Most recently, in October 2025, the silver price rose above $50 per troy ounce. Silver had already reached this level in 1980 and then again in 2011. On both occasions, this was followed by a prolonged decline in prices. Some investors are therefore wondering whether such a decline is looming again. To answer this question, let us first take a closer look at the situation at that time.

However, this raises the next question: What were the peak prices back then? Because for 1980, this is anything but clear. This has now sparked further discussion. Let’s examine these questions using databases and contemporary accounts and take a closer look at the circumstances surrounding previous silver highs.

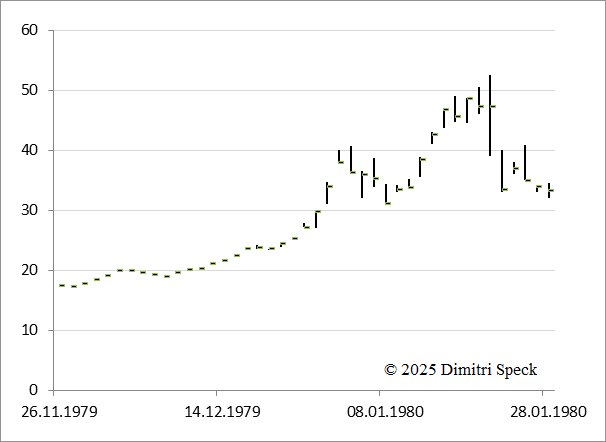

The course of silver futures at their peak in 1980

Let’s first look at the prices on the futures market in the US, i.e. the market for silver to be delivered soon. Here we encounter the first problem. On January 18, 1980, the near contract on the Comex futures market reached a high of $50.36 per troy ounce. On the competing CBOT exchange, the high is said to have been $52.50 per troy ounce on the following Monday, January 21, 1980. This was reported at the time by the New York Times newspaper and has now been picked up in an article by the financial services provider Bloomberg.

However, the exchange no longer exists. The prices are not available from common data providers. I couldn’t find a chart on the internet. Then I remembered a data provider that has long since ceased to exist. So I searched my archives – and found what I was looking for! We can now see the price development on the CBOT futures market with daily prices and the real high of 1980:

Silver at its 1980 high, in US Dollar per troy ounce, CBOT January contract, 1979 to January 28, 1980

The chart shows how the price almost tripled within a month and a half, and the real high on January 21, 1980, is also visible. This was a spectacular and unprecedented rise! However, the subsequent decline was also rapid.

The spot market high in 1980 was even higher: $54.50 per troy ounce!

But what was the spot market high in London, i.e. for silver available for immediate delivery? This question is also not easy to answer. I have intraday prices (tick or minute-by-minute) for precious metals up to 1983 (futures) and 1986 (spot), and even these were extremely difficult to obtain. The responsible trading organisation, the London Bullion Market Association, also does not have the intraday or highest prices from 1980. Perhaps the prices are still available in the archives of trading houses – but who would look for them?

Through John Bollinger – the inventor of Bollinger Bands, the lines that elegantly swing around the price in charts – I came into contact with Eddie Tofpik. In the 1980s, he worked for one of the major precious metal dealers in London at the time, Mocatta & Goldsmid. Tofpik recalls a conversation with one of the silver dealers, the now deceased Mike Jennings. According to him, the highest price in 1980 was $54.50 per troy ounce of silver! The volume of the trade was 200,000 ounces (two ‘lakhs’). This price is higher than previously known to the public.

The Hunt brothers drove up the price of silver

It was a very hectic, highly volatile market at the time, which made this price spike possible. This hectic activity was caused by brothers Nelson Bunker Hunt and William Herbert Hunt. Together with Arab partners, they had bought several hundred million ounces of silver. This drove up the price. Other investors quickly followed suit with their purchases.

But they hadn’t reckoned with the US authorities. The authorities raised the margin on the futures market to 50 per cent. Prices subsequently collapsed. The short but very excessive bull market was over. So there were unique circumstances both during the rise and the decline. In the broadest sense, these were cases of price manipulation. The Hunt brothers’ silver speculation made history.

The silver high of April 2011

Let’s move on to the next silver high, which did not occur until 2011. Thanks to improved computerisation, the data available is considerably better than for 1980. On April 28, 2011, an intraday high of $49.47 per troy ounce was paid on the spot market. At four months, the rise to this high took considerably longer than in 1980 for the price to double. But what came after the high is particularly noteworthy.

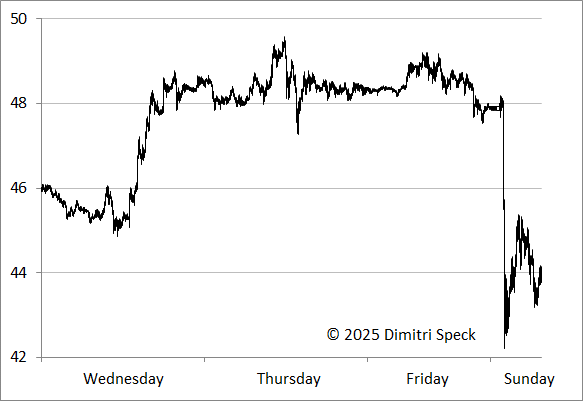

The chart shows the intraday movement of the spot silver price from Wednesday, April 27, to Sunday, May 1, 2011, around the high at that time. The prices during the day are based on New York time. Friday is therefore shortened, and the first prices are already available on Sunday afternoon, when trading begins in Australia on Monday morning, but it is still Sunday on the US East Coast. The 2011 silver price high can be seen in the middle.

Silver at its 2011 high, in US Dollar per troy ounce, April 27, to May 1, 2011

But what do we see on the right side of the chart? The price plummeted sharply on Monday morning shortly after the markets opened in Australia. Within just 12 minutes, the price lost 12 per cent – minutes, mind you, not hours or days, as is usual with corrections. On the parallel futures market, trading volume multiplied during these 12 minutes. Strangely enough, this all took place during early Australian trading, when trading volume is still very low. Who was so clumsy as to sell large quantities of silver into the thin market – or was there another reason for the sell-off?

Price manipulators pushed down the price of silver in 2011.

In fact, the extremely rapid decline was not normal price behaviour. The sales were made deliberately in thin trading on the futures market in order to suppress the price. This approach makes sense: The price is suppressed with relatively little money, investors are driven out of the market, and the positions are then covered later at a profit. What many market observers do not know or do not want to admit is that price manipulation in the precious metals market is not a myth. In fact, there have been court rulings with prison sentences for price manipulation, and the trading houses involved have had to pay millions in settlements.

The extremely sharp slump two trading days after the high was the result of such manipulation. I have developed a statistical method to identify these manipulations. My method was also used in the expert opinion presented in court on price manipulation in the precious metals market. It clearly shows that there was price manipulation on the silver market after May 1, 2011, when the price fell, but not in the months before, when the price rose. I have written about this in detail in my book The Gold Cartel (Palgrave Macmillan).

Silver is once again at an all-time high

Let’s turn to the present. In 2025, the price of silver performed very well. In October, it surpassed the $50 per troy ounce level. On October 16, 2025, it peaked at $54.41 per troy ounce. This was still slightly below the 1980 high! The increase since an interim low in April was 90 per cent. Then there was a price correction.

Silver in US Dollar per troy ounce, 1/2024 to October 21, 2025

Corrections in bull markets are quite normal. They correct periods of exaggeration. Precious metals had risen sharply since the beginning of September. Articles about gold and silver appeared frequently in the media. After a long period of stagnation, precious metal ETFs recorded growth in assets and apparently attracted new, more speculative investor groups. Some bank analysts announced higher price targets.

In short, there had been an exaggeratedly steep rise, and investors had become too optimistic. A correction is quite normal after such an exaggeration and is also healthy as a basis for the next bullish surge.

Seven differences between the current bull market in silver and those of 1980 and 2011

Or is there a threat of a prolonged bear market, as was the case after 1980 and 2011? After analysing the previous highs of 1980 and 2011, let’s look at the differences between then and now to answer this question. A total of seven differences stand out:

- Since 1980, the value of money has decreased significantly. The $50 silver high at that time is roughly equivalent to $200 today.

- In 1980, the peak price for gold was $850 per troy ounce; in October 2025, gold broke through the $4,000 per troy ounce level. So while gold is more than four times higher, the price of silver is still at its 1980 peak.

- Before the silver boom in 2011, the long-standing starting level was $5 per troy ounce. Before the current boom, it was around $20 per troy ounce. Here, too, we arrive at a factor of four.

- The rise in the price of silver in 2025 was sensational. However, it was less steep than that of 2011 and far less rapid than that of 1980. Technically, the market is less overheated.

- The long-term sentiment indicator is still far from overheating. On the contrary, investor investment ratios in the precious metals market are low compared to previous eras – there is still a lot of upside potential. Most investors’ discussions and media articles are still largely dominated by technology stocks. Holdings in precious metal ETFs are low in the long term, and the prices of mines and silver have lagged behind gold in the long term. These sentiment indicators for the precious metals market therefore also suggest that the precious metals markets are by no means overheated in the long term.

- In 1980, there was open intervention in the market; in 2011, there was covert price manipulation. Although manipulation cannot be ruled out even at the 2025 high, I do not see it happening, at least I have not been able to detect any using my methods. The private sector is deterred by the penalties, and central banks are now more on the buying side when it comes to gold.

- Government deficits are higher today than at the previous highs, and global debt as a percentage of GDP is much higher than it was then. This poses considerable risks to the global financial system and generally creates a favourable environment for gold and silver as liquid stores of value.

Fears of a sharper decline in silver are understandable. However, circumstances today are completely different from those in 1980 and 2011. A major bear market is not to be expected. Silver could see much higher prices in the coming years.

How can you buy precious metals cheaply and store them safely?

Elementum Deutschland GmbH, based in Sindelfingen (Germany), specializes in trading physical precious metals. Customers who purchase precious metals from Elementum Deutschland (or one of the other national Elementum companies in five European countries) can store them in the renowned high-security vaulting facilities in the St. Gotthard Massif in Switzerland at Elementum International AG.

Of course, you also have the option of purchasing gold and silver directly and having it delivered to your desired address. However, storing silver in the so-called open duty-free warehouse (“offenes Zollfreilager”) at St. Gotthard offers decisive tax advantages:

- The 19% value added tax customary in Germany is completely waived on purchases and sales – a considerable price advantage that effectively secures you 19% more silver for your money.

- If you store your silver in this high-security vault, you can sell it back to Elementum Deutschland GmbH at any time – without any bureaucratic hassle and also without VAT, as the trade takes place within the duty-free warehouse. You will receive the funds via bank wire.

- VAT is only payable when you physically remove the stored silver – either by picking it up in person (after prior notification) or by having it shipped to your address.

More silver, more return

Thanks to duty-free storage, you receive 19% more physical silver when you buy. This additional amount also participates in the performance of the silver price if it rises – a leverage effect that significantly improves your return opportunities.

Secure your storage space now – free of charge and without obligation

Register now for a storage space in the St. Gotthard high-security vaulting facility and receive free access to:

- our General Terms and Conditions (GTC)

- current fee tables

- annual audit reports from the auditing company BDO AG

- transparent proof of use of funds

- family discount information

- the popular children’s program “Schatz4Kids” (“Treasure4Kids”)

- as well as numerous other documents and information on storage, purchase, and resale, as well as the ratio “switching” strategy.

Register now: https://silberbar.elementum.de/

Tip for discounted entry: Enter the promotional code “50” (“Aktionscode“) and the “Vermittler” number 1000166 when registering to receive a 50% discount on the storage space setup fee.

Important: Registration is non-binding and does not commit you to anything – but it is your first step towards an independent and crisis-proof precious metal investment.

Elementum is a second-generation, owner-managed family business. Trust, consistency, and long-term thinking are at the heart of our philosophy. The Board of Directors of Elementum International AG is composed of internationally renowned experts in the money and precious metals markets, including economists, analysts, university professors, and precious metals specialists. This in-depth expertise forms the backbone of our actions—for your security, your assets, and your future.

About the Author

Dimitri Speck

Member of the Board of Directors of Elementum International AG

Dimitri Speck specializes in analyzing the financial system and financial markets. He is the author of a stock market newsletter and the books “Geheime Goldpolitik” (“Secret Gold Policy”) and “Die größte Finanz-Blase aller Zeiten” (“The Greatest Financial Bubble of All Time”). His work on commodities, precious metals, and seasonality was awarded the German Precious Metals Association Prize in 2013 and the Scope Award in 2018. Mr. Speck is the editor of the website www.seasonax.com on seasonal studies.

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer: This article reflects the personal opinion of the author. Elementum assumes no responsibility for the accuracy of the content and accepts no liability for its use. This article may contain links to external third-party websites. Elementum is not responsible for the content of these external sites and expressly distances itself from all information provided there. At the time the links were created, no unlawful content was identifiable. This article does not constitute a recommendation to buy or sell. Elementum International AG is a Swiss company that specializes exclusively in the storage of physical precious metals in a high-security vault facility located in the St. Gotthard mountain massif in Central Switzerland. The Board of Directors and Executive Management of Elementum International AG have been selected solely based on their professional expertise and long-standing experience in precious metals markets. As these individuals may also be professionally active outside their roles at Elementum International AG, the company has no influence over their external activities and respects their right to freedom of expression. Therefore, the views expressed by persons working with or for Elementum do not necessarily reflect the opinion of Elementum International AG. Investments in precious metals are subject to risks, including those specific to the structure of this market. Please read our full risk disclosures and consult a licensed financial advisor before making any investment decisions. Neither the author, Elementum International AG, nor Elementum Deutschland GmbH assume any liability for actions taken based on the information provided. Past performance is not indicative of future results.