Nothing in today’s world works without them – not smartphones, satellites, or supercomputers. Gallium, germanium, hafnium, tungsten, and tantalum are the hidden heroes of the modern era. These obscure metals form the backbone of the semiconductor industry – and by extension, the entire digital economy.

But they are scarce, difficult to mine, and politically sensitive. A new global race is underway between China, the United States, Japan, South Korea, and Europe. The prize: control over the materials that define technological supremacy in the 21st century.

Small Metals, Big Impact

While copper, nickel, or aluminum dominate commodity headlines, the real value often lies in grams, not tons.

-

Gallium powers high-frequency chips, 5G networks, and satellite communication.

-

Germanium enables fiber optics, infrared optics, and solar technology.

-

Hafnium boosts the efficiency of modern microprocessors.

-

Tantalum stabilizes capacitors and advanced electronics.

-

Tungsten withstands extreme heat in chipmaking tools and aerospace components.

These critical metals are the unsung foundation of global technology – and their scarcity has turned them into strategic weapons.

China’s Strategic Grip

China dominates global production and refining. The country controls over 60% of global supply for many of these elements and nearly all refining capacity for gallium and germanium.

When Beijing imposed export restrictions in 2023, the message to the West was unmistakable: control the tech, or risk losing the metals that make it possible.

This move exposed how fragile global supply chains had become. The U.S., Japan, and South Korea scrambled to secure alternative sources – but most mines and refineries remain concentrated in Asia.

The Western Countermove

In response, Western governments are investing heavily in supply diversification and domestic production.

The United States launched multi-billion-dollar initiatives to rebuild refining capacity and stockpile critical materials.

Canada is emerging as a reliable partner, rich in niobium, tantalum, and germanium.

The European Union passed the Critical Raw Materials Act, setting targets for mining and recycling within Europe.

Yet the reality is that building a mine and a refining facility can take a decade or more. The West is not just catching up in mining – it’s catching up in chemistry, engineering, and logistics.

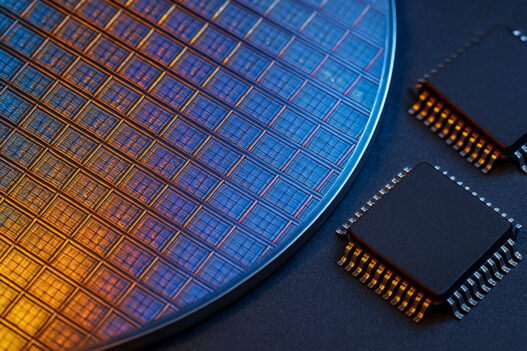

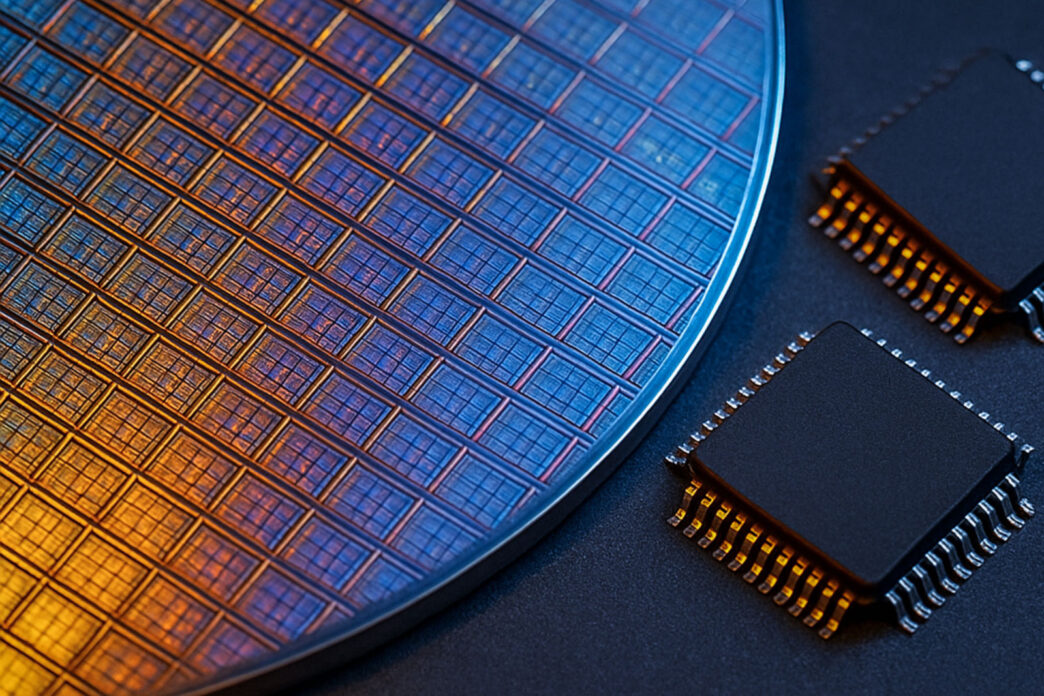

Semiconductors: The Core of Power

Semiconductors are the nervous system of modern civilization. They run everything from electric grids to missile guidance systems.

That’s why access to the metals that make chips possible has become a matter of national security.

While the U.S. pours billions into domestic chip plants under the CHIPS and Science Act, China secures upstream supply chains – the raw materials feeding those plants.

The result is a delicate standoff: technological might in the West, raw material leverage in the East.

New Players, New Opportunities

Despite the rivalry, the shake-up is creating room for new players:

Canada and Australia are stepping forward as politically stable sources of critical metals.

African nations like Rwanda and the DRC hold significant tantalum and tungsten reserves.

Recycling technologies are gaining traction, turning electronic waste into valuable metal feedstock.

Innovation, not just extraction, will define the winners of this new race. The nations that master both – the geology and the technology – will lead the next industrial age.

Outlook

This new race for chip metals isn’t just about economics; it’s about power, independence, and the ability to innovate.

The global balance of power is shifting beneath the surface – quite literally. Tiny elements buried deep in the Earth are shaping the next era of human progress.

Gallium, germanium, and tungsten might never make front-page headlines. But they are quietly deciding who leads the technological world of tomorrow.

Andy Schmidt

Contact

Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell commodities or securities. All assessments and forecasts are current as of the date of publication and are subject to change at any time. There is no guarantee of future performance. Investing in commodities involves risks. Consulting a licensed financial advisor is strongly recommended.