Some mining stories advance by adding metres, tonnes or permits. Others advance by crossing an invisible line, the moment when uncertainty gives way to control. Homerun Resources Inc. has now crossed that line.

The latest news-releases do not simply report progress. Taken together, they reveal why Santa Maria Eterna (SME) stands among the most unusual and strategically powerful silica assets on the planet today, and why comparisons with conventional silica projects in Australia or elsewhere fail to capture what is truly being built in Bahia.

Deliberate consolidation and long-term alignment have transformed an entire district into a controllable industrial system. Homerun now commands one of the world’s purest and largest silica districts, unlocking the ability to build and operate manufacturing at scale.

Not Just Another Silica Deposit

What makes this moment so easy to misread is that silica is often dismissed as a simple commodity: Abundant, interchangeable and structurally low margin. That assumption is precisely why Santa Maria Eterna remained overlooked for so long, and why Homerun was able to assemble something that is now exceptionally rare.

SME is not defined by a single deposit or a finite pit. It is a district-scale sedimentary silica system characterized by remarkable purity, consistency and lateral continuity, located in a jurisdiction that allows long-term tenure, state partnership and industrial-scale development.

Recent work has shown that this silica does not require complex or capital-intensive beneficiation to reach ultra-high purity. Simple washing and further straightforward processing are sufficient to unlock grades suitable for demanding downstream applications.

In most global silica regions, particularly in Australia, comparable material is fragmented across multiple operators, constrained by land access, layered royalties and internal competition. Pricing power is diluted before production even begins. By contrast, Homerun has assembled control over an entire system: Resources, permits, land, timing and strategic direction.

This is the quiet but decisive difference between discovering material and building an industrial foundation. And it is the lens through which the latest milestones must be understood.

The Permit That Converts Potential into Reality

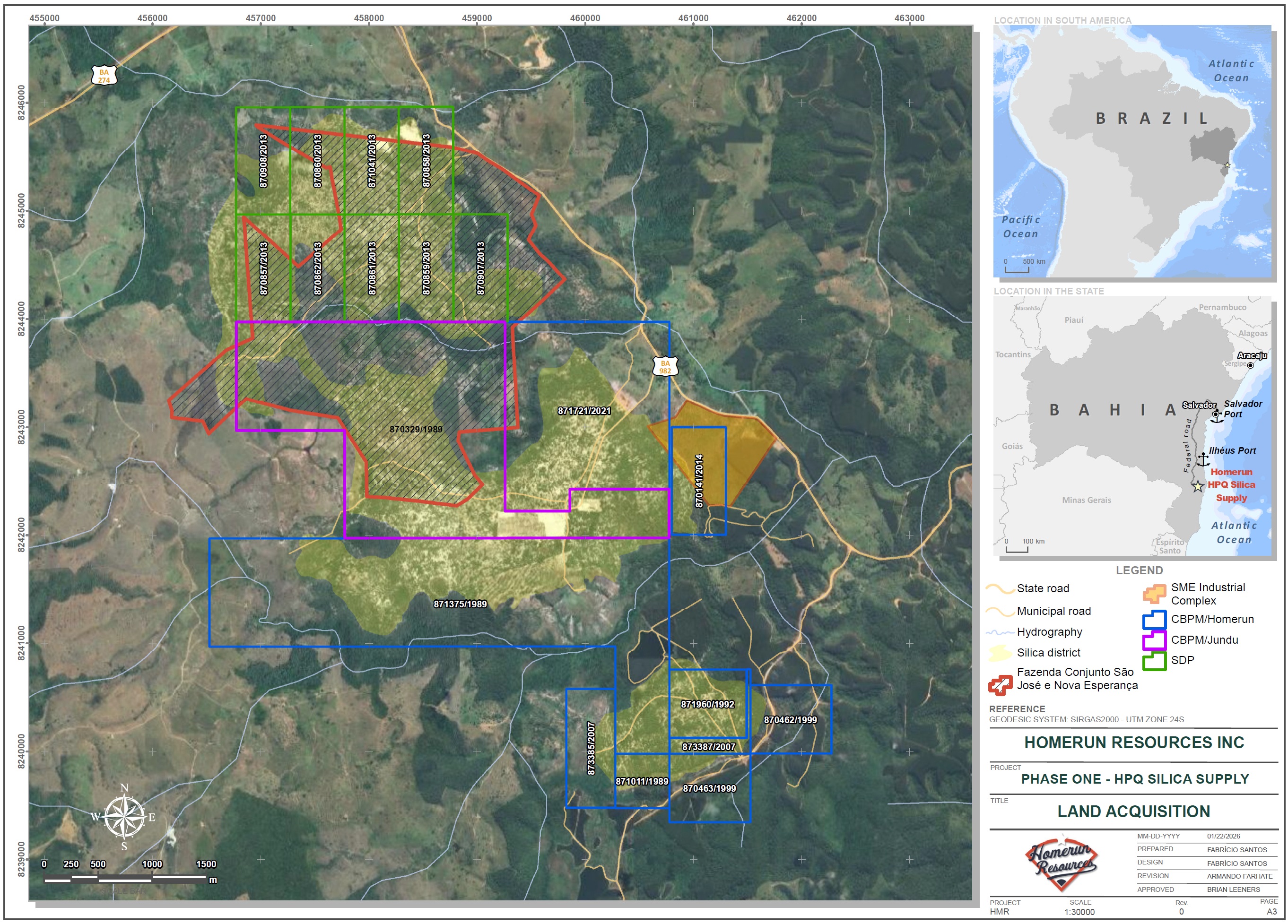

On November 7, 2025, Brazil’s National Mining Agency (ANM) issued Mining Permit No. 743 for mineral right 870.011/1989, a milestone formally announced on January 8, 2026. This permit covers the core area that underpins Homerun’s NI 43-101-compliant mineral resource estimate (released April 29, 2025), outlining 25.56 million tonnes of Measured Resources and 38.35 million tonnes of Inferred Resources, consistently grading above 99.6% SiO₂.

In Brazil, a mining permit is not merely a conditional approval or an early-stage authorization. It is the final regulatory step, granting the right to extract on a long-term basis under clearly defined operating conditions. With this single act, SME moved from a technically defined resource into a fully permitted mining asset, a transition that many projects never achieve.

Crucially, the issuance of the permit triggered the final execution of Definitive Lease Agreement No. 026/2025 with Companhia Bahiana de Produção Mineral (CBPM), dated December 23, 2025, and the release of the final 1,000,000 BRL (currently ~259,780 CAD) payment. The definitive agreement confirms the long-term lease over 4 strategic mineral rights (871.011/1989, 871.375/1989, 873.385/2007, and 870.141/2014) under a 40 year framework.

“Completion of this final definitive agreement gives Homerun three fully permitted leases in partnership with CBPM and the State of Bahia and aligns with our original stated plans to leverage Homerun into the direct control of significant resources in the SME Silica Sand District. This milestone positions Homerun with operational-ready, permitted assets to support high-purity silica sand sales and the development of advanced purification processing and the development of advanced materials like solar glass for the energy and technology sectors.”

Homerun-CEO Brian Leeners in the news-release on January 8, 2026.

This distinction matters. CBPM is not a private counterparty. It is the mineral development arm of the State of Bahia. Alignment at this level materially reduces tenure risk, legal risk and political friction, and is one of the key reasons SME now stands apart from peer silica projects globally.

District Consolidation Completed, Competition Eliminated

Just 2 days earlier, on January 6, 2026, Homerun announced the closing of its acquisition of additional mineral rights from Pedreiras do Brasil S.A., a company controlled by Vitoria Stone. This transaction marked the third and final CBPM-related lease acquisition, completing Homerun’s long-articulated strategy to consolidate control over the SME District.

The Pedreiras tenement is fully permitted and carries a notably low royalty rate of 30.17 BRL (currently ~7.83 CAD) per extracted tonne, further enhancing the district’s already compelling cost profile. The acquisition was settled through the issuance of 1,656,000 common shares, valued at 1 CAD per share, and 276,000 share purchase warrants exercisable at 1 CAD for 1 year. Importantly, the vendor agreed to limit monthly sales to 100,000 shares, aligning long-term interests and minimizing potential market disruption.

This closing is not merely additive. In industrial minerals, fragmented ownership destroys margin and optionality. By contrast, Homerun now controls the district without internal competition, overlapping royalty interests or conflicting development agendas. This level of consolidation is exceptionally rare in the silica space, including in jurisdictions such as Australia, where even tier-one deposits are typically divided among multiple operators.

This is how industrial mineral wealth is built; not with headlines, but with structure.

Taken individually, each of these milestones is meaningful. Taken together, they represent a structural transformation of Homerun.

Regulatory risk has been materially reduced through the granting of full mining permits. Tenure risk has been addressed through definitive, long-term lease agreements with CBPM. District fragmentation risk has been eliminated through the completion of final acquisitions, while infrastructure risk is being actively mitigated through direct land ownership.

This is the difference between a company advancing a promising resource and one building a vertically integrated industrial platform.

Homerun now controls the critical inputs (land, permits, resources and contracts) required to move decisively into high-margin silica processing, antimony-free solar glass manufacturing and silica-based energy storage solutions.

In parallel with mineral rights consolidation, and as announced in today’s news-release, Homerun has secured the Fazenda land position within the SME District, establishing direct surface ownership for processing, logistics and industrial-scale manufacturing. This land acquisition removes a critical execution bottleneck typically faced by industrial mineral projects, enabling infrastructure development, plant construction and downstream manufacturing to proceed without third-party dependency or land-use uncertainty. Together with full mining permits and district-wide control, the Fazenda acquisition completes the physical and legal foundation required to transition SME from a resource district into a fully integrated industrial platform.

Simple Processing, Structural Advantage

Recent technical work and third-party testing have reinforced one of the most underestimated aspects of SME: The raw silica sand can be upgraded to ultra-high purity through washing and relatively simple processing. Grades averaging >99.8% SiO₂, with exceptionally low impurity levels, have been demonstrated without the need for complex chemical beneficiation.

The economic implications are profound. Many silica projects rely on acid leaching, energy-intensive processing or specialized infrastructure, all of which inflate capital and operating costs and compress margins. SME does not. When simple processing is combined with full district control, the result is something virtually unseen in the silica sector: True pricing power.

Full District Control Transforms the BFS

Most Bankable Feasibility Studies (BFS) are constrained by factors beyond management’s control: Neighboring producers, competing supply, shared infrastructure and uncertain land access. Homerun’s forthcoming BFS will be built on a fundamentally different foundation.

Because Homerun controls the district, it controls production sequencing, development phasing, feedstock allocation and long-term expansion. There is no internal competition eroding margins and no nearby operator setting a lower price ceiling.

These structural advantages translate directly into stronger and more resilient BFS assumptions, a longer modeled mine life and materially enhanced strategic flexibility.

Bigger Than the Current Resource, and Still Open

The current NI 43-101 resource is substantial, but it represents only a portion of the SME system. To date, resource definition has been driven primarily by extensive auger drilling to average depths of ~10 m, which forms the basis of the Measured Resource.

Importantly, numerous drill holes did not intersect barren material at depth, and the Qualified Person concluded that mineralization continues beyond the limits of current drilling. Based on site inspections, natural and artificial outcrops, the Technical Report conservatively infers continuous, homogeneous mineralization to depths of at least 25 m. Beyond this, no one yet knows how deep the deposit ultimately extends. In district-scale sedimentary silica systems such as SME, vertical continuity frequently exceeds initial drilling depths, particularly where deposits demonstrate high homogeneity and lateral consistency. The Technical Report explicitly recommends future drilling to depths of up to 30 m to further define and upgrade the resource.

With district-scale control firmly established, any future lateral or vertical expansion is captured directly by Homerun, without renegotiation, dilution of control, or strategic leakage.

One District, Multiple Futures

Perhaps most importantly, SME is not constrained to a single end market. With secure access to vast volumes of high-purity feedstock and full district control, Homerun can allocate material across multiple high-value verticals, including antimony-free solar glass, silica-based thermal energy storage systems such as sand batteries, advanced silicon applications and specialty industrial and technology markets.

Most silica producers are forced to optimize for a single end market. Homerun is not. Unlike conventional operations that are structurally locked into one product stream, SME provides the flexibility to adapt production, processing and allocation as demand evolves across sectors and over time.

This is a platform asset, not a single-product mine. One that can evolve as markets evolve, absorbing technological shifts, policy changes and emerging applications without sacrificing margins or strategic control.

With district-scale resources, simple processing and integrated land and permit ownership, Homerun is positioned to move up and down the value chain as opportunities arise, rather than being confined by the limitations of a single market thesis. In the context of converging energy, technology and materials markets, structural optionality represents a decisive strategic advantage.

“Just over three years ago we were the only party to identify the globally unique value of the SME Silica Sand District in the global solar glass and energy storage sectors. At that time, we set about on an ambitious plan to commercially control the SME District. An ambitious plan considering Homerun had no position in the District and no capital, at that time. That original plan has manifested today into Homerun obtaining the desired control of the SME District through direct resource ownership, resource partnership and direct land ownership. Homerun’s SME control is a key requirement for the next phases of the plan which are to build high-margin silica processing and high-margin, antimony-free solar glass manufacturing in the SME District on land now controlled by Homerun.”

Homerun-CEO Brian Leeners reflecting on the broader vision in today‘s news-release.

From District Control to Industrial Execution

The strategic significance of SME lies not only in its scale and purity, but in its readiness to support industrial deployment. That transition has now moved beyond concept.

On January 21, 2026, Homerun signed a Letter of Intent (LOI) with Germany-based Nikolaus SORG GmbH & Co. KG, one of the world’s most experienced suppliers of glass melting and conditioning technology, for the realization of a 1,000 t/day antimony-free solar glass manufacturing facility to be located adjacent to the SME Silica District.

SORG’s engagement is a critical signal. With nearly 150 years of operating history, more than 100 patents and over 300 industrial furnaces delivered globally, SORG represents the highest tier of technical credibility in glass manufacturing. Its sustained investment in research and development has placed the company at the forefront of furnace efficiency, advanced glass melting and conditioning and sustainable production technologies. SORG’s participation reflects the conclusion that SME’s silica quality, district-scale resource base, logistics access, land tenure and permitting status meet the threshold required for large-scale industrial deployment.

The proposed facility, expected to be Latin America’s first dedicated solar glass manufacturing plant, is designed around Western, state-of-the-art technology and is intended to advance following completion of a BFS and project financing. Importantly, the plant concept is fully integrated into Homerun’s district strategy, drawing feedstock directly from controlled resources and operating on land secured under long-term surface rights.

In context, the SORG LOI represents the first industrial expression of SME’s district-scale control: A direct, structural link between resource ownership and manufacturing execution.

To support the financing of the German technology and equipment package supplied by SORG, Homerun intends to pursue German export credit–backed project financing, supported by guarantees from Euler Hermes, acting on behalf of the Federal Republic of Germany. Such export credit frameworks are commonly used for large, capital-intensive industrial projects and are designed to enhance financing certainty for internationally deployed German technology.

In practical terms, Euler Hermes support substantially improves the bankability of the project by:

lowering lender risk through sovereign-backed guarantees,

enabling longer repayment periods aligned with industrial asset lifecycles and

reducing overall cost of capital compared to purely commercial financing.

While the final financing structure will depend on the outcome of the BFS, equipment pricing, and credit approvals, export credit-backed loans for comparable industrial projects typically cover a significant portion of the eligible German equipment package. For a solar glass facility of this scale, this can reasonably translate into substantial project debt capacity.

Importantly, the contemplated German export credit financing is designed to work alongside previously announced Brazilian government support mechanisms, including BNDES and Finep, creating a layered, multi-jurisdictional financing structure that aligns technology supply, local infrastructure development and sovereign risk mitigation.

Taken together, the involvement of Euler Hermes underscores both the strategic importance of the SORG technology package and the increasing institutional credibility of Homerun’s planned solar glass plant as it advances toward final investment decision and construction.

2025 Execution, 2026 Inflection

As emphasized by CEO Brian Leeners in mid-January‘s news-release “2025 Year in Review: Exceptional Execution Across Verticals Positions Company for Operational Launches in 2026“: 2025 was about de-risking and execution. 2026 is positioned as the year of transition, where this foundation advances into mining operations, construction activity and early commercial revenues across multiple verticals. Importantly, each of these pathways remains structurally anchored to SME, the district that enables scale, control and durability across the platform.

While this report focuses on the structural transformation of the SME District, 2025 marked a broader year of disciplined execution across Homerun’s vertically integrated platform. Resource definition, district consolidation, full mining permits, third-party product validation, institutional financing and government partnerships were advanced in parallel, often quietly and without promotional emphasis.

During the year, Homerun delivered a NI 43-101 compliant maiden resource of 63.91 million tonnes at 99.6% SiO₂, consolidated control over the SME District with full mining permits across 3 leases, and secured long-term surface rights enabling industrial development at scale. Independent validation by Dorfner Anzaplan and Minerali Industriali Engineering confirmed suitability for solar glass and ultra-high-purity applications, while antimony-free solar glass production was independently verified in response to tightening global environmental regulations.

Beyond silica, Homerun expanded its strategic footprint through the acquisition of Halocell Europe (now Homerun Energy SRL), securing perovskite photovoltaic intellectual property, supported by recent Nature Energy durability results, AI-driven energy management solutions and European distribution channels. Homerun also executed a global intellectual property agreement with the U.S. Department of Energy’s National Renewable Energy Laboratory for long-duration thermal energy storage, further extending the value chain anchored at SME.

Bottom Line

The market is trained to focus on drill results, resource estimates, flashy metallurgy and short-term catalysts.

District control, permitting depth, land consolidation and true pricing power are harder to model, and therefore easier to overlook. Yet these are precisely the elements that separate projects from platforms, resources from industries and optionality from inevitability.

Few investors fully appreciate how unusual it is to see full district control achieved over a silica system of this quality, scale and simplicity. Fewer still recognize what that control enables. Homerun has crossed that line.

SME is no longer a geological curiosity, nor merely a discovery or development story. It has become a controlled industrial ecosystem, forming the foundation of a vertically integrated industrial platform capable of feeding multiple clean-energy supply chains for decades.

This is why Homerun is different.

This is why comparisons to typical silica projects miss the point entirely.

And this is why, in this case, the phrase “the sky is the limit” is not rhetoric, but a rational conclusion drawn from structure, control and scale.

Company Details

Homerun Resources Inc.

#2110 – 650 West Georgia Street

Vancouver, BC, V6B 4N7 Canada

Phone: +1 844 727 5631

Email: info@homerunresources.com

www.homerunresources.com

ISIN: CA43758P1080 / CUSIP: 43758P

Shares Issued & Outstanding: 73,021,563

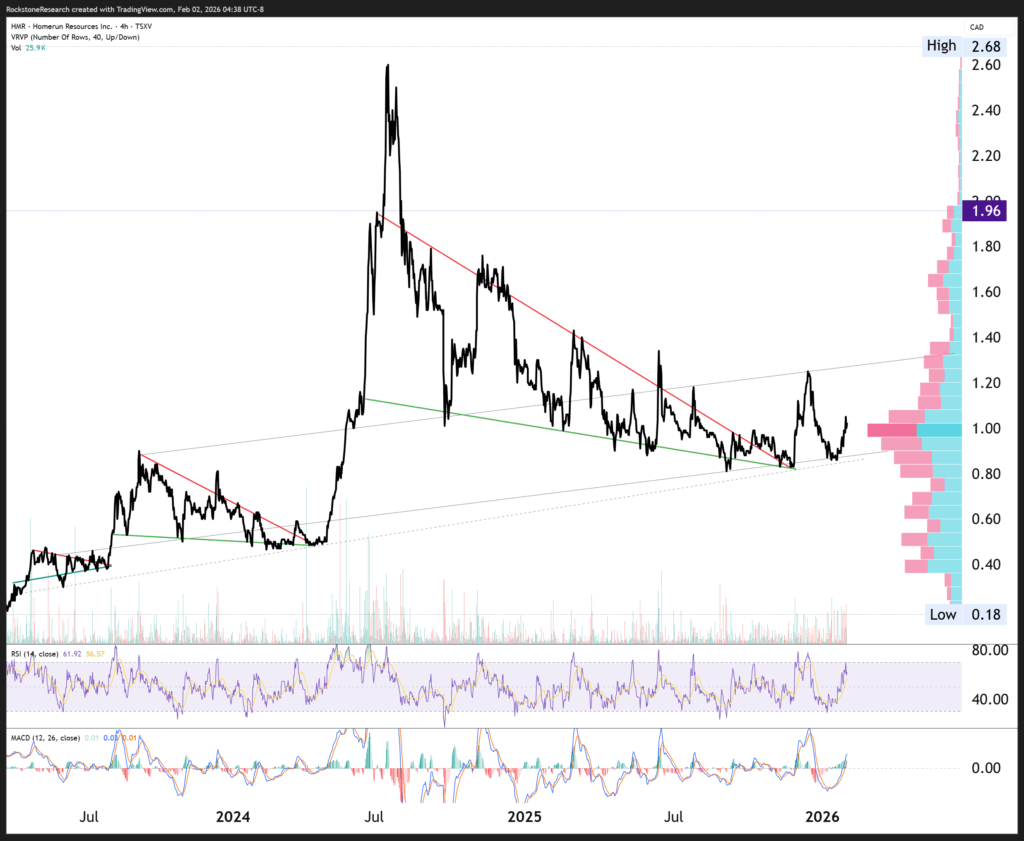

Canada Symbol (TSX.V): HMR

Current Price: 1.02 CAD (01/30/2026)

Market Capitalization: 75 Million CAD

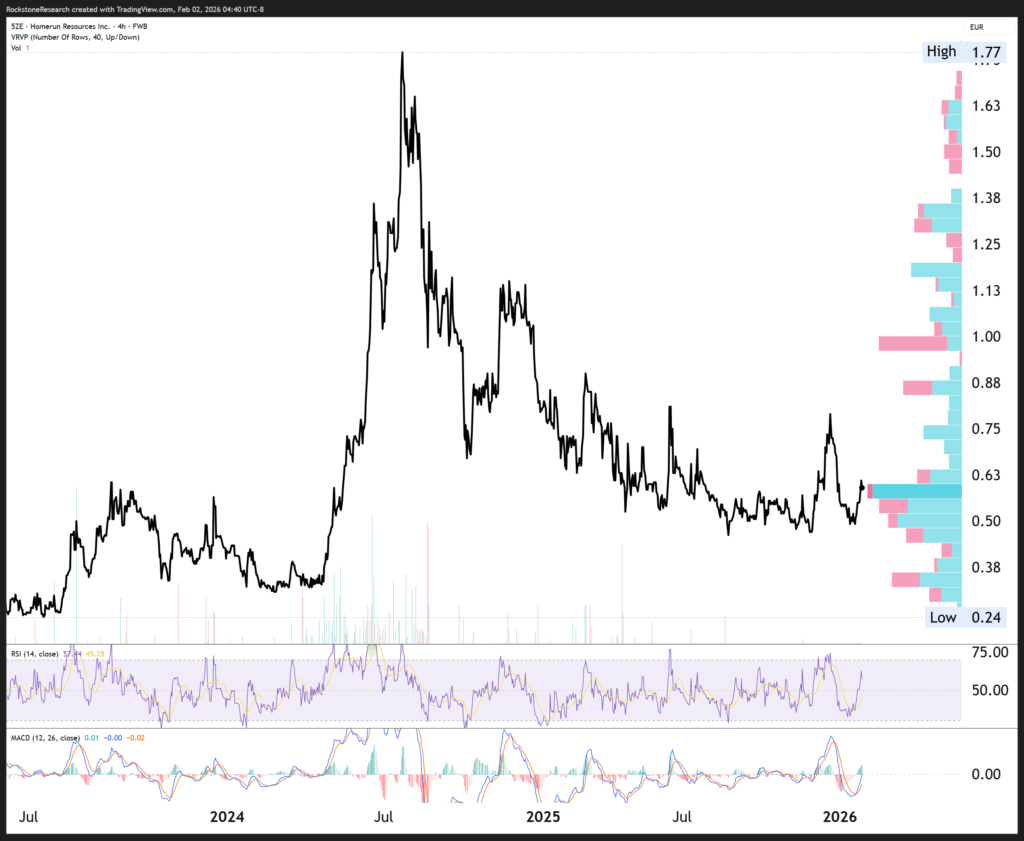

Germany Ticker / WKN: 5ZE / A3CYRW

Current Price: 0.62 EUR (02/02/2026)

Market Capitalization: 45 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone and Homerun Resources Inc. (“Homerun“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun’s public filings for a more complete discussion of such risk factors and their potential effects, which may be accessed through its documents filed on SEDAR+ at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements in this report include expectations related to district-scale control, land tenure and legal certainty, including assumptions that the Company’s mineral rights, long-term lease agreements and surface land positions in the Santa Maria Eterna district will remain in full force and effect as contemplated and that such tenure will continue to provide the legal foundation required for long-term operations, infrastructure development and industrial-scale manufacturing. Forward-looking statements also include expectations regarding project development, processing and manufacturing, including assumptions that the Company will be able to advance from resource development into large-scale silica processing and downstream manufacturing activities; that processing flowsheets, capital requirements and operating parameters can be defined and optimized through further technical studies, including a Bankable Feasibility Study; and that the scale, quality and continuity of the silica system will support long-life operations and multiple product streams. Forward-looking statements in this report also include expectations related to potential industrial partnerships, non-binding letters of intent and preliminary arrangements for downstream manufacturing, including assumptions that such arrangements may progress through further technical, commercial, financing and regulatory stages, or may be revised, delayed or not completed. Forward-looking statements also include expectations related to project financing, including assumptions that export credit, supported financing instruments, government guarantees or comparable support mechanisms, particularly in connection with German export credit coverage and Brazilian development banks, may be available, may be structured on acceptable terms and may be successfully combined with other financing sources. Additional forward-looking statements relate to infrastructure, logistics and execution, including assumptions that existing and planned transportation infrastructure will continue to support efficient access to and from the Santa Maria Eterna district; that logistics solutions will remain available on acceptable terms; and that development sequencing can be executed in a timely, coordinated and economically viable manner. Forward-looking statements further include expectations regarding strategic positioning and commercialization, including assumptions that the Santa Maria Eterna district may support vertically integrated silica-based activities, including high-purity silica products, solar glass manufacturing and energy-related applications; that market demand for such products will continue to develop; and that the Company may be able to establish commercial relationships, financing arrangements and partnerships on terms acceptable to the Company. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Such risks include, but are not limited to, changes in market conditions, regulatory or permitting outcomes, technical and engineering risks, financing availability, execution risks, infrastructure dependencies and general economic conditions. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this report. In preparing this report, Rockstone and the author have relied upon a combination of publicly available information, Company disclosures, technical reports, third-party data and management statements believed to be reliable at the time of publication. However, no independent verification of such information has been undertaken, and no representation or warranty, express or implied, is made as to the accuracy, completeness or continued validity of such information. Geological, technical and economic information presented herein is subject to interpretation, estimation and change as additional data becomes available or assumptions are revised. Any references to potential scale, processing capability, manufacturing development, downstream integration or industrial applications are conceptual in nature and reflect management’s current strategic vision rather than a commitment to construct, operate or finance specific facilities. Timelines, sequencing, capital requirements and commercial outcomes remain subject to technical, regulatory, market and financing considerations. Readers should not interpret references to structure, control or scale as assurances of future performance, profitability or valuation. This report is not intended to provide investment, legal, tax or engineering advice. Each reader must conduct their own independent due diligence and consult with qualified professional advisors before making any investment decision. Past performance, comparisons and illustrative examples are not indicative of future results. Risks and uncertainties include, but are not limited to: Land Tenure, Mineral Rights and Legal Risks: While the Company has consolidated long-term mineral rights, lease agreements and surface land positions within the Santa Maria Eterna (SME) district, risks remain related to interpretation, enforcement, renewal mechanics, registration and potential future legal challenges under applicable Brazilian law. Changes in land-use regulations, judicial interpretations, administrative procedures or third-party claims could affect the scope, timing or cost of mining, processing or manufacturing activities. Permitting, ESG and Community Risks: The development of mining operations, processing facilities and industrial-scale manufacturing infrastructure requires multiple environmental, land-use and operational approvals. Regulatory permits may be delayed, denied, modified or conditioned on additional environmental, social or community-related requirements. Evolving ESG standards, stakeholder expectations or community engagement outcomes could affect development timelines, project scope or costs. Financing, Export Credit and Government Support Risks: The Company’s assumptions regarding the availability, structuring and implementation of export credit-supported financing, including government guarantees or incentive mechanisms, are subject to political, regulatory, banking and administrative processes. There can be no assurance that such financing will be approved, made available on a timely basis, or structured on economically acceptable terms, or that it can be successfully combined with other national or international funding or financing sources. Infrastructure, Logistics and Access Risks: Although the SME district benefits from existing road access and proximity to regional logistics corridors, assumptions regarding transportation efficiency, infrastructure upgrades and logistics availability may not be realized as expected. Delays, funding reallocations, contractor performance issues, weather events or changes in government priorities could negatively affect access, logistics reliability and operating costs. Execution, Construction and Scale-Up Risks: As the project advances from planning and technical studies into execution, the Company faces risks associated with construction, commissioning and ramp-up of processing and manufacturing facilities. These include engineering challenges, contractor and supplier performance, equipment delivery delays, cost inflation, workforce availability and deviations from design assumptions. Actual timelines, capital costs and operating performance may differ materially from expectations. Industrial Partnership and Letter of Intent Risks: The Company has entered into non-binding letters of intent and preliminary arrangements with third-party industrial partners related to potential downstream manufacturing activities. Such arrangements are subject to further technical studies, commercial negotiations, financing, definitive agreements and regulatory approvals. There can be no assurance that these arrangements will result in binding agreements, project financing or construction, or that any such projects will proceed on anticipated timelines or at all. Technical, Processing and Operational Risks: While testwork indicates that high-purity silica can be achieved through relatively simple processing, performance at commercial or industrial scale may differ from laboratory or pilot results. Throughput, recoveries, energy consumption, maintenance requirements, plant availability or processing efficiency may vary from engineering models, impacting operating costs and project economics. Bankable Feasibility Study and Development Risk: The outcomes of ongoing and future technical studies, including a Bankable Feasibility Study, may differ from current expectations. Changes in assumptions related to capital costs, operating costs, mine life, processing configuration, infrastructure requirements or economic parameters could materially affect project viability or development decisions. Financing and Capital Market Risks: Advancing SME through feasibility, construction and commercial operation will require significant capital. Financing may not be available when required or on acceptable terms due to market conditions, interest rates, investor sentiment or broader capital market volatility. Equity or debt financing may dilute existing shareholders or impose covenants that restrict operational or strategic flexibility. Product Qualification and Commercialization Risks: Entry into solar glass, antimony-free solar glass and other advanced industrial markets requires customer qualification, technical validation and long-term performance testing. Customers may delay approvals, adjust specifications, require additional testing or favor incumbent suppliers. Commercial adoption may occur more slowly or on less favorable terms than anticipated. Market, Pricing and Demand Risks: Markets for silica, solar glass and advanced materials are subject to pricing volatility driven by supply-demand dynamics, technological change, energy costs and macroeconomic conditions. Assumptions regarding sustained demand growth, premium pricing or market penetration may not be realized. Competitive and Industry Risks: The global silica, glass and advanced materials industries are competitive. Existing producers or new entrants may expand capacity, reduce pricing, secure long-term contracts or develop alternative materials, processing technologies or supply chains that reduce the Company’s relative advantages. Regulatory, Trade and Policy Risks: Changes in mining, environmental, tax, trade, export or industrial policy in Brazil or internationally could affect project economics, timelines or market access. Trade restrictions, tariffs, localization requirements or changes in incentives for renewable energy or clean-energy manufacturing could alter competitive dynamics. Macroeconomic, Currency and Inflation Risks: Inflation, recessionary conditions, geopolitical instability, supply-chain disruptions or currency fluctuations between BRL, USD, CAD and EUR may materially affect capital costs, operating costs, financing availability and projected returns. Force Majeure and External Event Risks: Extreme weather events, climate-related impacts, natural disasters, pandemics, political instability, labor disruptions or other external events could materially disrupt construction, logistics, operations or project scheduling. Liquidity and Market Risks: As a small-cap issuer, the Company’s securities may experience limited liquidity, significant price volatility or wide bid-ask spreads. Market sentiment may diverge materially from project fundamentals, affecting valuation independently of operational progress. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. Past performance and comparisons to other companies or jurisdictions are provided for illustrative purposes only and should not be considered indicative of future results.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Homerun Resources Inc. On September 8, 2025, Homerun announced that the company “entered into an agreement with Rockstone Research to provide marketing services to the company”, and that “Rockstone Research is an arm’s-length marketing firm and has been engaged for an initial three-month term for total consideration of $25,000, which is payable up front. The company does not propose to issue any securities to Rockstone in consideration for the services to be provided to the company.” The author owns equity of Homerun and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Homerun (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Stockwatch.com, Tradingview.com, Homerun Resources Inc. and the public domain.