The government is running up record debts and citizens are saving diligently – can this end well?

While Germany recently amended its constitution to allow for a 1 trillion (i.e., 1,000 billion) Euro “special fund” – effectively new debt – German savers are painting a very different picture.

Germans save like no other nation. The chart shows an impressive trend: Over the past 20 years, the volume of savings has risen steadily. At the end of last year, around 3 trillion Euro were held in savings accounts in Germany. This development speaks for itself: Germans trust their savings accounts. And that is a tradition.

Security instead of returns – typically German

Many people suffered painful losses when the dot-com bubble burst in the early 2000s, during the financial crisis of 2008, and most recently during the market turmoil caused by the pandemic. But even in times of negative interest rates, they held on tightly to their savings accounts. The reason? Security. For many, despite the loss of purchasing power, a bank account is considered a safe haven. Cash in the bank seems to be the most reliable way to preserve hard-earned assets.

But times are changing – and with them the rules of the game.

Savers in the crosshairs: A new agenda for your money

On March 10, European Commission President Ursula von der Leyen wrote some remarkable words:

“This month, the EU Commission will unveil the Savings & Investment Union. We’ll turn private savings into much needed investment. And we’ll work with our institutional partners to get it off the ground.”

Behind the technocratic tone lies a clear plan: In the future, savings are to be more tightly controlled, redirected – some would say harnessed. Who are these “institutional partners”? Presumably the very banks that savers trust.

Shortly thereafter, the EU Commission presented a far-reaching plan: Up to 10 trillion Euro in bank deposits within the EU are to be mobilized for “strategic investments” – primarily to strengthen European defense capabilities. Whether this corresponds to the ideas of the average saver is doubtful.

Digital Euro – freedom or control?

Almost at the same time, ECB President Christine Lagarde also made a statement. Her words: “We need to prepare our currency for the future.”

Specifically, she is referring to the introduction of the digital Euro. The preparatory phase is expected to be completed by October of this year. Then the decisive phase will begin: Will the digital Euro be introduced – and what consequences would this have for the financial freedom of savers?

Lagarde emphasized: “Another significant development on the horizon is our digital euro. We are in the preparatory phase and awaiting European legislation. Once this is complete, we will decide whether to proceed with the development of a digital form of cash.”

Critics are sounding the alarm: In a world of programmable money, traditional savings could become increasingly unattractive or even impossible. Cash would no longer be neutral, but controllable – perhaps even expirable. The digital Euro threatens to transform money from a tool of freedom into an instrument of control.

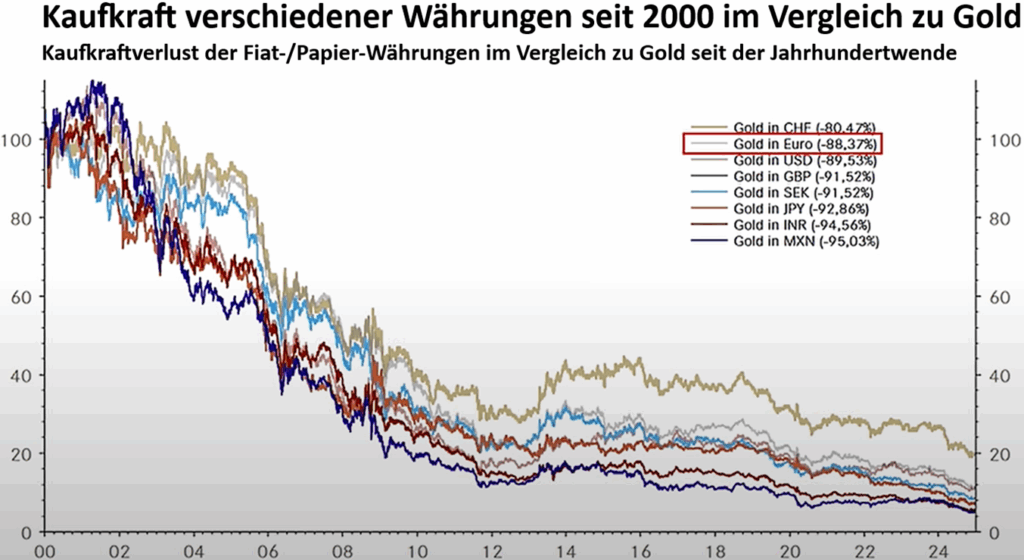

A look at the long-term comparison with gold clearly shows how unsuccessful monetary policy has been in recent decades: Since its introduction, the Euro has lost around 88% of its purchasing power relative to gold. The message is clear: If you want to protect your wealth, you need to invest in tangible assets – especially precious metals such as gold and silver.

Voltaire already knew this in the 18th century: “Paper money sooner or later returns to its intrinsic value: Zero.”

This statement sounds more relevant today than ever before.

Security above all else – real value outside the EU

If you own physical gold or silver, one aspect becomes the decisive criterion: Security. And this is precisely where we at Elementum set ourselves apart from the rest. We offer you the opportunity to store your precious metals in highly secure duty-free vaulting facilities in Switzerland – outside the reach of the EU and far away from regulatory experiments.

We make no compromises. We spare no expense or effort to ensure the best possible security. Because when it comes to your assets, only one thing matters to us: Safety is everything.

How can you buy precious metals cheaply and store them safely?

Elementum Deutschland GmbH, based in Sindelfingen (Germany), specializes in trading physical precious metals. Customers who purchase precious metals from Elementum Deutschland (or one of the other national Elementum companies in five European countries) can store them in the renowned high-security vaulting facilities in the St. Gotthard Massif in Switzerland at Elementum International AG.

Of course, you also have the option of purchasing gold and silver directly and having it delivered to your desired address. However, storing silver in the so-called open duty-free warehouse (“offenes Zollfreilager”) at St. Gotthard offers decisive tax advantages:

- The 19% value added tax customary in Germany is completely waived on purchases and sales – a considerable price advantage that effectively secures you 19% more silver for your money.

- If you store your silver in this high-security vault, you can sell it back to Elementum Deutschland GmbH at any time – without any bureaucratic hassle and also without VAT, as the trade takes place within the duty-free warehouse. You will receive the funds via bank wire.

- VAT is only payable when you physically remove the stored silver – either by picking it up in person (after prior notification) or by having it shipped to your address.

More silver, more return

Thanks to duty-free storage, you receive 19% more physical silver when you buy. This additional amount also participates in the performance of the silver price if it rises – a leverage effect that significantly improves your return opportunities.

Secure your storage space now – free of charge and without obligation

Register now for a storage space in the St. Gotthard high-security vaulting facility and receive free access to:

- our General Terms and Conditions (GTC)

- current fee tables

- annual audit reports from the auditing company BDO AG

- transparent proof of use of funds

- family discount information

- the popular children’s program “Schatz4Kids” (“Treasure4Kids”)

- as well as numerous other documents and information on storage, purchase, and resale, as well as the ratio “switching” strategy.

Register now: https://silberbar.elementum.de/

Tip for discounted entry: Enter the promotional code “50” (“Aktionscode“) and the “Vermittler” number 1000166 when registering to receive a 50% discount on the storage space setup fee.

Important: Registration is non-binding and does not commit you to anything – but it is your first step towards an independent and crisis-proof precious metal investment.

Elementum is a second-generation, owner-managed family business. Trust, consistency, and long-term thinking are at the heart of our philosophy. The Board of Directors of Elementum International AG is composed of internationally renowned experts in the money and precious metals markets, including economists, analysts, university professors, and precious metals specialists. This in-depth expertise forms the backbone of our actions—for your security, your assets, and your future.

About the Author

Stephan Bogner

CEO of Elementum International AG

Stephan Bogner, who holds a degree in business administration, studied economics at ISM Dortmund (Germany) and wrote the university’s first thesis on precious metals as a hedge against inflation. After studying in the UK and Australia and gaining professional experience in Dubai, he took over as CEO of Elementum International AG in Switzerland in 2012. His expertise in precious metals has had a significant impact on the company’s development.

Contact

Disclaimer: This article does not constitute a recommendation to buy or sell. Elementum International AG is a Swiss company that specializes exclusively in the storage of physical precious metals in a high-security vault facility located in the St. Gotthard mountain massif in Central Switzerland. The Board of Directors and Executive Management of Elementum International AG have been selected solely based on their professional expertise and long-standing experience in precious metals markets. As these individuals may also be professionally active outside their roles at Elementum International AG, the company has no influence over their external activities and respects their right to freedom of expression. Therefore, the views expressed by persons working with or for Elementum do not necessarily reflect the opinion of Elementum International AG. Investments in precious metals are subject to risks, including those specific to the structure of this market. Please read our full risk disclosures and consult a licensed financial advisor before making any investment decisions. Neither the author, Elementum International AG, nor Elementum Deutschland GmbH assume any liability for actions taken based on the information provided. Past performance is not indicative of future results.