Copper Quest Exploration Inc. (CSE: CQX) has quietly but decisively transformed its balance sheet over the past 2 months, raising approximately 4 million CAD in total financing and positioning the company to aggressively advance exploration across its growing portfolio of copper and gold assets in 2026.

The financing momentum culminated today, when Copper Quest announced a 1.95 million CAD strategic private placement with Concept Capital Management Ltd., an international investor with a demonstrated track record as a foundational backer of junior mining and exploration companies.

“We’re thrilled to welcome Concept Capital as a new cornerstone investor into Copper Quest and thankful for their shared vision to grow shareholder value through the acquisition and advancement of multiple properties by drilling and discovery. This hard dollar investment into Copper Quest adds another level of value for our shareholders through a strong treasury and working capital that allows the Company to expand its planned exploration and drilling operations for the 2026 season.”

Brian Thurston, CEO of Copper Quest, in today's news-release.

Breakdown of Capital Raised Since Early December

Copper Quest’s strengthened treasury is the result of multiple successful financings recently. In aggregate, the company has raised approximately 3.99 million CAD since early December 2025.

This combination of flow-through exploration capital and hard-dollar strategic funding provides the company with both tax-efficient exploration financing and flexible working capital, an important distinction in the junior exploration space.

Strategic Cornerstone Investor: Concept Capital Management

Today’s financing announcement introduces Concept Capital Management Ltd. as a cornerstone investor. While Concept Capital maintains a relatively low public profile, available disclosures and prior market activity indicate a long-term, sector-focused investor with meaningful exposure to junior mining companies, including past significant ownership positions in Canadian resource issuers.

Concept Capital’s investment thesis, as outlined by its board, focuses on copper discoveries such as Copper Quest’s Stars and Kitimat Projects, gold assets with potential for rapid resource growth through drilling and stable, mining-friendly jurisdictions, particularly British Columbia. This positioning aligns closely with Copper Quest’s asset base and near-term strategy.

“We are very excited for the opportunity to invest in a company that we see has great potential to advance multiple notable properties. Our management group is focused on up-and-coming copper properties that we feel have undervalued discovery hole results such as the Stars and Kitimat properties owned by Copper Quest. We also see exceptional value in gold properties we believe could quickly increase current gold resources through drilling. We are particularly interested in stable, mining friendly jurisdictions such as British Columbia and so we feel Copper Quest is just a great investment opportunity for us.”

Statement by the Board of Concept Capital Management in today's news-release.

Management Focus Shifts From Acquisition to Execution

With 7 projects now under control, spanning more than 45,000 hectares across British Columbia and the United States, Copper Quest’s management has signaled a clear transition from portfolio build-out to on-the-ground exploration and drilling.

CEO Brian Thurston summarized the inflection point well during the December 5 financing announcement, noting that after a year of acquisitions, the company is now focused on advancing multiple properties simultaneously and delivering discovery-driven results.

“The team has spent the last 12 months building Copper Quest to be a standout junior explorer holding seven quality projects including the recent acquisitions of Stars, Stellar, Nekash, and pending Kitimat and Alpine. It is now time for the Company to grow shareholder value through advancing these properties through work on the ground and drilling. These funds will allow us advance multiple properties in 2026 while we continue vetting quality partners to help advance the rest.”

Brian Thurston, President & CEO of Copper Quest, in the news-release of December 5, 2025.

The latest strategic financing further reinforces this shift by providing the working capital necessary to expand exploration programs across priority copper-gold porphyry targets, advance drill-ready projects in infrastructure-rich regions of British Columbia and maintain flexibility to evaluate partnerships while retaining upside exposure.

From Capital Preservation to Exploration Execution

Many junior exploration companies enter new exploration seasons constrained by limited capital and forced into selective or delayed programs. Copper Quest, by contrast, moves into 2026 with a strengthened treasury, the backing of a strategic long-term cornerstone investor and a portfolio of multiple drill-ready assets located in stable, mining-friendly jurisdictions.

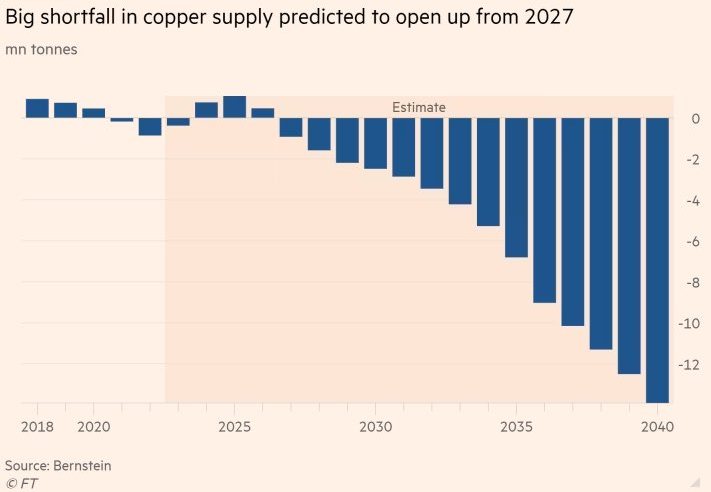

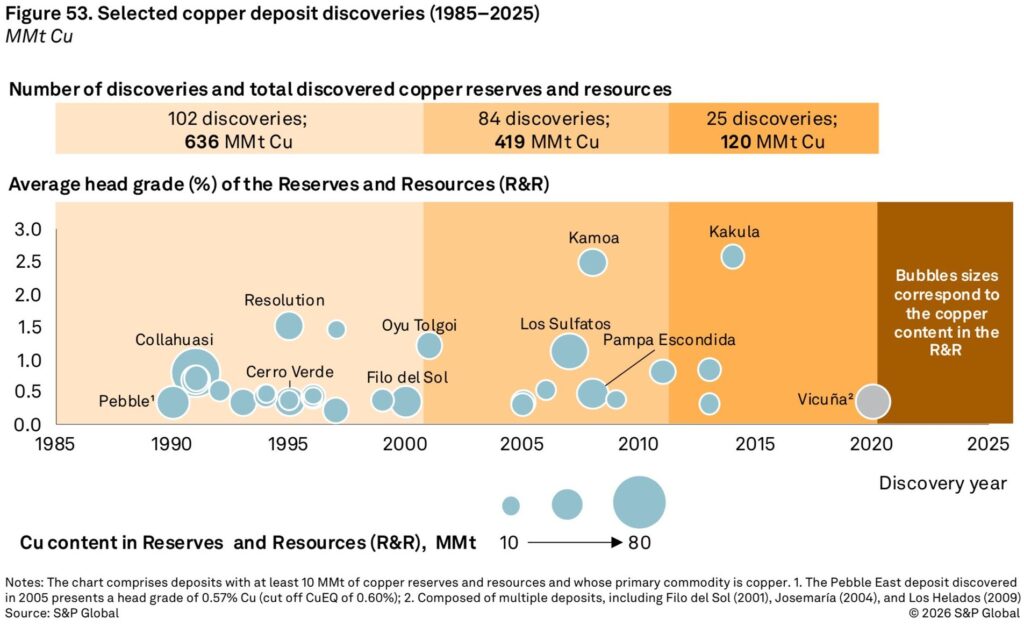

As global copper demand accelerates due to electrification, energy transition infrastructure and tightening supply dynamics, financial readiness becomes a key differentiator among junior explorers.

With its recent financings completed, Copper Quest is now positioned to actively test the geological potential of its properties through drilling and fieldwork, rather than relying solely on historical data or promotional narratives.

Bottom Line

By raising nearly 4 million CAD in less than 2 months, Copper Quest has materially de-risked its near-term exploration plans. The entry of Concept Capital Management as a strategic investor marks a meaningful endorsement of the company’s asset base and direction – and signals that Copper Quest is no longer in capital-preservation mode, but in execution mode as it heads into the 2026 exploration season.

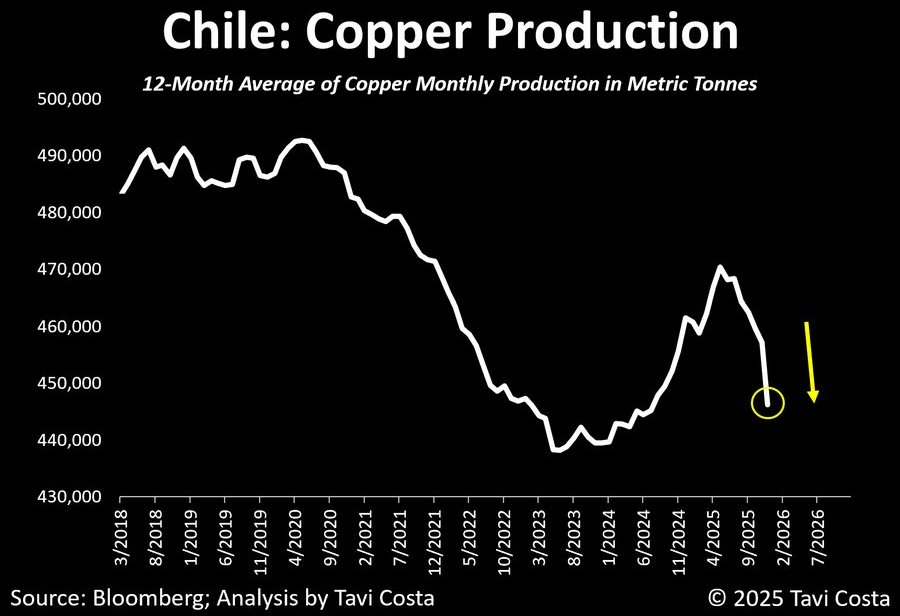

Against this backdrop, the following charts illustrate the increasingly constrained global copper supply environment relative to accelerating demand. These structural trends provide important macro context for well-capitalized exploration companies positioned to advance new copper projects in stable mining jurisdictions.

Company Details

Copper Quest Exploration Inc.

#2501 – 550 Burrard Street

Vancouver, BC, V6C 2B5 Canada

Phone: +1 778 949 1829

Email: investors@copperquestexploration.com

www.copper.quest

CUSIP: 217523 / ISIN: CA2175231091

Shares Issued & Outstanding: 98,143,191

Canada Symbol (CSE): CQX

Current Price: 0.17 CAD (01/26/2026)

Market Capitalization: 17 Million CAD

Germany Ticker / WKN: 3MX0 / A40ZSP

Current Price: 0.096 EUR (01/26/2026)

Market Capitalization: 9 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone, Zimtu Capital Corp. (“Zimtu“) and Copper Quest Exploration Inc. (“Copper Quest“; “the Company“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Copper Quest‘s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through its documents filed on SEDAR at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. This report contains certain forward-looking statements within the meaning of applicable securities laws. Forward-looking statements include, but are not limited to, statements regarding Copper Quest Exploration Inc.’s expectations related to its financial position, ability to fund and execute exploration programs, advancement of its project portfolio, potential exploration outcomes, timing and scope of drilling activities, future capital requirements, strategic positioning within the copper and gold markets, and anticipated benefits of recent financings and strategic investments. Forward-looking statements also include expectations regarding macroeconomic and commodity market trends, including projected copper supply deficits, rising demand driven by electrification, data centers and energy transition infrastructure, and the potential implications of these trends for copper exploration, discovery and development-stage projects. Statements regarding the strategic value of new copper discoveries, stable mining jurisdictions and infrastructure-supported assets are also forward-looking in nature. These forward-looking statements are based on assumptions that management considers reasonable at the time they are made, including but not limited to the continued availability of capital, successful execution of planned exploration programs, availability of personnel and contractors, favorable weather and access conditions, stable regulatory and permitting environments, supportive commodity prices, and the accuracy of geological interpretations derived from historical data, sampling, geophysics and drilling results. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those expressed or implied. There can be no assurance that forward-looking statements will prove to be accurate, as actual outcomes may differ materially due to a variety of risks and uncertainties. Risk factors include, but are not limited to: Exploration and Geological Risks: Exploration activities may not result in the discovery of economically viable mineralization. Historical data, sampling, geophysical results and prior drilling may be incomplete, inaccurate or not representative. Geological interpretations may change as additional data is collected, and mineral continuity, grade or tonnage may differ from expectations. Financing and Liquidity Risks: While the Company is currently well capitalized, ongoing exploration and potential future development activities will require additional funding. There can be no assurance that financing will be available on acceptable terms, or at all. Market conditions, investor sentiment and commodity price volatility may adversely affect access to capital. Market and Commodity Price Risks: Copper, gold and other metal prices are volatile and subject to global economic conditions, interest rates, currency movements and geopolitical factors. A sustained decline in metal prices could negatively impact exploration activity, investor interest and project economics. Operational Risks: Field programs may be affected by weather, terrain, access limitations, wildfire, equipment availability, contractor performance, supply chain disruptions or health and safety considerations. Delays or cost overruns may occur. Permitting and Regulatory Risks: Exploration and potential development activities are subject to permitting, regulatory approvals and ongoing compliance with environmental and Indigenous consultation requirements. Approvals may be delayed, restricted or denied, or conditions may be imposed that increase costs or limit activities. Jurisdictional and Community Risks: Although Copper Quest operates in mining-friendly jurisdictions, changes in laws, regulations, taxation, land access or consultation frameworks may adversely affect operations. Agreements with governments, Indigenous groups or landowners may not be reached or maintained. Portfolio and Strategic Risks: Diversification across multiple exploration projects does not guarantee success. Advancing one or more projects may divert capital or management focus from others. Strategic partnerships, joint ventures or asset transactions may not occur on favorable terms or at all. ESG and Environmental Risks: Environmental liabilities, reclamation obligations, evolving ESG standards and community expectations may increase costs or create delays. Historic mining areas may present unknown environmental or remediation risks. Liquidity and Trading Risks: Shares of Copper Quest may experience volatility, limited liquidity and wide bid-ask spreads. Investors may experience difficulty buying or selling shares and may lose some or all of their investment. Third-Party Information Risks: Certain information contained in this report, including market data, supply-demand forecasts and industry analysis, has been obtained from third-party sources believed to be reliable but has not been independently verified. No assurance can be given as to its accuracy or completeness. Caution to Readers: Forward-looking statements are not guarantees of future performance. Readers are cautioned not to place undue reliance on such statements. Actual results may differ materially from those expressed or implied due to the risks and uncertainties described above and in the Company’s public disclosure documents. Mineralization on nearby properties or in similar geological settings is not necessarily indicative of mineralization on Copper Quest’s properties. All of the Company’s projects are exploration-stage projects and there is no certainty that exploration will result in the definition of a mineral resource or reserve. Surface sampling results do not necessarily correlate with drilling results and are not indicative of grades at depth.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Zimtu Capital Corp. (“Zimtu”), a TSX Venture Exchange listed investment company. Part of the author’s responsibilities at Zimtu is to research and report on companies in which Zimtu has an investment. So while the author of this report is not paid directly by Copper Quest Exploration Inc. (“Copper Quest“), the author’s employer Zimtu Capital Corp. will benefit from volume and appreciation of Copper Quests stock prices. Copper Quest pays Zimtu Capital Corp. to provide this report and other services. As per news on August 27, 2025: “Copper Quest Exploration Inc. (CSE: CQX; OTCQB: IMIMF; FRA: 3MX) (“Copper Quest” or the “Company”) is pleased to announce that it has signed an agreement with Zimtu Capital Corp. (TSX.V: ZC) (FSE: ZCT1) (“Zimtu”) whereby Zimtu will provide marketing services under its ZimtuADVANTAGE program (https://www.zimtu.com/zimtu-advantage/), effective September 1, 2025 for an initial term of 12 months at a cost of $12,500 per month. Marketing Agreement: The ZimtuADVANTAGE program is designed to provide opportunities, guidance, marketing and assistance. Services include investor presentations, email marketing, lead generation campaigns, blog posts, digital campaigns, social media management, Rockstone Research reports & distribution, video news releases and related marketing & awareness activities. Zimtu is based in Vancouver, at Suite 1450 – 789 West Pender Street, Vancouver, BC V6C 1H2. Zimtu may be reached at 604.681.1568, or info@zimtu.com. Zimtu’s compensation does not include securities of the Company; as of the date hereof, Zimtu owns 2,633,333 shares of the Company and 2,333,333 warrants to acquire common shares of the Company.“ The author owns equity of Copper Quest and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Copper Quest (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the report will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Copper Quest Exploration Inc., Tradingview, Stockwatch, and the public domain. The cover picture has been obtained and licenced from 123rf.com.