As major gold producers face declining reserve profiles and a shrinking pipeline of large discoveries, mergers and acquisitions (M&A) have become the primary mechanism for replacing ounces. In today’s gold market, scale, jurisdiction and mining method matter more than ever.

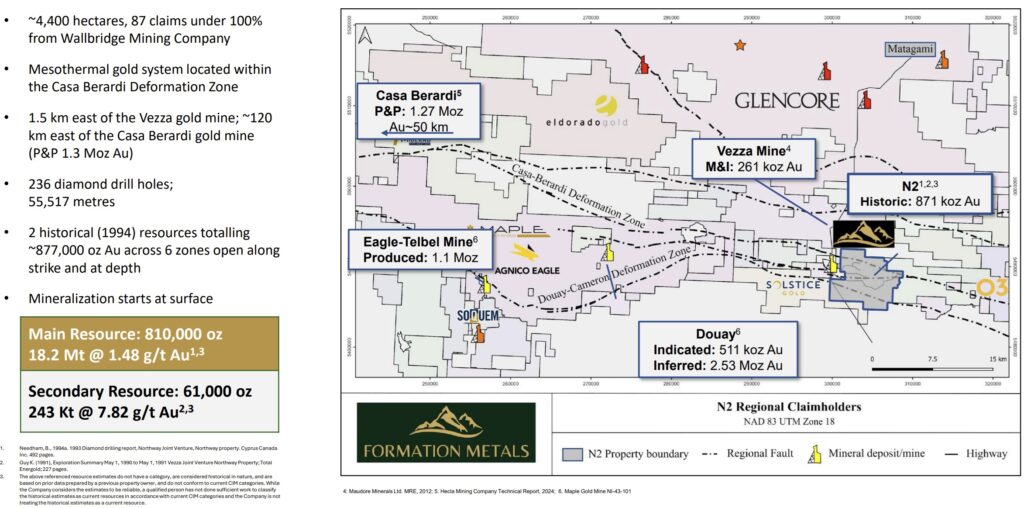

Against this backdrop, Formation Metals Inc. (CSE: FOMO) is advancing its flagship N2 Gold Project in Quebec’s Abitibi Greenstone Belt toward a maiden NI 43-101 compliant mineral resource estimate, which the company expects to complete in Q3 2026. This milestone historically marks the point at which advanced gold projects begin to attract broader strategic and corporate development interest.

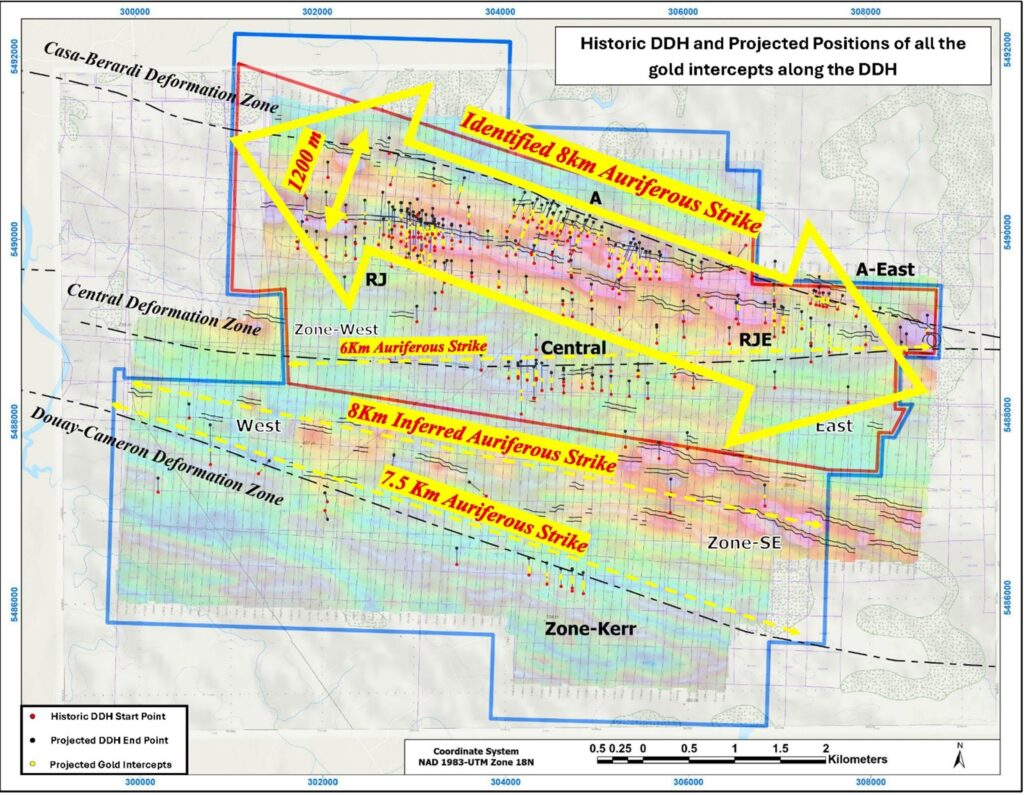

In today’s news-release, FOMO confirmed that the maiden resource estimate will incorporate nearly 70,000 m of drilling, combining extensive historical data with results from the ongoing drill program. The company is targeting a conceptual open-pit resource, supported by near-surface mineralization, thick and laterally continuous zones and strong geological continuity.

Following completion of its recently expanded Phase-1 drill program, now totaling 14,000 m, FOMO plans to integrate the majority of historical and new drilling into a modern geological, geostatistical and metallurgical model prepared by an independent qualified person in accordance with NI 43-101 standards.

The company also noted that the first batch of assay results from the ongoing Phase-1 drill program is expected imminently, providing a near-term catalyst ahead of the resource estimate.

Why Size Matters in Today’s Gold M&A Market

Across multiple gold cycles, a consistent pattern has emerged: Major producers rarely acquire small deposits. Instead, acquisitions overwhelmingly focus on projects that already demonstrate meaningful scale, typically exceeding 1-2 million ounces, with many transactions occurring closer to or above the 3 million ounce level.

This preference is especially pronounced when projects are located in tier-1 jurisdictions such as Canada and Quebec, are near surface and amenable to open-pit mining and benefit from established infrastructure. FOMO believes N2 is evolving toward this profile as drilling continues to confirm continuity and scale.

"We are excited to advance to this critical next step at N2 following the impressive outcomes from our maiden drill program. The wide intercepts of near-surface mineralization, coupled with the project's historic resource base from decades of work by reputable operators like Agnico-Eagle and others, and significant underexplored strike potential, position us well to delineate a substantial NI 43-101 compliant resource. Our internal target and view of potential for N2 reflects the substantial upside we see as we integrate these new data points and continue to unlock value in this advanced Abitibi gold asset."

Deepak Varshney, CEO of Formation Metals Inc., in today's news-release.

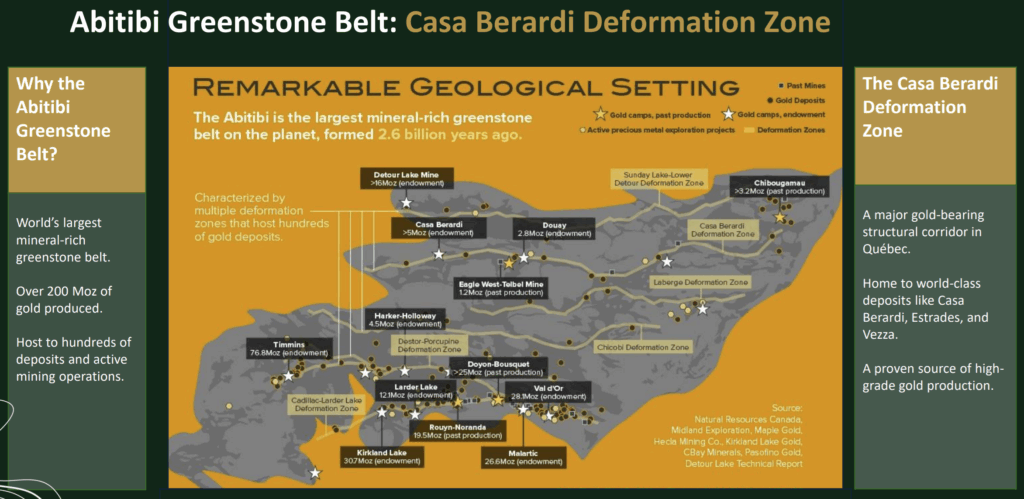

Abitibi and Quebec: A Proven Acquisition Corridor

The Abitibi Greenstone Belt, and Quebec more broadly, represent one of the world’s most established gold acquisition regions. Over decades, major producers have repeatedly acquired Abitibi assets once scale and continuity were demonstrated, often at or shortly after a maiden or first major resource estimate.

Well-known precedents include Canadian Malartic, a bulk-tonnage open-pitable system that ultimately exceeded 10 million ounces and became a cornerstone asset following consolidation by Agnico Eagle. Additional examples include Casa Berardi, operated by Hecla Mining. Éléonore was acquired by Goldcorp based on scale, jurisdictional quality and long-term optionality.

While outside Quebec, Detour Lake in Ontario further illustrates the premium majors place on large, long-life Canadian open-pit gold assets even at average reserve grades of approximately 0.8-1 g/t gold.

Globally, similar dynamics are evident in Australia and select US jurisdictions, where large gold deposits amenable to surface mining in safe jurisdictions consistently attract strategic interest.

What Majors Have Historically Paid Per Ounce

One of the most commonly referenced metrics in gold sector acquisitions is the price paid per ounce of gold in the ground. While valuations vary depending on project stage, grade and market conditions, historical transactions reveal clear and consistent ranges.

Advanced exploration to early development projects have often been acquired in the range of 20-60 USD per ounce. Large, scalable open-pit projects in tier-1 jurisdictions have frequently commanded 50-150 USD or more per ounce. Producing or near-construction assets have in many cases exceeded 150-300 USD per ounce, depending on margins and remaining mine life.

Notably, projects that cross the 1-3 million ounce threshold, particularly those with near-surface bulk tonnage geometry, tend to migrate toward the upper half of these valuation ranges, even prior to construction decisions.

While no valuation or transaction can be assumed, historical precedent shows that scale combined with jurisdiction materially increases strategic value on a per ounce basis.

How N2 Fits the Historical M&A Profile

Formation’s N2 Project exhibits several characteristics that align closely with assets historically acquired by major producers:

- Scale and growth potential: A global historic resource of ~871,000 ounces with significant room for expansion through infill and step-out drilling.

- Open-pit geometry: Mineralization begins near surface and occurs in thick, laterally continuous zones with low grade variability.

- Significant upside: Large portions of the A and RJ Zones remain undrilled and multiple geophysical targets remain untested.

- Tier-1 jurisdiction: Quebec consistently ranks among the world’s most attractive mining jurisdictions.

In an environment where new tier-1 discoveries are increasingly rare, projects that already demonstrate scale and expandability carry strategic value well beyond their current resource size.

The Strategic Importance of the Maiden Resource Estimate

The upcoming maiden NI 43-101 mineral resource estimate, which the company expects to complete in Q3 2026 following completion of Phase-1 drilling, represents more than a technical milestone. From a M&A perspective, it is a de-risking and validation event that transforms N2 from a historically defined gold system into a market-recognized, compliant asset.

The resource estimate will incorporate advanced geological modeling, updated metallurgical inputs and rigorous geostatistical analysis of both historical and recent drilling.

Importantly, the maiden resource estimate is expected to represent a snapshot in time rather than the full potential of the N2 Project. FOMO is currently undertaking a fully funded 30,000 m drill program, of which 14,000 m are planned for Phase-1. The remaining drilling, potentially totaling a further 16,000 m, may be completed following the maiden resource estimate and could provide additional opportunities for resource expansion beyond the initial NI 43-101 estimate.

Historically, many Abitibi acquisitions have occurred after this exact transition, once uncertainty around scale, continuity and geometry was materially reduced.

Financial Strength Preserves Strategic Optionality

FOMO enters this phase with approximately 12.1 million CAD in working capital, no debt and an exploration budget of roughly 8.1 million CAD for 2025-2026, including Quebec tax credits. This financial strength allows the company to continue advancing N2 without near-term financing pressure, preserving strategic flexibility as the resource story matures.

Bottom Line

While no acquisition is implied, history suggests that gold projects in tier-1 jurisdictions with open-pit potential and demonstrated scale are more likely to attract meaningful strategic interest as they advance through the resource definition stage.

By progressing toward a compliant resource estimate in one of the world’s most proven gold belts and continuing to drill beyond that milestone, FOMO is positioning N2 within the jurisdictional, technical and scale window that has historically driven gold-sector M&A.

As major producers continue searching for their next generation of long-life assets, projects like N2, near-surface, scalable and located in Quebec, are becoming increasingly difficult to replace.

Company Details

Formation Metals Inc.

#1245 – 300 Granville Street

Vancouver, BC, V6C 1V4 Canada

Phone: +1 778 899 1780

Email: info@formationmetalsinc.com

www.formationmetalsinc.com

CUSIP: 34638F / ISIN: CA34638F1053

Shares Issued & Outstanding: 96,177,458

Canada Symbol (CSE): FOMO

Current Price: 0.405 CAD (01/21/2026)

Market Capitalization: 39 Million CAD

Germany Symbol / WKN: VF1/ A3D492

Current Price: 0.248 EUR (01/21/2026)

Market Capitalization: 24 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone, Zimtu Capital Corp. (“Zimtu“) and Formation Metals Inc. (“FOMO“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the FOMO‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. This report contains forward-looking statements within the meaning of applicable securities laws. Forward-looking statements include, but are not limited to, statements regarding: The expectation that pending assay results from the ongoing Phase 1 drill program may confirm the presence, continuity and grade of mineralization; the interpretation that the thickness, continuity and shallow depth of mineralization observed to date may support the potential for a conceptual open-pit gold resource; the potential for the Company’s fully funded, multi-phase 30,000 metre drill program to expand known mineralized envelopes across multiple zones, contribute to the delineation of a future NI 43-101 compliant mineral resource estimate, or support subsequent resource updates; the possibility that continued drilling, structural interpretation, geophysical surveys and modelling may identify additional mineralized corridors, extensions at depth, or higher-grade domains; the expectation that the maiden mineral resource estimate, anticipated by Q3 2026, may provide a de-risking milestone relevant to strategic or corporate development interest; and statements regarding broader gold market conditions that may influence project economics, financing conditions, investor sentiment, or potential strategic outcomes. Forward-looking statements are based on management’s current expectations, interpretations, assumptions and beliefs as of the date of this report and involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Readers are cautioned not to place undue reliance on forward-looking statements. Key risks and uncertainties include, but are not limited to: Exploration and geological risk: Mineral exploration is inherently speculative. The presence of visually identified mineralization, alteration, sulphides, or visible gold does not guarantee the presence of economically significant gold grades. Pending assay results may return lower-than-expected grades, narrower mineralized intervals, or inconsistent results. Mineralization may not be continuous along strike or at depth as currently interpreted and geological models may change with additional drilling. Sampling, assay, and QA/QC risk: Descriptions of mineralization in this report are based on geological interpretation and, where referenced, visual observations that do not replace laboratory assays. Coarse-gold effects, sampling bias, analytical variability, QA/QC issues, laboratory capacity constraints, or delays in assay turnaround may affect the reliability, timing, or interpretation of results. Historical estimate and data verification risk: The N2 Project contains historical (non–NI 43-101 compliant) resource estimates and extensive historical drilling. There is no assurance that historical estimates will be verified, reproduced, or converted into current mineral resources or reserves. Verification work may reveal differences in grade, tonnage, geometry, metallurgical response, or continuity that materially alter project interpretation. Mineral resource estimate risk: Any maiden mineral resource estimate prepared under NI 43-101 will be subject to key assumptions and interpretive parameters including geological modelling, domaining, cut-off grade selection, density assumptions, capping, compositing, variography, search parameters and other geostatistical inputs. Estimates are inherently uncertain and may change with new data, revised assumptions, updated modelling, or changes in economic parameters. Conceptual development risk: Any references to a conceptual open-pit resource, bulk-tonnage scenarios, or potential development pathways are conceptual in nature. Key parameters such as strip ratio, metallurgy, geotechnical conditions, hydrology, environmental constraints, permitting requirements and economic thresholds may not be established at this time. Future drilling and technical studies may determine that the project is not suitable for open-pit mining or economic development. Permitting, regulatory, Indigenous consultation, and community risk: Exploration activities are subject to permitting, regulatory approvals, environmental requirements and consultation with Indigenous groups and local communities. Delays, additional conditions, regulatory changes, or consultation challenges could materially affect timelines, costs, access and the scope of exploration activities. Commodity price and macroeconomic risk: The potential economic relevance of the N2 Project is sensitive to gold prices, which are volatile and influenced by macroeconomic conditions beyond the Company’s control. Declines in gold prices may negatively affect project economics, investor sentiment, financing conditions and potential strategic interest. Financing and liquidity risk: While the current drill program is described as fully funded, additional exploration, resource delineation, metallurgical work and any future development studies will require additional capital. Future financing may not be available on acceptable terms, if at all and may result in dilution to existing shareholders. Operational risk: Exploration activities may be impacted by weather, seasonal limitations, equipment availability, contractor performance, labour constraints, supply-chain disruptions, access conditions, health and safety incidents, or unforeseen technical challenges that could affect costs and timelines. Environmental and title risk: Exploration and potential development activities may encounter environmental liabilities or unforeseen impacts requiring mitigation or remediation. Mineral titles and permits, while believed to be in good standing, may be subject to disputes, overlapping land uses, third-party claims, or changes in land access regulations. Strategic and M&A risk: Any references to potential strategic interest, partnerships, joint ventures, acquisitions, or corporate transactions are speculative. There is no assurance that the N2 Project will attract strategic partners or acquirers, regardless of exploration success, resource definition, or market conditions. Market volatility risk: The Company’s share price may be subject to significant volatility unrelated to exploration results, driven by broader market conditions, macroeconomic factors, sector sentiment and the liquidity constraints typical of junior exploration companies. Caution to readers: Forward-looking statements are not guarantees of future performance. Actual results may differ materially due to the risks and uncertainties described above and in Formation Metals’ public disclosure filings. Mineralization in similar rocks or nearby deposits is not necessarily indicative of mineralization on the Company’s properties. Historical work and data have not necessarily been independently verified and should not be relied upon as current. Surface sampling, where referenced generally, does not necessarily correlate with drilling results and only indicates potential for mineralization that may or may not be confirmed by drilling.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment. So while the author of this report is not paid directly by Formation Metals Inc. (“FOMO“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of FOMO‘s stock prices. The author also owns equity of FOMO, and he also owns equity of Zimtu Capital Corp. and thus will benefit from volume and price appreciation of these stocks. FOMO pays Zimtu Capital Corp. to provide this report and other services. FOMO has signed an agreement with Zimtu Capital Corp. (TSX.V: ZC) (FSE: ZCT1) (“Zimtu”) whereby Zimtu will provide marketing services under its ZimtuADVANTAGE program, effective August 1, 2025, for an initial term of 12 months at a cost of $12,500 per month. The program is designed to provide opportunities, guidance, marketing and assistance. Services include investor presentations, email marketing, lead generation campaigns, blog posts, digital campaigns, social media management, Rockstone reports & distribution, video news releases and related marketing & awareness activities. Zimtu is based in Vancouver, at Suite 1450 – 789 West Pender Street, Vancouver, BC V6C 1H2. Zimtu may be reached at 604.681.1568, or info@zimtu.com. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Formation Metals Inc., Tradingview, Stockwatch, and the public domain. The cover picture has been obtained and licenced from 123rf.com.