There is a moment in every great resource story when something quietly changes. Not with a drill result. Not with a headline number. But with certainty. For Homerun Resources Inc. that moment is now.

For years, Santa Maria Eterna was a vision: A rare geological gift with the potential to anchor an entire silica-to-solar-glass value chain in Brazil. Investors could see the logic. The strategy made sense. The end markets were obvious. But great projects are not built on logic alone. They are built on land certainty, infrastructure and commitment. And in the past days, these key elements snapped firmly into place.

From Permission to Control

Securing long-term surface rights is not glamorous, but it is foundational.

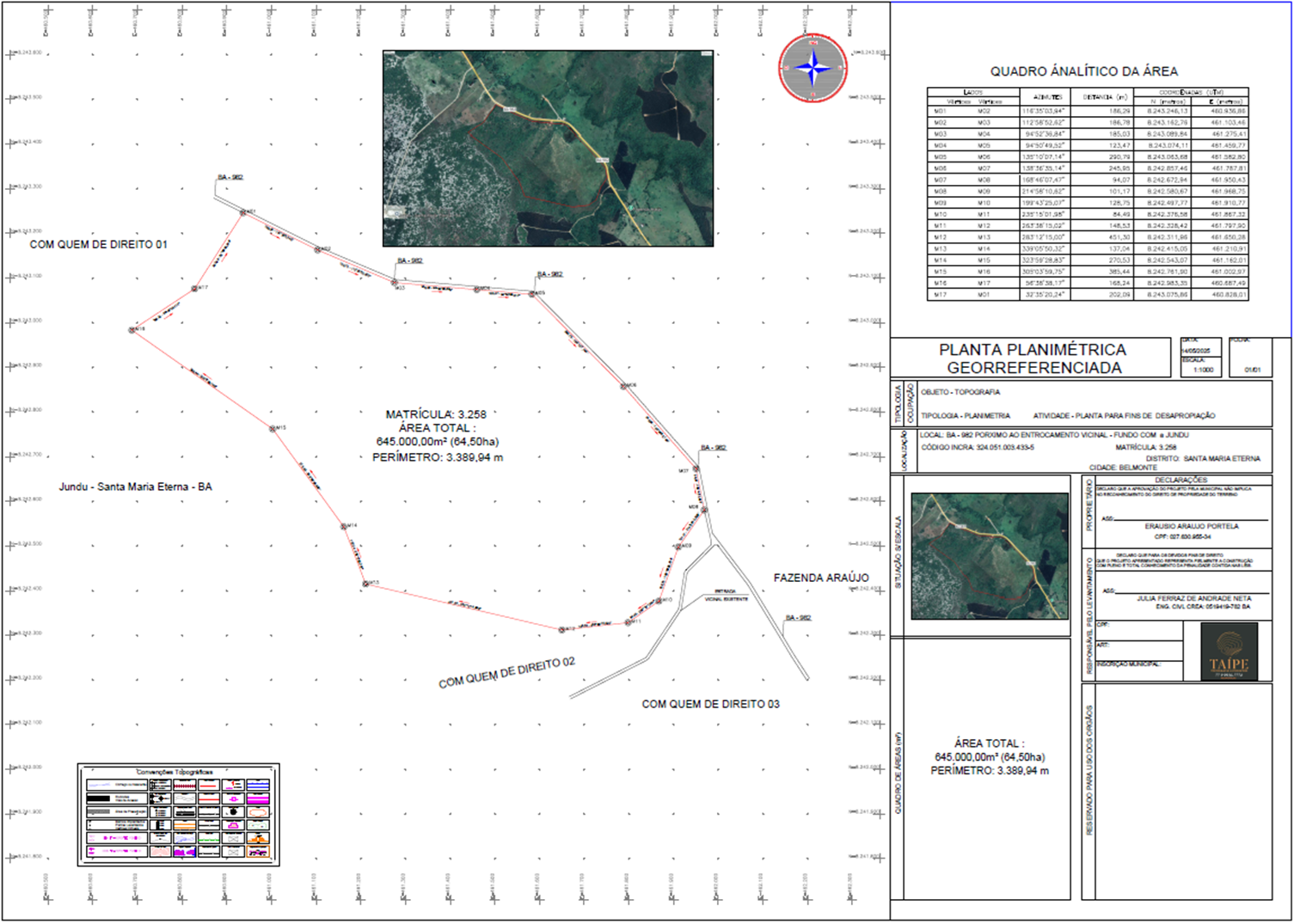

With nearly 2 centuries of surface rights now locked in (a 99 year term automatically renewable for another 99 years), Santa Maria Eterna is no longer dependent on political goodwill, shifting municipal priorities or conditional agreements. The land is secured. The rules are clear. The control is absolute.

This is the difference between being allowed to build and having the right to build. For investors, this is one of the most powerful forms of de-risking there is: Legal permanence that unlocks financing, permitting and execution.

Projects don’t fail because the geology disappears. They fail because uncertainty creeps in. That uncertainty has just been removed – structurally, legally and for the long term.

When Roads Start to Appear, Reality Follows

On Monday, Homerun locked in long-term surface rights at Santa Maria Eterna (SME) in Bahia, Brazil. The site is secured. The legal risk is gone. Financing just got easier. Execution just got faster.

Then, the difference between promise and progress became visible today.

The road didn’t just get approved. It didn’t just get promised. It started getting built.

Heavy equipment moved in. Earth was graded. The logistics artery connecting SME to Brazil’s federal highway network began to take physical shape.

This matters more than many realize.

Roads are not built for news-releases. They are built because governments expect long-term economic activity.

Infrastructure spending is one of the strongest signals a jurisdiction can send. It says: We believe this project will last, scale and matter.

SME is no longer an isolated silica district on a map. It is becoming a strategic hub: Connected, accessible and industrially viable.

The Quiet Inflection Point

What we are witnessing is not just progress but a phase change.

Homerun is crossing the invisible line that separates exploration stories from development stories, development stories from financing stories and financing stories from construction realities.

With land secured, infrastructure underway and government alignment clearly visible, the project has moved beyond aspiration and into a materially different stage of execution.

These are the ingredients that turn timelines from hopeful projections into inevitable outcomes.

Bottom Line

Markets often react loudly to drill holes and test results. But seasoned investors know that the real value inflection usually comes earlier – at the moment when risk quietly drains out of a project and uncertainty gives way to structure, visibility and execution. That is the point where probability begins to outweigh speculation.

SME is no longer waiting for conditions to align. They are aligning around it, step by step, in ways that are visible both on paper and on the ground.

Land security is in place. Infrastructure is taking physical form. Institutional and governmental support has moved from intent to action. These are not abstract milestones but the hard prerequisites that determine whether a project can actually be built, financed and scaled in the real world.

This is how industrial complexes are born. Not through a single announcement or technical result, but through a sequence of irreversible steps that progressively remove barriers to financing, permitting and construction. Each step narrows the range of outcomes and strengthens the investment case. Once those steps are taken, optionality turns into momentum.

And once momentum takes hold, the story stops being about if. It becomes about how big and how scalable.

That shift is also reflected in management’s own assessment of the moment:

“We wish to thank the parties to the original MoU and the landowner for helping to get this key deliverable completed in a timely manner before the pending receipt of our Bankable Feasibility Study and Financing of the Industrial Plants. We continue to work with the parties to the original MoU to facilitate the further items under the MoU, including the utilities and the Municipality of Belmonte’s financial support toward the development of infrastructure. The signing of this new Agreement aligns with the execution of the Company’s strategy to develop and construct Homerun’s Silica Processing and Solar Glass Manufacturing facilities, in the Municipality of Belmonte, ensuring the establishment of the entire silica value chain, from resource to extraction to processing to high value-added final product at the Santa Maria Eterna site, maximizing both the socioeconomic and environmental benefits for the people of the State of Bahia.”

Homerun‘s CEO, Brian Leeners, in the news-release of December 15, 2025

In essence, this is no longer a resource story searching for a pathway forward.

It is a pathway actively being built – deliberately, visibly and with growing permanence, one irreversible step at a time, from groundwork today to an industrial future defined by scale, resilience and long-term strategic relevance.

Company Details

Homerun Resources Inc.

#2110 – 650 West Georgia Street

Vancouver, BC, V6B 4N7 Canada

Phone: +1 844 727 5631

Email: info@homerunresources.com

www.homerunresources.com

ISIN: CA43758P1080 / CUSIP: 43758P

Shares Issued & Outstanding: 64,081,179

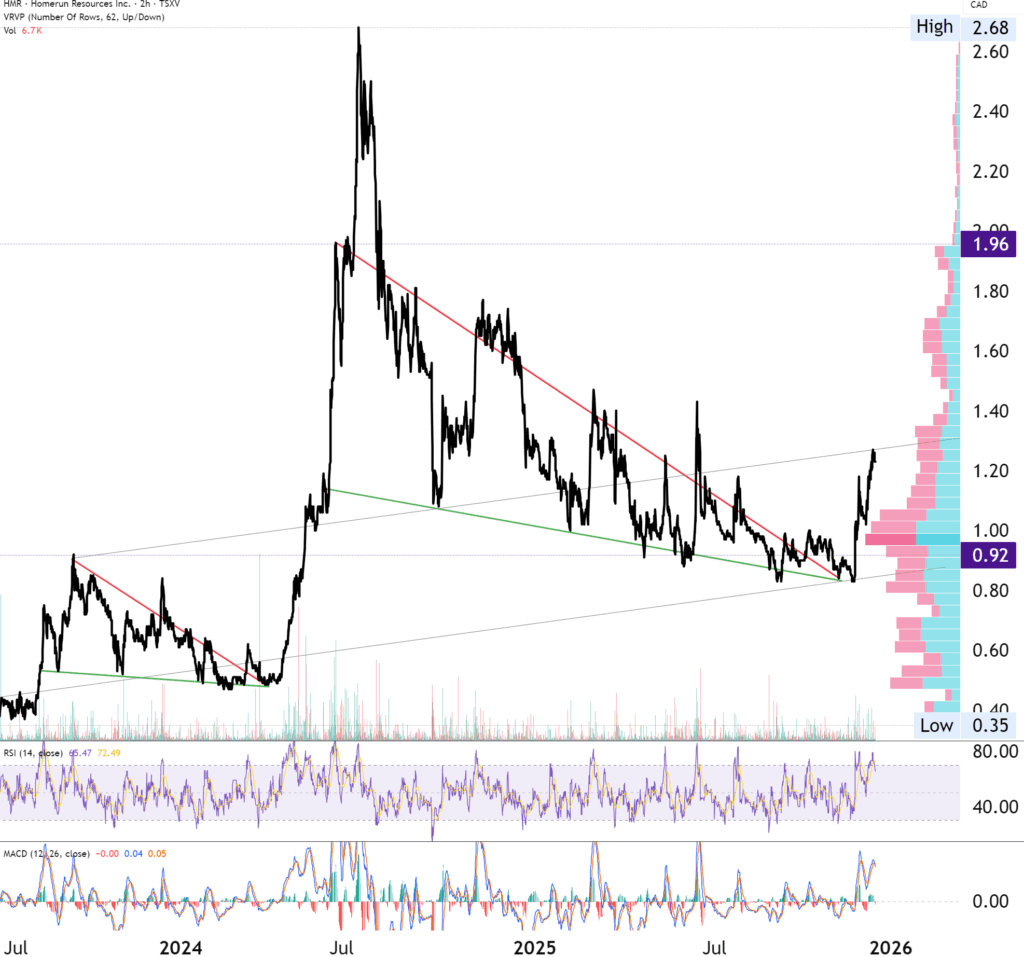

Canada Symbol (TSX.V): HMR

Current Price: 1.23 CAD (12/15/2025)

Market Capitalization: 79 Million CAD

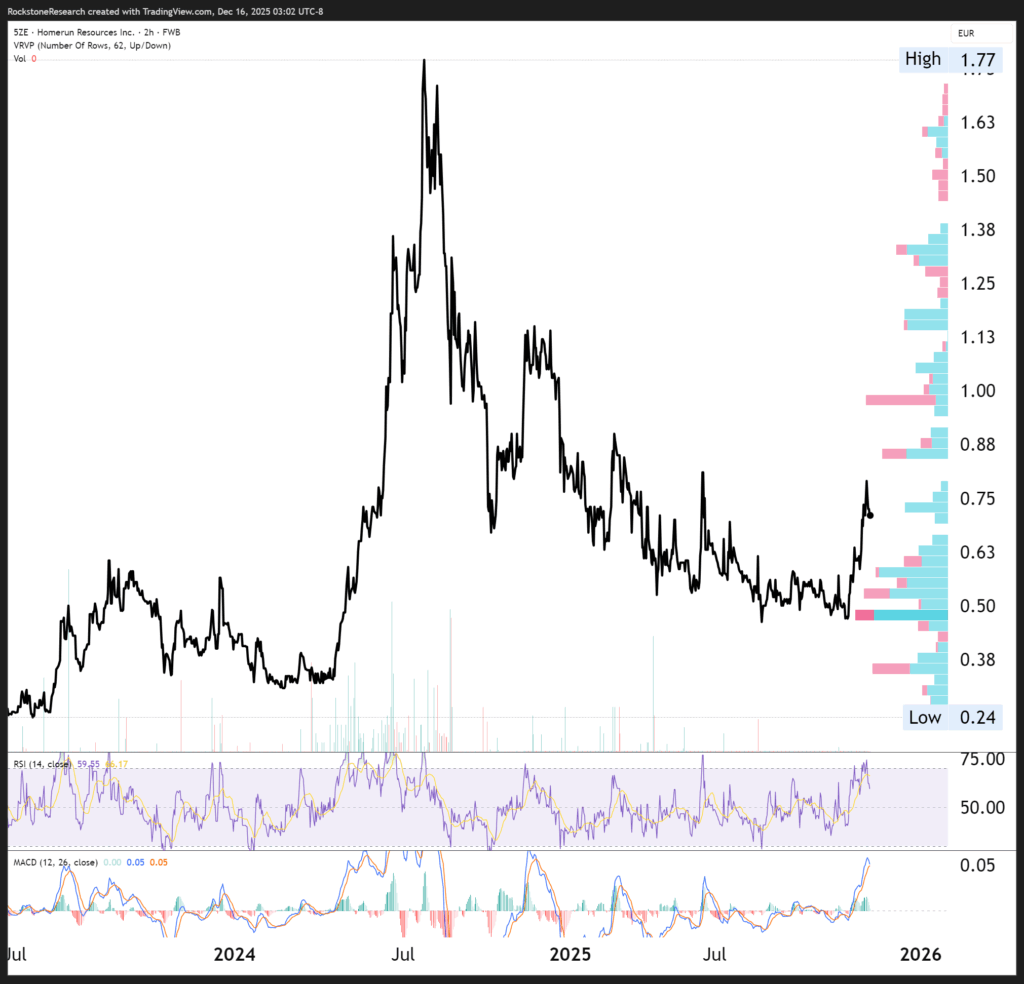

Germany Ticker / WKN: 5ZE / A3CYRW

Current Price: 0.71 EUR (12/16/2025)

Market Capitalization: 46 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone and Homerun Resources Inc. (“Homerun“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun’s public filings for a more complete discussion of such risk factors and their potential effects, which may be accessed through its documents filed on SEDAR+ at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements include expectations related to: Land tenure, surface rights and legal certainty, including assumptions that the recently secured long-term surface rights at Santa Maria Eterna will remain in full force and effect as contemplated; that such rights will provide enduring legal security for the construction and operation of industrial facilities; and that they will support permitting, financing and development activities as anticipated. Infrastructure development and logistics access, including expectations that road improvement works connecting Santa Maria Eterna to regional and federal transportation networks will continue as planned; that such infrastructure will materially improve site accessibility, logistics reliability and operating efficiency; and that public-sector support for infrastructure development will remain aligned with the project’s long-term industrial objectives. Governmental, institutional and stakeholder alignment, including assumptions that cooperation with municipal, state and federal authorities will continue; that commitments related to infrastructure, land use, and regional development will be executed substantially as envisioned; and that policy, regulatory and administrative frameworks will remain supportive of industrial development in the Santa Maria Eterna district. Project development sequencing and execution, including expectations that the reduction of land, infrastructure and jurisdictional risk will enable the project to advance from planning into execution; that development timelines will benefit from improved certainty and coordination; and that remaining project milestones can be pursued in a more predictable and financeable manner. Strategic positioning as an emerging industrial hub, including assumptions that Santa Maria Eterna may evolve from a resource district into a broader industrial and manufacturing center; that infrastructure, land security and scale potential will enhance its attractiveness to industrial partners, customers and financiers; and that such positioning may support vertically integrated silica, glass, and energy-related activities over time. Economic, financing and commercialization outcomes, including assumptions that improved legal and infrastructure certainty will enhance access to capital; that financing terms and structures will be available on acceptable conditions; and that market, cost and execution risks will remain manageable as the project advances toward construction and operation. Such forward-looking statements are based on assumptions that Rockstone considers reasonable as of the date of this report; however, no assurance can be given that these expectations will prove correct. Actual results and outcomes may differ materially due to risks, uncertainties, and factors beyond the control of the Company. Readers are cautioned not to place undue reliance on forward-looking information. Risks and uncertainties include, but are not limited to: Land Tenure & Legal Risks: Although long-term surface rights have been secured for the Santa Maria Eterna (“SME”) industrial site, risks remain related to interpretation, enforcement, renewal mechanics, registration or future legal challenges under applicable Brazilian law. Changes in land-use regulations, judicial interpretations or administrative procedures could affect the scope, timing or cost of project development despite the secured surface rights. Infrastructure & Logistics Risks: While road improvements and infrastructure upgrades are underway or supported by public-sector commitments, there can be no assurance that such works will be completed on anticipated timelines, to expected specifications or without cost overruns. Delays, funding reallocations, contractor performance issues, weather impacts or changes in government priorities could affect access, logistics efficiency and operating costs. Execution & Construction Risks: As SME transitions from planning into execution, the project faces risks associated with construction, commissioning and ramp-up of industrial facilities. These include engineering challenges, contractor performance, equipment delivery delays, cost inflation, workforce availability and deviations from design assumptions. Actual construction timelines and costs may differ materially from expectations. Permitting, ESG & Community Risks: Development of mining areas, processing plants and associated infrastructure requires multiple environmental, land-use and operational permits. Regulatory approvals may be delayed, denied, modified or conditioned on additional environmental, social or community-related requirements. While SME’s development approach is expected to reduce environmental impact, evolving ESG standards or stakeholder expectations could affect timelines, scope or cost. Financing & Capital Market Risks: Advancing SME through feasibility, construction and commercial operation will require significant capital. Financing may not be available when needed or on acceptable terms due to market conditions, interest rates, investor sentiment or broader capital-market volatility. Equity or debt financing may dilute existing shareholders or impose restrictive covenants that affect operational flexibility. Industrial Scale-Up & Operational Risks: Although the project has advanced beyond early-stage concept, operational performance at industrial scale may differ from expectations. Processing efficiency, throughput, recoveries, energy consumption, maintenance requirements or plant availability may vary from engineering models or early testwork, impacting costs and economics. Product Qualification & Commercial Adoption Risks: Entry into solar glass, antimony-free solar glass and other premium industrial markets requires multi-stage qualification, customer validation and long-term performance testing. Customers may delay or decline approval, adjust specifications, require additional testing or favor incumbent suppliers. Commercial adoption may occur more slowly or on less favorable terms than anticipated. Market, Pricing & Demand Risks: Silica, solar glass and advanced materials markets are subject to pricing volatility driven by supply-demand dynamics, technological change, energy costs and macroeconomic conditions. Assumptions regarding sustained demand growth or premium pricing for low-iron or high-purity silica may not be realized. Competitive & Industry Risks: The global silica and glass markets are competitive. Established producers or new entrants may expand capacity, reduce pricing, secure long-term contracts or develop alternative materials, processing technologies or supply chains that reduce SME’s relative advantages. Regulatory, Trade & Policy Risks: Changes in mining, environmental, tax, trade, export or industrial policy in Brazil or internationally may affect project economics, timelines or market access. Trade restrictions, tariffs, reshoring initiatives or changes in incentives for solar or clean-energy manufacturing could alter competitive dynamics. Macroeconomic, Currency & Inflation Risks: Inflation, recessionary conditions, geopolitical instability, supply-chain disruptions or currency fluctuations between BRL, USD, CAD and EUR may materially affect capital costs, operating costs, financing availability and projected returns. Force Majeure & External Event Risks: Extreme weather events, climate-related impacts, natural disasters, pandemics, political instability, labor disruptions or other external events may materially disrupt construction, logistics, operations or scheduling. Liquidity & Market Risks: As a small-cap issuer, Homerun’s shares may experience limited liquidity, significant price volatility or wide bid-ask spreads. Market sentiment may diverge materially from project fundamentals, affecting valuation independently of operational progress. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. Past performance and comparisons to other companies or jurisdictions are provided for illustrative purposes only and should not be considered indicative of future results.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Homerun Resources Inc. On September 8, 2025, Homerun announced that the company “entered into an agreement with Rockstone Research to provide marketing services to the company”, and that “Rockstone Research is an arm’s-length marketing firm and has been engaged for an initial three-month term for total consideration of $25,000, which is payable up front. The company does not propose to issue any securities to Rockstone in consideration for the services to be provided to the company.” The author owns equity of Homerun and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Homerun (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Stockwatch.com, Tradingview.com, Homerun Resources Inc. and the public domain.