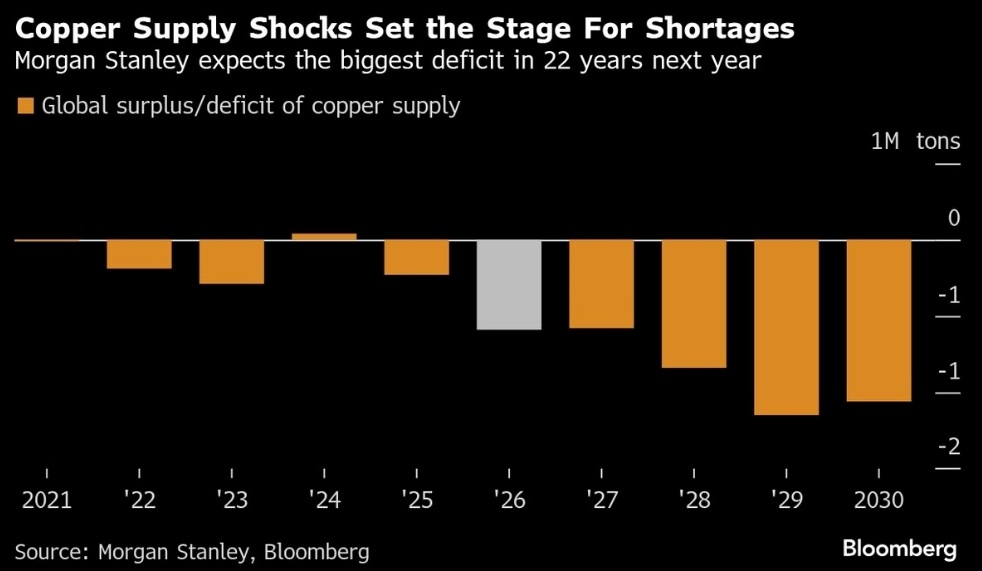

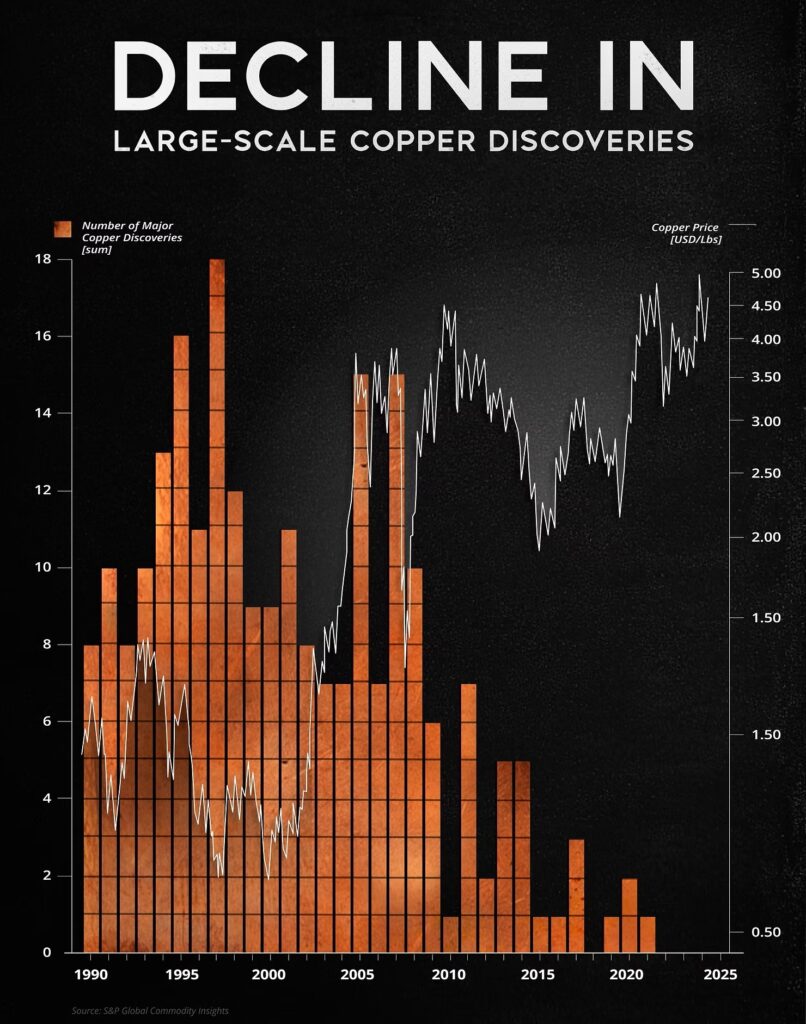

Positioned for the Copper Supercycle

Copper demand continues to accelerate with global electrification, renewable-energy infrastructure, and now AI-driven data-center expansion. At the same time, supply constraints, declining grades, and geopolitical friction have intensified the search for new, reliable sources of copper.

Governments across North America have formally designated copper as a critical mineral essential to economic and national security.

Investor take-away: With demand surging from electrification, grid expansion, and AI data centers, copper scarcity is becoming inevitable – highlighting the strategic value of new discoveries such as Copper Quest’s expanding portfolio in British Columbia and Idaho.

By consolidating its British Columbia assets – Stars, Stellar, Rip, Thane, and now Kitimat – Copper Quest is strategically positioned to capitalize on this tightening market from within one of the world’s most secure jurisdictions.

Bottom Line

The acquisition of Kitimat gives Copper Quest a road-accessible, port-proximal copper-gold system supported by strong historical drilling and modern confirmation.

The Jeannette Zone’s extensive phyllic alteration and 100-m-scale copper-gold drill intercepts mirror early-stage signatures seen at several producing porphyries in British Columbia.

Combined with immediate infrastructure access and the company’s data-driven exploration strategy, this addition strengthens Copper Quest’s position as an emerging multi-asset copper growth platform poised to benefit from the coming supply squeeze.

Excerpts from “Is a copper supply crunch coming?“ (Allianz Global Investors, November 2025):

“This tightening supply comes while demand is booming… Yet new mine development is lagging far behind demand growth… That imbalance strong demand and constrained supply is classic fuel for a sustained bull market in copper. Many analysts now expect copper prices to trend higher into the late 2020s, with some forecasting new record highs if deficits persist. Goldman Sachs has described copper as the “most strategically important metal” for the green transition, noting that current supply constraints could make prices structurally higher for years… Looking ahead, the copper market faces a structural shortage, not just a temporary squeeze… For investors, that sets the stage for potential opportunities across the copper value chain from miners and smelters to recycling firms and energy transition technologies that rely on the metal. However, it also signals broader inflationary pressure, as copper is a foundational material in industrial production and green infrastructure.“

Read more about the recent supply disruptions and looming price escalation in Rockstone´s recent article “Riding the Copper Supply Crunch: Today’s Juniors Are Tomorrow’s Headlines” – an analysis of how structural demand meets fragile supply, why majors are scrambling for growth, and where the real opportunities lie for investors positioning ahead of the next copper supercycle, with a spotlight on juniors poised to become tomorrow’s takeover targets and market leaders.

Company Details

Copper Quest Exploration Inc.

#2501 – 550 Burrard Street

Vancouver, BC, V6C 2B5 Canada

Phone: +1 778 949 1829

Email: investors@copperquestexploration.com

www.copper.quest

CUSIP: 217523 / ISIN: CA2175231091

Shares Issued & Outstanding: 71,243,806

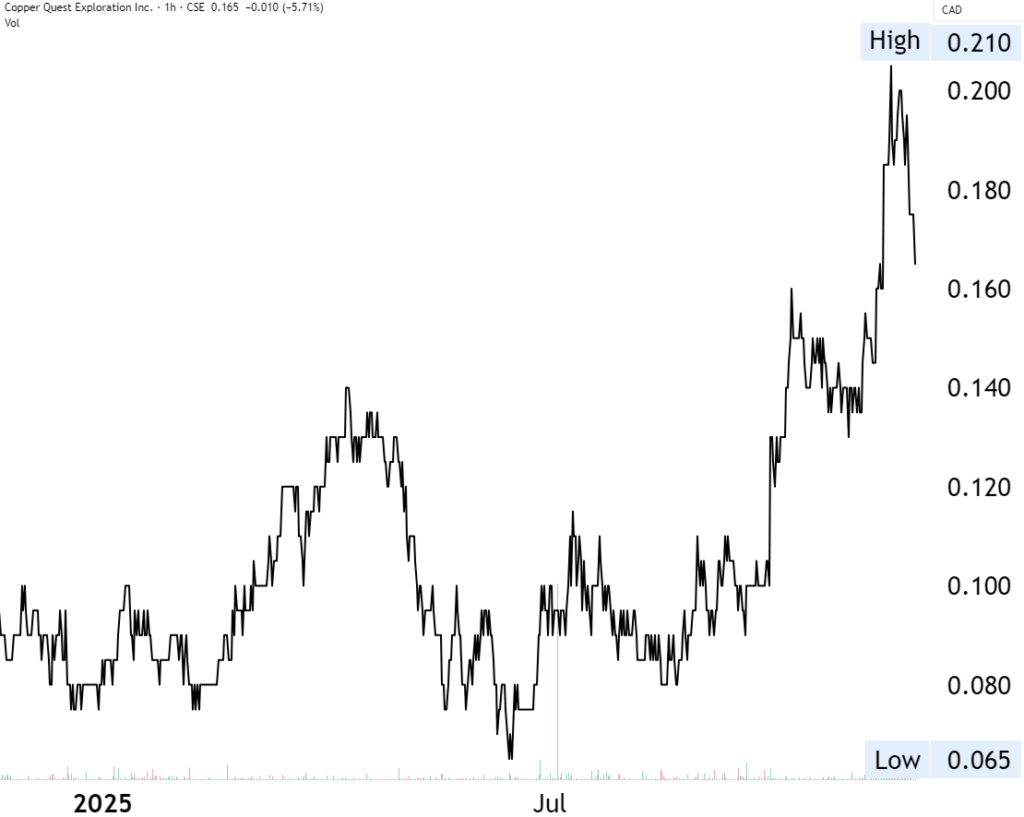

Canada Symbol (CSE): CQX

Current Price: 0.165 CAD (11/05/2025)

Market Capitalization: 12 Million CAD

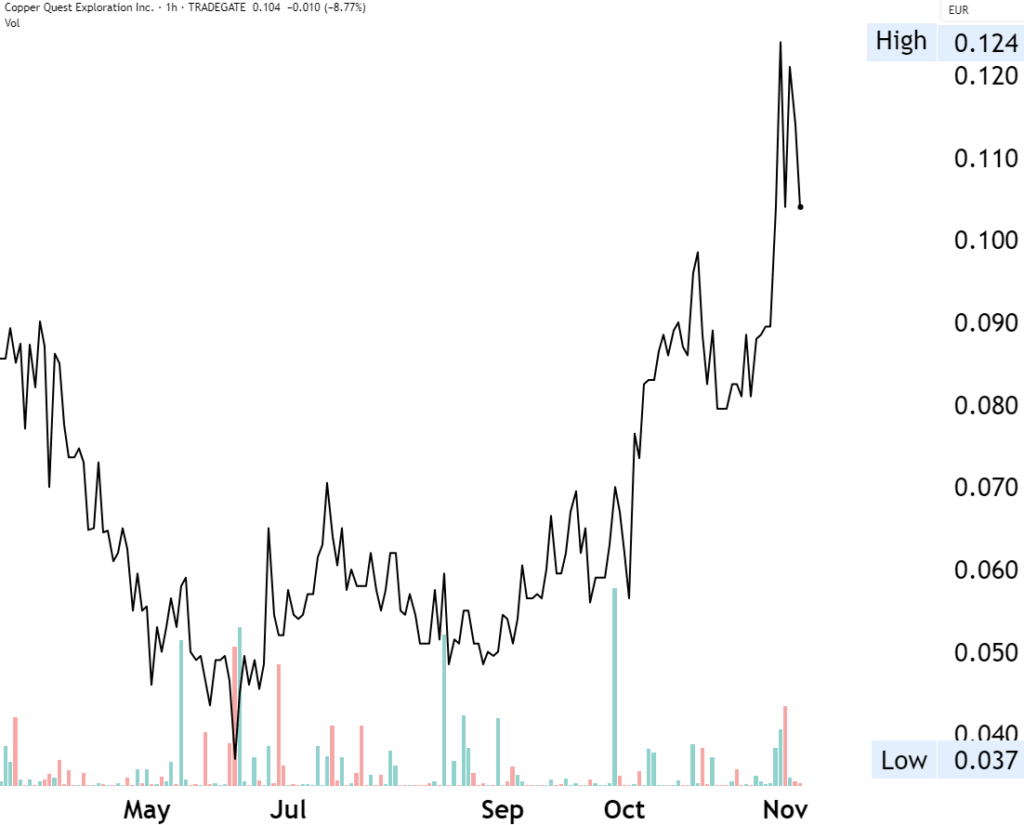

Germany Ticker / WKN: 3MX0 / A40ZSP

Current Price: 0.104 EUR (11/05/2025)

Market Capitalization: 7 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone Research, Zimtu Capital Corp. (“Zimtu“) and Copper Quest Exploration Inc. (“Copper Quest“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Copper Quest‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Statements in this report that are forward-looking include, but are not limited to, statements that Copper Quest is positioned to deliver scale and value through the acquisition, exploration, and development of copper-gold assets across North America; that the Kitimat Copper-Gold Project may represent the near-surface expression of a larger porphyry system at depth; that AI-assisted data integration, 3-D geological modeling, and future ground-based geophysical surveys (including magnetics, IP, and passive seismic) will improve target definition and support the design of a follow-up drill program; and that such exploration work could expand known mineralization within the Jeannette Zone and discover additional copper-gold zones elsewhere on the property. Forward-looking statements also include expectations that Copper Quest will complete its due-diligence review of the Kitimat Project on or before January 5, 2026, and, subject to satisfactory results, will issue 2 million common shares to the vendor as full consideration for the acquisition; that the Company will be able to maintain access to infrastructure advantages including deep-water port, rail, and hydroelectric power; and that subsequent exploration may confirm the higher-temperature, chalcopyrite-rich core interpreted from surface mineralization. Such statements further include Copper Quest’s belief that continued exploration across its other British Columbia projects (Stars, Stellar, Thane, and Rip) and its Nekash Project in Idaho may identify additional copper centres, provide opportunities for strategic partnerships, joint ventures, or consolidation, and enhance shareholder value through discovery and development success. Forward-looking statements also relate to market conditions and macroeconomic trends, including expectations that electrification, renewable-energy infrastructure, and AI-driven data-center expansion will continue to drive demand for copper; that declining global grades and permitting challenges will constrain supply; and that these factors will support higher long-term copper prices and valuations for companies such as Copper Quest. Copper Quest also believes that its data-driven exploration strategy, portfolio diversification, and small market capitalization offer significant leverage to exploration success, potential future resource definition, and the ability to attract institutional and strategic partners as the copper market continues to tighten. Such statements are based on assumptions including, but not limited to: The continued availability of capital and technical expertise; successful completion of exploration activities; favourable commodity pricing; stable regulatory and social environments; and accurate geological interpretation of data and drill results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Risks and uncertainties include, but are not limited to: Historical Data and Due Diligence Risks: The Kitimat Copper-Gold Project includes historical data generated by previous operators. Such data may be incomplete or imprecise, and verification work during Copper Quest’s due diligence review or future programs may yield different results. Permitting and Approvals: Future exploration or expansion activities at the Kitimat Copper-Gold Project or other Copper Quest properties may require additional governmental, regulatory, Indigenous, or third-party approvals that could be delayed or denied. Market Risks: Adequate buyers, partners, or acquirers for Copper Quest’s copper, gold, silver, or molybdenum resources may not be secured; demand projections for copper related to electrification, AI data centers, EV adoption, renewable energy, and defense applications may not materialize as expected. A sustained decline in copper prices, or reduced investor appetite for exploration-stage companies, could affect Copper Quest’s ability to raise capital and advance the Kitimat and other projects. Technical Risks: Exploration drilling may not confirm mineral grades, continuity, or thickness consistent with previous results; historical data may not be reliable or indicative of future economic viability; metallurgical recoveries may be lower than expected. Geology and Resource Risks: The geological characteristics of the Kitimat Copper-Gold Project and other Copper Quest properties may differ from current interpretations; mineralization encountered to date may not continue at depth or laterally; and even if future resources are defined, they may not prove economically viable for development. Operational Risks: Although Copper Quest plans to integrate AI-based data analysis and field programs such as mapping, geophysics, and drilling, unforeseen operational challenges – such as weather, access, logistics, or technical limitations – could increase costs or cause delays. Infrastructure availability, though excellent near Kitimat, may still affect exploration and development schedules. Financing Risks: Required capital expenditures for exploration and project advancement may exceed estimates; financing may not be available on reasonable terms, or at all, which could delay or prevent development. Geopolitical and Regulatory Risks: Legislative, political, social, or economic developments in Canada, the U.S., or other jurisdictions may hinder progress or add costs; agreements with governments, First Nations, or local communities may not be reached or maintained. Human Capital Risks: Copper Quest may not be able to retain or attract key employees, advisors, contractors, or technical partners needed to execute its exploration and corporate strategy. Commodity Price Risks: Prices for copper, gold, silver, and molybdenum may fluctuate and may not be sufficient to support profitable development or attract financing. Comparability Risks: What appear to be similarities with other successful porphyry copper projects in British Columbia or elsewhere may not be substantially comparable in geology, costs, recoveries, or economics. Environmental and ESG Risks: Environmental opposition, stricter permitting requirements, or evolving ESG standards could delay or prevent exploration and development; failure to comply with sustainability standards could limit financing, partnerships, or investor interest. Offtake and Counterparty Risks: Potential offtake agreements, joint ventures, or partnerships may not be secured; counterparties may fail to perform or may renegotiate terms under adverse market conditions. Currency and Macroeconomic Risks: Fluctuations in the Canadian Dollar relative to the US Dollar and other currencies may affect capital and operating costs; inflation, interest rate shifts, or global economic downturns could weaken project economics and investor appetite. Timing Risks: Project milestones, permitting, drilling campaigns, exploration results, or potential transactions may take longer than anticipated, leading to delays in advancement and value creation. Force Majeure / Natural Events Risks: Extreme weather, wildfires, flooding, earthquakes, pandemics, or other uncontrollable events could disrupt exploration, logistics, or operations in remote project areas. Logistics and Infrastructure Risks: Project success relies on dependable road access, power supply, and regional infrastructure (e.g. processing facilities, mills, and transmission lines); delays, failures, or cost overruns in infrastructure development could materially impact timelines and economics. Although the Kitimat Project benefits from nearby port, rail, and power infrastructure, reliance on third-party access routes or utilities may still pose logistical or cost risks. Third-Party Information Risks: Certain information contained in this report, including market data, industry statistics, and third-party commentary, has been obtained from sources believed to be reliable but has not been independently verified. Rockstone and the author make no representation or warranty as to its accuracy, completeness, or reliability. Liquidity and Trading Risks: Securities of small-cap issuers such as Copper Quest often involve a high degree of risk and may be subject to volatility, limited trading liquidity, wide bid/ask spreads, and potential loss of invested capital. Investors should be prepared to bear the risk of illiquidity and price fluctuations. Statements herein assume the availability of financing, successful permitting, exploration results that validate historical data, continued favorable commodity pricing, and supportive regulatory and social conditions. There can be no assurance that these assumptions will prove accurate. Caution to Readers: Forward-looking statements are not guarantees of future performance. Actual results may differ materially due to the risks and uncertainties described above and in Copper Quest’s public disclosure. Readers should not place undue reliance on forward-looking information. Note that mineral grades and mineralization described in similar rocks and deposits on other properties are not representative of the mineralization on Copper Quest’s properties, and historical work and activities on its properties have not been verified and should not be relied upon. Mineralization outside of Copper Quest’s projects is no guarantee for mineralization on the properties from Copper Quest, and all of Copper Quest’s projects are exploration projects. Also note that surface sampling does not necessarily correlate to grades that might be found in drilling but solely shows the potential for minerals to be found at depth through drilling below the surface sampling anomalies.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment. So while the author of this report is not paid directly by Copper Quest Exploration Inc. (“Copper Quest“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of Copper Quests stock prices. Copper Quest pays Zimtu Capital Corp. to provide this report and other services. As per news on August 27, 2025: “Copper Quest Exploration Inc. (CSE: CQX; OTCQB: IMIMF; FRA: 3MX) (“Copper Quest” or the “Company”) is pleased to announce that it has signed an agreement with Zimtu Capital Corp. (TSX.V: ZC) (FSE: ZCT1) (“Zimtu”) whereby Zimtu will provide marketing services under its ZimtuADVANTAGE program (https://www.zimtu.com/zimtu-advantage/), effective September 1, 2025 for an initial term of 12 months at a cost of $12,500 per month. Marketing Agreement: The ZimtuADVANTAGE program is designed to provide opportunities, guidance, marketing and assistance. Services include investor presentations, email marketing, lead generation campaigns, blog posts, digital campaigns, social media management, Rockstone Research reports & distribution, video news releases and related marketing & awareness activities. Zimtu is based in Vancouver, at Suite 1450 – 789 West Pender Street, Vancouver, BC V6C 1H2. Zimtu may be reached at 604.681.1568, or info@zimtu.com. Zimtu’s compensation does not include securities of the Company; as of the date hereof, Zimtu owns 2,633,333 shares of the Company and 2,333,333 warrants to acquire common shares of the Company.“ The author owns equity of Copper Quest and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Copper Quest (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Copper Quest Exploration Inc., Tradingview, Stockwatch, and the public domain.