The first drill results from the North Block of Tocvan Ventures Corp.’s Gran Pilar Project mark an important milestone: For the first time, this previously untested area has been systematically drilled at depth.

The reported results show consistent silver mineralisation, albeit predominantly with moderate grades in the low double-digit range and generally short mineralised intervals.

Investors who had hoped for long intervals with significantly higher grades may therefore have expected stronger numbers. That expectation is understandable. However, a purely grade-based assessment falls short. What matters more is the geological objective of these initial drill holes and what they have actually demonstrated.

That management views the results as constructive despite the moderate initial grades is also reflected operationally: Tocvan is already preparing the next exploration phase and has secured a second drill rig, which is expected to be deployed for additional North Block-focused drilling starting in February. The objective is to rapidly build on the geological insights gained to date and further refine the exploration model.

CEO Video: Brodie Sutherland on the Significance of the Results

In the video below, Tocvan CEO Brodie Sutherland explains the significance of the North Block drill results and outlines how the company intends to build on these findings:

A Completely New Area – Not A Resource Definition

The North Block differs fundamentally from the well-known South Block. While a robust geological model has been developed there over an extended period, supported by numerous drill holes and now a clear production outlook, the North Block represents a largely untested area to date. There are no historical drill holes, no defined geometry of mineralization and no known high-grade zones. Until now, the geological basis has consisted primarily of surface samples, old workings and pronounced alteration zones.

Against this backdrop, the current drilling should not be interpreted as resource definition drilling, but rather as classic first-pass exploration. The objective was not to immediately demonstrate economic grades, but to address a far more fundamental question: Whether a coherent epithermal gold-silver system exists at depth in the North Block, or whether the surface indications are limited to shallow anomalies.

Hit Versus System Confirmation: An Often Underestimated Distinction

Many investors unconsciously equate a “good drill hole” with high grades and long intervals.

From a geological perspective, this assumption is misleading, particularly in epithermal deposits. Such systems are well known for the fact that high-grade zones are typically narrow and strongly controlled by structure, that economic ore shoots are often only a few metres thick and that these zones are offset, stacked and difficult to predict spatially.

Many large epithermal mines displayed a very similar pattern in their first holes. Instead of clearly defined ore shoots, early drilling commonly intersected peripheral parts of the system, transitional zones or only weakly mineralised structures.

For this reason, confirmation of the epithermal mineral system is the critical first step, not the immediate discovery of a high-grade hit.

The Decisive Advance: System Confirmation Achieved

Regardless of the moderate grades, drilling in the North Block presents a consistent geological picture, including:

- silicified andesites and veins (dikes)

- a typical epithermal pathfinder signature with silver, lead, zinc, antimony and arsenic

- pronounced hydrothermal alteration

- multiple mineralised horizons within individual drill holes

- clear structural and lithological control of the mineralisation

This combination does not occur by chance. It is characteristic of a genuine epithermal system with meaningful spatial extent.

On this basis, subsequent drilling can be conducted in a far more targeted manner, focusing for example on identified dike corridors, structural intersections and geochemical vectors. The targeting framework is further supported by correlation with recently completed drone magnetic survey data, which is expected to assist in refining structural corridors for follow-up drilling.

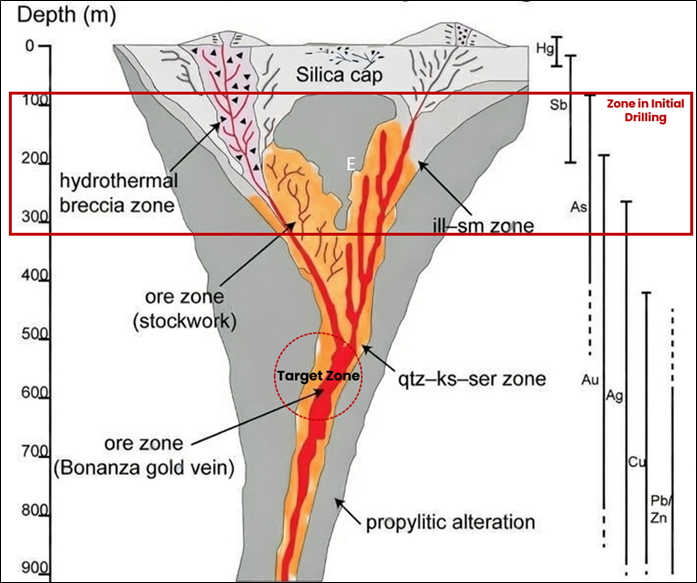

How Epithermal Gold-Silver Systems Are Structured: Why Early Drilling Rarely Hits the Core

The illustration shows the typical architecture of an epithermal system as observed at numerous gold-silver deposits worldwide. A defining characteristic of such systems is their large spatial footprint, while the economically relevant ore shoots are concentrated within comparatively narrow, structurally focused zones.

The yellow area represents a so-called sheeted vein complex, a zone of closely spaced, mineralised veins in which hydrothermal fluids circulated in a focused manner over extended periods. These zones typically host the highest grades. The majority of the system, however, consists of alteration halos, transitional zones and more weakly mineralised structures that indicate an active hydrothermal system but do not, by themselves, necessarily contain economic grades.

From an exploration perspective, this means that early drilling often intersects these peripheral and transitional zones first, even when drill holes are geologically well positioned. Only through continued drilling, detailed analysis of structural geometries and targeted vectoring along permeable pathways such as veins, dikes or fault zones can the areas hosting higher-grade mineralisation be progressively delineated.

Applied to the North Block at Gran Pilar, such models help explain why the drilling to date, despite moderate grades, can be viewed as constructive: The results confirm the presence of an epithermal system and provide the critical geological information needed to more precisely target the structurally focused core zones in subsequent drilling phases.

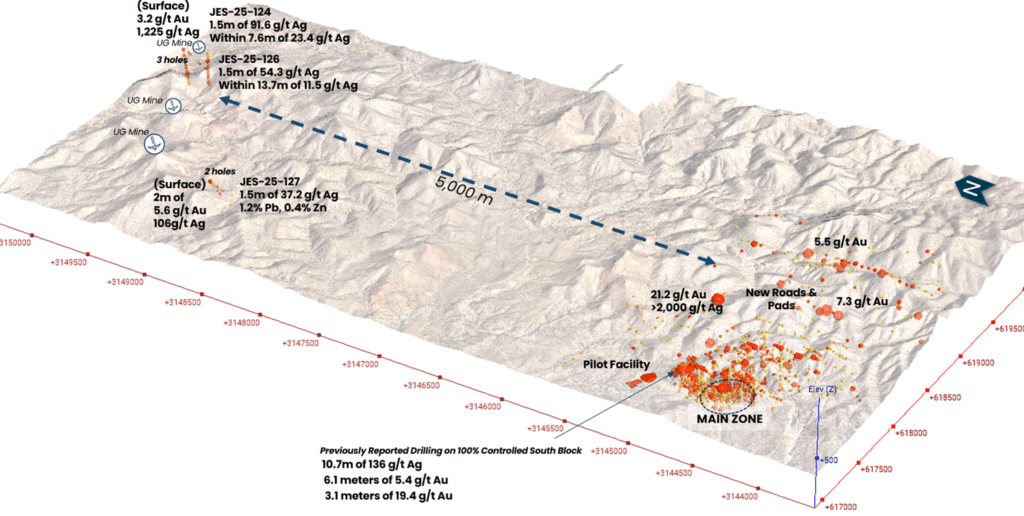

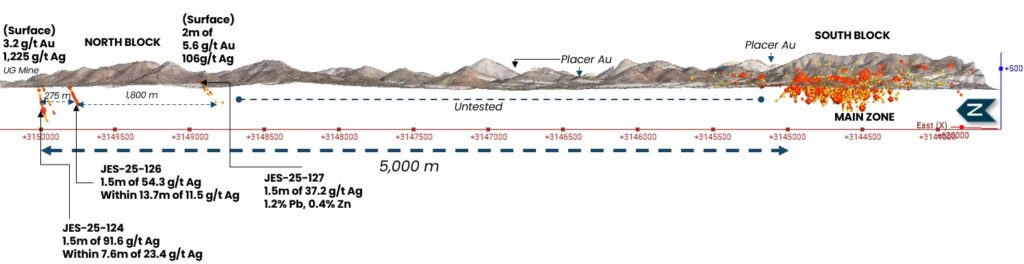

Gran Pilar North Block: Interpretive Exploration Model of a Low-Sulfidation Epithermal System

The model graphic released by Tocvan today integrates lithological, structural, alteration (AI/CCPI) and geochemical information and illustrates the position of the drill holes completed to date within the central, silver-rich feeder and stockwork zone of the system.

According to Tocvan’s interpretation, the current drilling suggests that the most prospective, structurally focused core of the system may lie at greater depth.

The model clearly shows that the mineralisation encountered so far does not represent peripheral features, but rather forms an integral part of a coherent epithermal system. Instead, the spatial association of mineralisation, alteration and structure indicates that the drilling to date has intersected a central, fluid-focused portion of the system.

At the same time, the model provides, for the first time, a consistent geological framework in which the observed silver grades, polymetallic pathfinder elements and alteration patterns can be interpreted. On this basis, future drilling programs can be more precisely targeted along identified structural corridors, dike systems and geochemical vectors to test those areas where further increases in grade and improved continuity of mineralisation may be expected.

Why Low Initial Grades Are Not A Negative Signal

In epithermal gold-silver deposits, early drilling frequently does not deliver spectacular grades. Instead, drill holes often intersect broader but more weakly mineralised zones that display moderate, recurring grades across multiple holes together with a consistent geochemical signature. This pattern is typical in the initial stages of exploration rather than an exception.

Such results should therefore not be interpreted as a sign of weakness, but rather as an indication of the size and overall extent of the system. Higher-grade zones in epithermal deposits are usually concentrated where structures intersect, fluid pathways are focused or specific elevation windows within the system are reached. These areas can only be targeted progressively and with greater precision once the underlying structural model is better understood.

The Key Point: Structure Trumps Grade

Of particular importance is the fact that the best intervals in the North Block are associated with silicified dikes. In epithermal systems, such structures are commonly regarded as the principal conduits for mineralising fluids, zones of enhanced permeability and potential hosts to later high-grade ore shoots.

In many well-known epithermal deposits, the economically relevant zones were only identified after precisely such structural corridors had been recognised and systematically followed up.

Management also views the results primarily as confirmation of a larger epithermal system rather than as an immediate economic discovery. In particular, the dike-hosted mineralisation is considered a geologically decisive indicator. CEO Brodie Sutherland commented on the results as follows:

“These first holes at the North Block immediately confirm a new silver discovery over five kilometers from our Main Zone. The combination of high-grade silver, strong polymetallic support, and textbook hydrothermal alteration signals us we are into a significant mineralized system. Particularly exciting is the discovery of a high-grade silver zone hosted within a silicified dike structures like this are known to focus mineralizing fluids in productive epithermal environments. With multiple stacked intervals across several holes, we are rapidly building confidence that Gran Pilar has the grades, continuity, and scale potential to make this an exciting new growth area for Tocvan. With a second drill rig arriving in February, we are positioned to rapidly build on these results.”

Brodie Sutherland, CEO of Tocvan Ventures Corp., in today's news-release.

Historical Context: Not An Unusual Pattern

Importantly, mineralised intercepts have now been identified across multiple targets within the North Block over a lateral distance of approximately 1.8 km, underscoring early indications of lateral system continuity rather than a single isolated occurrence.

A sober but investor-relevant comparison shows that many large epithermal gold-silver mines exhibited a very similar pattern during their initial drill programs. Early results often returned only moderate grades and short mineralised intervals, yet they provided the critical clues related to alteration, structure and overall system extent.

Only on the basis of this information, supported by additional drilling, tighter drill spacing and more focused vectoring, were the economically relevant high-grade zones systematically discovered.

Bottom Line

The current drill results from the North Block do not represent an economic discovery, and this should be stated openly and objectively. At the same time, they are not a failure. The drilling has demonstrated that a coherent epithermal gold-silver mineral system exists at depth, that the geological setting is fundamentally sound and that clear structural and geochemical vectors for further, more targeted follow-up drilling are already in place. The North Block therefore represents more than a surface anomaly and is now technically substantiated as a standalone exploration target.

This step is particularly significant in the context of epithermal gold-silver deposits, which often extend over very large areas while economically relevant zones are only delineated through systematic vectoring and continued drilling. This fundamentally distinguishes the North Block from the South Block and the Main Zone, which follows a different deposit style and is already at a much more advanced stage of development. A direct comparison of early drill results between both areas would therefore not be geologically meaningful.

With the data now in hand, the key prerequisite has been established to advance future drilling phases in a more focused, efficient manner and with greater geological precision. Whether and where higher-grade zones may be concentrated within this large epithermal system will only become clear as additional drill results are reported. The results to date therefore mark not the end of the assessment, but the beginning of a structured learning and development process in the North Block. Further drill results are expected in the near term, building on the geological insights gained so far and allowing for a more targeted evaluation of the identified structures.

Against this backdrop, Tocvan is already preparing the next exploration program. A Phase-2 drilling program is planned for early 2026 and is specifically designed to build on the results achieved to date. To accelerate the work, a second drill rig has been secured and is expected to be deployed for additional North Block focused drilling starting in February.

In parallel, Tocvan is advancing the construction of the pilot mine in the South Block, as reported on Wednesday. While the North Block is being developed as a longer-term, exploration-driven growth opportunity, Tocvan is pursuing a clear and independent strategy in the South Block focused on near-term value realisation. The objective is to benefit from the current strong gold price environment, gather operational experience and data, and generate initial cash flows without slowing ongoing exploration progress.

Exploration and pilot operations are therefore advancing in parallel rather than sequentially, allowing Tocvan to pursue both short-term and long-term value drivers simultaneously, while the next round of assays is awaited with interest.

Company Details

Tocvan Ventures Corp.

Suite 1150 Iveagh House

707 – 7th Avenue S.W.

Calgary, Alberta, Canada T2P 3H6

Phone: +1 403 668 7855

Email: bsutherland@tocvan.ca (Brodie Sutherland)

www.tocvan.com

ISIN: CA88900N1050

Shares Issued & Outstanding: 67,548,954

Canada Symbol (CSE): TOC

Current Price: 1.16 CAD (01/22/2026)

Market Capitalization: 78 million CAD

Germany Symbol / WKN (Tradegate): TV3 / A2PE64

Current Price: 0.714 EUR (01/22/2026)

Market Capitalization: 48 million EUR

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Forward-Looking Information: Rockstone and Tocvan Ventures Corp. (“Tocvan”) expressly point out that all forward-looking information contained in this report does not represent a guarantee of future results or performance. Actual results may differ materially from those projected. Readers are referred to Tocvan’s public filings, available on SEDAR+ at www.sedarplus.ca, for a more detailed discussion of risk factors and their potential impact. All statements in this report that are not historical facts should be considered forward-looking statements. A portion of this report consists of expectations, interpretations, projections, and assumptions made by the author based on information available at the time of writing. Forward-looking statements include, but are not limited to, statements, expectations, assessments and assumptions regarding: The continued exploration and evaluation of the North Block at the Gran Pilar Gold-Silver Project; the planned Phase-2 drilling program and the anticipated deployment of a second drill rig for North Block-focused drilling beginning in February 2026; the timing, receipt, interpretation and significance of pending and future drilling results; the use of geological, structural and geochemical data including alteration indices (AI/CCPI) to refine drill targeting and guide subsequent exploration programs; the potential scale, continuity and economic relevance of epithermal mineralisation at Gran Pilar; the advancement, construction, commissioning and operation of the permitted pilot mine in the South Block; the anticipated timing, performance and outcomes of pilot-scale processing activities; the potential generation of initial cash flows and the use of operational data to inform future development decisions; the Company’s ability to advance Gran Pilar along both exploration-driven and near-term operational pathways; expectations regarding future gold and silver prices, market conditions and investor interest; and Tocvan Ventures Corp.’s ability to secure financing, manage liquidity and execute its exploration and operational programs in a manner that supports long-term shareholder value creation. Forward-looking statements are based on the current expectations, assumptions and beliefs of management and the author as of the date of publication. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to: The inherently speculative nature of mineral exploration and pilot-scale mining activities; the risk that planned Phase-2 drilling or the deployment of additional drilling capacity may be delayed, modified or not proceed as currently anticipated; the risk that drilling, sampling or geophysical programs may not confirm current geological interpretations or expectations; geological uncertainties, including variability in grade, continuity, geometry or scale of mineralised zones; the possibility that early-stage or interim exploration results may change as additional data becomes available; operational risks associated with exploration activities and pilot mine construction and operation, including technical, logistical, equipment-related, workforce-related or supply-chain challenges; uncertainties related to the ramp-up, performance, recoveries, throughput, costs or timelines of the pilot mine; the risk that pilot-scale results may not be indicative of larger-scale commercial outcomes; potential cost overruns, inflationary pressures or deviations from projected budgets; regulatory, environmental or permitting risks, including potential delays, modifications or changes to compliance requirements, even where key permits have been granted; volatility in gold and silver prices, exchange rates and capital markets; political, regulatory, fiscal or legal changes in Mexico that could affect mining operations or project economics; risks related to financing, liquidity and access to capital on acceptable terms; dependence on key personnel, contractors, suppliers and third-party service providers; environmental, social or community-related risks; and broader macroeconomic, geopolitical or market-related factors beyond the Company’s control. Forward-looking statements are inherently subject to significant risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. Actual results and future events may differ materially from those expressed or implied by forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements. Neither Rockstone, the author nor Tocvan Ventures Corp. undertakes any obligation to update or revise forward-looking statements, except as required by applicable law.

Disclosure of Interests and Legal Notice: Nothing in this report should be construed as an invitation to buy or sell securities. Rockstone, its owners, and the author of this report are not registered broker-dealers or financial advisors. Before investing in securities, you should always consult your financial advisor and a registered broker-dealer. Never make an investment decision based solely on online or printed reports, including reports from Rockstone – particularly when it comes to small, thinly traded companies. The author of this report, Stephan Bogner, received compensation from Tocvan Ventures Corp. in the amount of 19,000 CAD for a period of 3 months. In addition, he holds securities of Tocvan and will therefore also benefit from increased trading volume and share price appreciation. This represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Tocvan at any time without notice, which may give rise to additional conflicts of interest. This report should be understood as a promotional publication and does not replace individual investment advice. All information is current as of the date of publication and is subject to change without notice. Liability for financial losses resulting from investments made on the basis of this report is excluded. The views of Rockstone and the author regarding the companies presented in this report reflect solely their own assessments and are based on information from public sources deemed reliable. Rockstone and the author have not conducted independent due diligence. Neither Rockstone nor the author guarantees the accuracy, completeness, or usefulness of the content, nor its suitability for any particular purpose. There is likewise no guarantee that the companies mentioned will perform as expected, or that comparisons with other companies will prove valid. Please read the full disclaimer carefully. If you do not agree with it, do not use this website or report. By using the website or this report, you agree to the disclaimer, regardless of whether you have read it in full. The information provided is of a general and educational nature. Data, tables, figures, and images, unless otherwise indicated or linked, originate from Tradingview.com, Stockwatch.com, Tocvan Ventures Corp., and publicly available sources.