Gold investors have been enjoying high returns since 2022. Even in the long term, for example since 2000, gold has been one of the best investments, with a steady price increase and relatively low volatility.

Given this excellent performance, why should investors bet on silver, gold’s “little brother”?

The price of silver has even greater potential than gold

The price trends of gold and silver are largely parallel. Contrary price movements, as can often occur with stocks, are very rare with gold and silver. Nevertheless, the percentage extent of price movements often varies.

In addition, different price levels may emerge in the long term. If this is the case, one precious metal is often more promising than the other.

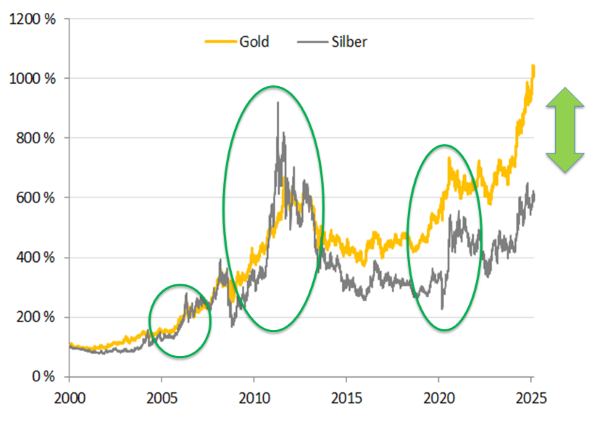

The chart shows the percentage performance of the price of gold in gold and silver in silver since 2000 on a dollar basis.

It is clear to see that the price of silver lags behind that of gold. The arrow marks the difference. At the same time, the circles show that, after periods of lagging behind, the price of silver tends to catch up quickly. Given the current lag, such a catch-up is to be expected again.

Silver is more of an industrial metal than gold

How do such phased differences in development come about?

Silver is used extensively in industry – around 60% of silver production ends up in industrial companies. Industrial demand for silver is very solid and is rising due to the continuing global increase in electrification, the expansion of renewable energies and, more recently, hardware for artificial intelligence.

In contrast, industrial demand accounts for less than 10% of gold demand. About half of the demand for gold comes from jewelry manufacturing. However, there is not only a difference between gold and silver in terms of consumption patterns, but also in terms of gold and silver holdings for investment purposes.

It is not known exactly how much gold and silver is held globally for investment purposes. This includes mainly coins and bars. In some cases, jewelry, art objects, and cutlery must also be included, which are melted down, especially in periods of high prices, and thus become investment metals again. Estimates of the value of all investment gold relative to all investment silver vary widely, ranging mostly between 15 and 35. The value of all available gold is thus far higher than that of all silver!

The price of silver catches up quickly in precious metal booms!

This has serious consequences for price developments. In precious metal booms, investors increasingly turn to silver. They do this to diversify and because silver coins are more accessible to small investors due to their lower price.

In addition, the difference in global gold and silver reserves mentioned above comes into play during bull markets. Since the value of all existing silver is much lower than that of all gold, less silver than gold comes onto the market through profit-taking after sharp price increases.

As a result, the percentage increase in silver is then greater than that of gold, as was the case in 2011, for example. This is also to be expected in future bull markets. Silver should then rise again at a higher rate than gold in percentage terms.

Given its current lag behind gold, silver therefore belongs in every portfolio!

How can you buy precious metals cheaply and store them safely?

Elementum Deutschland GmbH, based in Sindelfingen (Germany), specializes in trading physical precious metals. Customers who purchase precious metals from Elementum Deutschland (or one of the other national Elementum companies in five European countries) can store them in the renowned high-security vaulting facilities in the St. Gotthard Massif in Switzerland at Elementum International AG.

Of course, you also have the option of purchasing gold and silver directly and having it delivered to your desired address. However, storing silver in the so-called open duty-free warehouse (“offenes Zollfreilager”) at St. Gotthard offers decisive tax advantages:

- The 19% value added tax customary in Germany is completely waived on purchases and sales – a considerable price advantage that effectively secures you 19% more silver for your money.

- If you store your silver in this high-security vault, you can sell it back to Elementum Deutschland GmbH at any time – without any bureaucratic hassle and also without VAT, as the trade takes place within the duty-free warehouse. You will receive the funds via bank wire.

- VAT is only payable when you physically remove the stored silver – either by picking it up in person (after prior notification) or by having it shipped to your address.

More silver, more return

Thanks to duty-free storage, you receive 19% more physical silver when you buy. This additional amount also participates in the performance of the silver price if it rises – a leverage effect that significantly improves your return opportunities.

Secure your storage space now – free of charge and without obligation

Register now for a storage space in the St. Gotthard high-security vaulting facility and receive free access to:

- our General Terms and Conditions (GTC)

- current fee tables

- annual audit reports from the auditing company BDO AG

- transparent proof of use of funds

- family discount information

- the popular children’s program “Schatz4Kids” (“Treasure4Kids”)

- as well as numerous other documents and information on storage, purchase, and resale, as well as the ratio “switching” strategy.

Register now: https://silberbar.elementum.de/

Tip for discounted entry: Enter the promotional code “50” (“Aktionscode“) and the “Vermittler” number 1000166 when registering to receive a 50% discount on the storage space setup fee.

Important: Registration is non-binding and does not commit you to anything – but it is your first step towards an independent and crisis-proof precious metal investment.

Elementum is a second-generation, owner-managed family business. Trust, consistency, and long-term thinking are at the heart of our philosophy. The Board of Directors of Elementum International AG is composed of internationally renowned experts in the money and precious metals markets, including economists, analysts, university professors, and precious metals specialists. This in-depth expertise forms the backbone of our actions—for your security, your assets, and your future.

About the Author

Dimitri Speck

Member of the Board of Directors of Elementum International AG

Dimitri Speck specializes in analyzing the financial system and financial markets. He is the author of a stock market newsletter and the books “Geheime Goldpolitik” (“Secret Gold Policy”) and “Die größte Finanz-Blase aller Zeiten” (“The Greatest Financial Bubble of All Time”). His work on commodities, precious metals, and seasonality was awarded the German Precious Metals Association Prize in 2013 and the Scope Award in 2018. Mr. Speck is the editor of the website www.seasonax.com on seasonal studies.

Contact

Disclaimer: This article does not constitute a recommendation to buy or sell. Elementum International AG is a Swiss company that specializes exclusively in the storage of physical precious metals in a high-security vault facility located in the St. Gotthard mountain massif in Central Switzerland. The Board of Directors and Executive Management of Elementum International AG have been selected solely based on their professional expertise and long-standing experience in precious metals markets. As these individuals may also be professionally active outside their roles at Elementum International AG, the company has no influence over their external activities and respects their right to freedom of expression. Therefore, the views expressed by persons working with or for Elementum do not necessarily reflect the opinion of Elementum International AG. Investments in precious metals are subject to risks, including those specific to the structure of this market. Please read our full risk disclosures and consult a licensed financial advisor before making any investment decisions. Neither the author, Elementum International AG, nor Elementum Deutschland GmbH assume any liability for actions taken based on the information provided. Past performance is not indicative of future results.