A press release from the Silver Institute clearly shows that physical silver investments – i.e. bars and coins – are a structurally decisive, albeit volatile, factor in global silver demand.

The new market report by Metals Focus on behalf of the Silver Institute highlights the 4 largest markets: USA, India, Germany, and Australia. Together, these countries account for almost 80% of the global market for physical silver investments.

Strong price dynamics

Since the beginning of the year, silver has risen more strongly than gold and Bitcoin. The price of silver is benefiting from geopolitical tensions, growing government debt, and the growing awareness among many investors that silver is undervalued compared to gold.

This is also confirmed by a look at the gold-silver ratio: From a historical perspective, the current level signals a significant undervaluation of the white metal and opens up further catch-up potential.

The 4 key markets at a glance

USA: The giant among silver investors

- Since 2010, US investors have purchased a total of 1.5 billion ounces of silver.

- On average, the volume of silver purchases corresponded to around 70% of the value of gold purchases – worldwide, this figure is only 6%.

- IRAs (Individual Retirement Accounts) play an important role, even though precious metals have so far only accounted for a small portion of the total IRA volume – there is further growth potential here.

- Sales have been modest so far: The majority of holdings are still being held.

India: Silver culture with a future

- India is traditionally the “silver nation” and the second-largest market after the US.

- Particularly in demand: Silver bars, which accounted for around 70% of total demand in 2024.

- From 2010 to 2024, demand for Indian bars and coins totaled 840 million ounces.

- Even with record prices in rupees, the willingness to sell silver remains low – a sign of deep-rooted tradition.

Australia: The rising star

- In 2019, demand was only 3.5 million ounces.

- This was followed by a record high of 20.7 million ounces in 2022.

- The main drivers are tax advantages and the integration of silver into retirement products.

- Metals Focus expects a further increase of 11% in 2025.

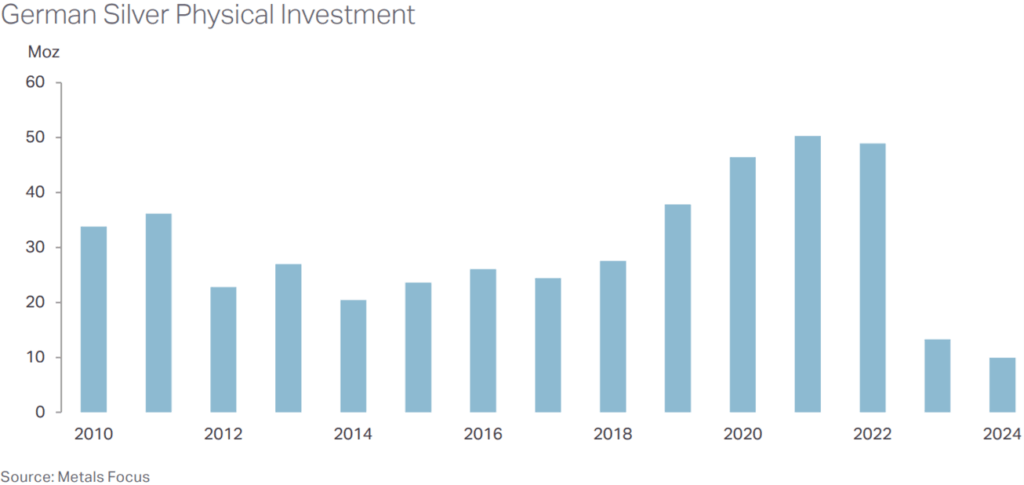

Germany: Characterized by regulation and crisis awareness

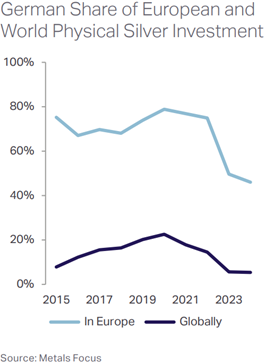

- For years, Germany was the third-largest market for silver investments and at times even dominated the European market. Between 2020 and 2022, physical demand averaged 48.5 million ounces per year.

- With the end of special tax regulations for silver coins and products (“differential taxation”) at the end of 2022, the market collapsed abruptly: Since then, investors have had to pay the full 19% VAT on purchases. The result: A decline of around 39 million ounces and a sharp loss of importance for Germany both in Europe and globally.

- Between 2015 and 2021, German buyers still accounted for over 80% of European silver demand; globally, the share was up to 22%. Since 2022, this figure has fallen to below 50% in Europe and less than 5% worldwide.

Interpretation: Germany has long been the driving force behind the European silver market. Due to VAT regulations, it has lost its special status, and investors have turned to other asset classes or foreign markets.

Elementum fills the gap: Since the silver is not delivered in Germany but stored in a duty-free, high-security warehouse in Switzerland, VAT is completely eliminated. Investors can thus secure physical silver without a 19% surcharge – tax-optimized, liquid, and at internationally competitive conditions.

Structural supply deficit reinforces the rally

According to the Silver Institute, the silver market is experiencing a supply deficit for the fourth consecutive year. Reasons:

- Growing industrial demand from the solar industry, electromobility, and electronics.

- Declining production in many mines.

- The increasing importance of physical investments.

The result: Silver is becoming scarcer – and therefore more valuable.

Silver beats paper: Why physical silver remains unbeatable

Although silver ETPs (exchange-traded products) are also booming with massive inflows, they harbor counterparty risks, cost traps, and the danger of limited deliverability in times of crisis.

Only physical ownership offers real security – ideally in a duty-free, high-security warehouse in Switzerland, as Elementum has been offering for years.

Your advantages with Elementum:

- 100% ownership of physical bars (no paper substitutes).

- Duty-free storage: No VAT, particularly important for silver.

- Maximum security in the St. Gotthard mountain massif (bulletproof safes, independent audits, insurance coverage).

- Flexibility: Delivery, sale, or exchange for gold at any time (ratio strategy).

- Family-friendly solutions such as FamilienSchatz and KinderSchatz to secure real silver values starting at just €50.

Conclusion: Silver in 2025 – more than just an investment

Data from the Silver Institute and analyses by Metals Focus prove that physical silver investments are a global megatrend. In the US, India, Germany, and Australia, a demand block is forming that is increasingly tightening the supply situation.

With a strong price increase since the beginning of the year and a structurally undervalued position compared to gold, silver remains the most dynamic precious metal investment of our time.

Those who invest in physical silver now and rely on secure, tax-free storage in Switzerland not only benefit from further return opportunities, but also secure their assets in the long term.

Elementum offers the perfect framework for this – from individual one-time investments to family-friendly savings programs.

How can you buy precious metals cheaply and store them safely?

Elementum Deutschland GmbH, based in Sindelfingen (Germany), specializes in trading physical precious metals. Customers who purchase precious metals from Elementum Deutschland (or one of the other national Elementum companies in five European countries) can store them in the renowned high-security vaulting facilities in the St. Gotthard Massif in Switzerland at Elementum International AG.

Of course, you also have the option of purchasing gold and silver directly and having it delivered to your desired address. However, storing silver in the so-called open duty-free warehouse (“offenes Zollfreilager”) at St. Gotthard offers decisive tax advantages:

- The 19% value added tax customary in Germany is completely waived on purchases and sales – a considerable price advantage that effectively secures you 19% more silver for your money.

- If you store your silver in this high-security vault, you can sell it back to Elementum Deutschland GmbH at any time – without any bureaucratic hassle and also without VAT, as the trade takes place within the duty-free warehouse. You will receive the funds via bank wire.

- VAT is only payable when you physically remove the stored silver – either by picking it up in person (after prior notification) or by having it shipped to your address.

More silver, more return

Thanks to duty-free storage, you receive 19% more physical silver when you buy. This additional amount also participates in the performance of the silver price if it rises – a leverage effect that significantly improves your return opportunities.

Secure your storage space now – free of charge and without obligation

Register now for a storage space in the St. Gotthard high-security vaulting facility and receive free access to:

- our General Terms and Conditions (GTC)

- current fee tables

- annual audit reports from the auditing company BDO AG

- transparent proof of use of funds

- family discount information

- the popular children’s program “Schatz4Kids” (“Treasure4Kids”)

- as well as numerous other documents and information on storage, purchase, and resale, as well as the ratio “switching” strategy.

Register now: https://silberbar.elementum.de/

Tip for discounted entry: Enter the promotional code “50” (“Aktionscode“) and the “Vermittler” number 1000166 when registering to receive a 50% discount on the storage space setup fee.

Important: Registration is non-binding and does not commit you to anything – but it is your first step towards an independent and crisis-proof precious metal investment.

Elementum is a second-generation, owner-managed family business. Trust, consistency, and long-term thinking are at the heart of our philosophy. The Board of Directors of Elementum International AG is composed of internationally renowned experts in the money and precious metals markets, including economists, analysts, university professors, and precious metals specialists. This in-depth expertise forms the backbone of our actions—for your security, your assets, and your future.

About the Author

Stephan Bogner

CEO of Elementum International AG

Stephan Bogner, who holds a degree in business administration, studied economics at ISM Dortmund (Germany) and wrote the university’s first thesis on precious metals as a hedge against inflation. After studying in the UK and Australia and gaining professional experience in Dubai, he took over as CEO of Elementum International AG in Switzerland in 2012. His expertise in precious metals has had a significant impact on the company’s development.

Contact

Disclaimer: This article does not constitute a recommendation to buy or sell. Elementum International AG is a Swiss company that specializes exclusively in the storage of physical precious metals in a high-security vault facility located in the St. Gotthard mountain massif in Central Switzerland. The Board of Directors and Executive Management of Elementum International AG have been selected solely based on their professional expertise and long-standing experience in precious metals markets. As these individuals may also be professionally active outside their roles at Elementum International AG, the company has no influence over their external activities and respects their right to freedom of expression. Therefore, the views expressed by persons working with or for Elementum do not necessarily reflect the opinion of Elementum International AG. Investments in precious metals are subject to risks, including those specific to the structure of this market. Please read our full risk disclosures and consult a licensed financial advisor before making any investment decisions. Neither the author, Elementum International AG, nor Elementum Deutschland GmbH assume any liability for actions taken based on the information provided. Past performance is not indicative of future results. The cover picture has been obtained and licenced from 123rf.com.