Yesterday, Homerun Resources Inc. delivered another major technical milestone with the release of confirmation test results from Minerali Industriali Engineering (MIE).

These independent results validate that the company’s Santa Maria Eterna (SME) silica sand is not only suitable for high-quality solar glass manufacturing, but in fact ranks among the naturally cleanest silica sand deposits known worldwide.

The implications extend far beyond simple compliance: The exceptional purity confirmed by MIE positions SME as a potential cornerstone asset in the global shift toward higher-efficiency photovoltaic materials, where ultra-low iron content directly translates into stronger performance and higher transmission in solar glass.

The MIE report highlights a core competitive advantage that is geological in origin: Unlike most silica deposits, which require complex processing circuits and chemical treatments to approach solar glass standards, SME arrives at near-specification purity straight from the ground.

Only minimal upgrading is needed to reach even the most demanding thresholds for premium and antimony-free glass – a rapidly growing segment of the photovoltaic industry as manufacturers transition away from legacy additives.

This natural advantage not only strengthens Homerun’s technical and economic positioning but also reinforces the strategic value of the SME Deposit within the broader clean-energy supply chain.

Key Highlights

1. Natural Purity Confirmed at Ultra-High Levels

MIE’s raw characterization of the unwashed SME silica sand shows an exceptional baseline:

- 99.7% SiO₂

- Only 24 ppm Fe (iron)

These numbers are almost unheard of in natural sand deposits. Many silica operations require multi-stage chemical leaching, flotation, and aggressive purification techniques just to approach these values.

At SME, these values are achieved as dug from the ground.

2. Basic Processing Already Meets Industry Expectations

The first round of testing (simple wet screening) reduced contaminants dramatically:

- Iron dropped from 24 to 14 ppm.

- All contaminants except titanium fell within desired ranges.

This outcome confirms that very light processing is sufficient to meet most glass-industry criteria – a rarity in the silica sector, where most projects require:

- flotation

- acid leaching

- magnetic circuits

- multi-stage classification

- chemical purification

Homerun only needs:

- washing

- classification

- light magnetic separation

Nature has effectively pre-built the processing plant.

3. Complete Solution Testing Achieves Full Compliance

The more advanced test circuit (attrition washing, grain-size classification, gravimetric separation, and magnetic separation) achieved 100% compliance with solar glass specifications.

- Iron reduced to 8 ppm.

- All other contaminants “well below acceptable ranges”.

This is a remarkable technical result; very few silica sands globally reach sub-10 ppm iron even after heavy chemical treatment or flotation circuits.

“Mother Nature Has Performed Most of the Work”

Homerun’s COO, Armando Farhate, summarized the significance perfectly:

“These results confirm our initial expectations, that mother nature has performed most of the work needed to make the Santa Maria Eterna silica sand a very unique material, giving Homerun an important competitive edge in the production of antimony-free solar glass.”

Homerun COO Armando Farhate in yesterday's news-release

This statement is more than a sound bite.

It reflects a geological reality.

Whereas most solar glass silica must be “artificially purified” through complex and costly processing, the SME Deposit is the product of natural purification on a geological timescale.

Over millions of years, nature has effectively pre-beneficiated the material, stripping impurities and concentrating ultra-clean quartz long before any modern equipment ever touched it.

The outcome is a rare strategic advantage: Lower capex, lower opex, higher margins and far simpler operational execution.

The Natural Forces Behind SME’s Exceptional Purity

1) Hydrothermal Alteration of Quartz-rich Source Rocks

Hydrothermal activity played a key role. The source rocks for the SME sand appear to have been:

- extremely quartz-rich

- extremely low in iron-bearing minerals

- exposed to hot, silica-rich fluids that dissolved impurities

Hydrothermal fluids can:

- remove iron, manganese, and other metals

- purify quartz veins along with sandstone bodies

- leave behind exceptionally clean silica

This is similar to the natural processes responsible for forming high-purity quartz (HPQ) used in semiconductor manufacturing.

2) Long-Term Tropical Weathering: Brazil’s “Natural Acid Leaching”

Bahia sits in a deeply weathered, high-rainfall tropical environment. Over millions of years, tropical weathering:

- removed clays

- leached iron oxides

- washed away heavy minerals

- left behind quartz, the most resistant mineral

This created a highly mature, well-washed silica sand with naturally low contaminants: A natural purification system operating continuously over geological time.

3) Mechanical Sorting and Natural Beneficiation

As the sand was transported and reworked by rivers, waves and wind, the grains became rounded, washed and sorted by density and size.

Heavy minerals (such as ilmenite, rutile, magnetite) naturally drop out earlier because they settle faster. Quartz, being lighter and more resistant, stays and concentrates.

This natural mechanical sorting produces highly uniform grain-size distribution, low heavy mineral content and very low iron contamination.

This is exactly what solar glass and semiconductor producers require.

A Key Step for the BFS

The MIE test work represents an important third-party deliverable within the ongoing Bankable Feasibility Study (BFS).

The key conclusions are clear: Ultra-high purity is confirmed, and only minimal processing is needed to achieve premium specifications. The material demonstrates excellent compatibility with solar glass manufacturing and aligns strongly with the global shift toward antimony-free production.

These findings add confidence to the BFS and lay the foundation for a sustained competitive advantage based on the deposit’s exceptional natural purity. They also strengthen Homerun’s strategic position and validate the economics of establishing large-scale, antimony-free solar glass production in Brazil.

Bottom Line

The latest results confirm that SME is not just a silica deposit but a naturally optimized raw-material system with characteristics rarely seen anywhere in the world. Its unique geological history delivers a level of inherent purity that gives Homerun a structural advantage from day one and positions the project exceptionally well for large-scale development.

In an industry where purity sets the ceiling for performance and economics, Homerun’s SME silica provides the kind of natural advantage competitors can not easily replicate or engineer through processing alone.

This is a foundational milestone for the company’s silica and solar-glass strategy. One that materially de-risks the commercial pathway ahead and strengthens the long-term visibility of Homerun’s development plans, future growth trajectory, and industry-shaping potential.

Company Details

Homerun Resources Inc.

#2110 – 650 West Georgia Street

Vancouver, BC, V6B 4N7 Canada

Phone: +1 844 727 5631

Email: info@homerunresources.com

www.homerunresources.com

ISIN: CA43758P1080 / CUSIP: 43758P

Shares Issued & Outstanding: 64,081,179

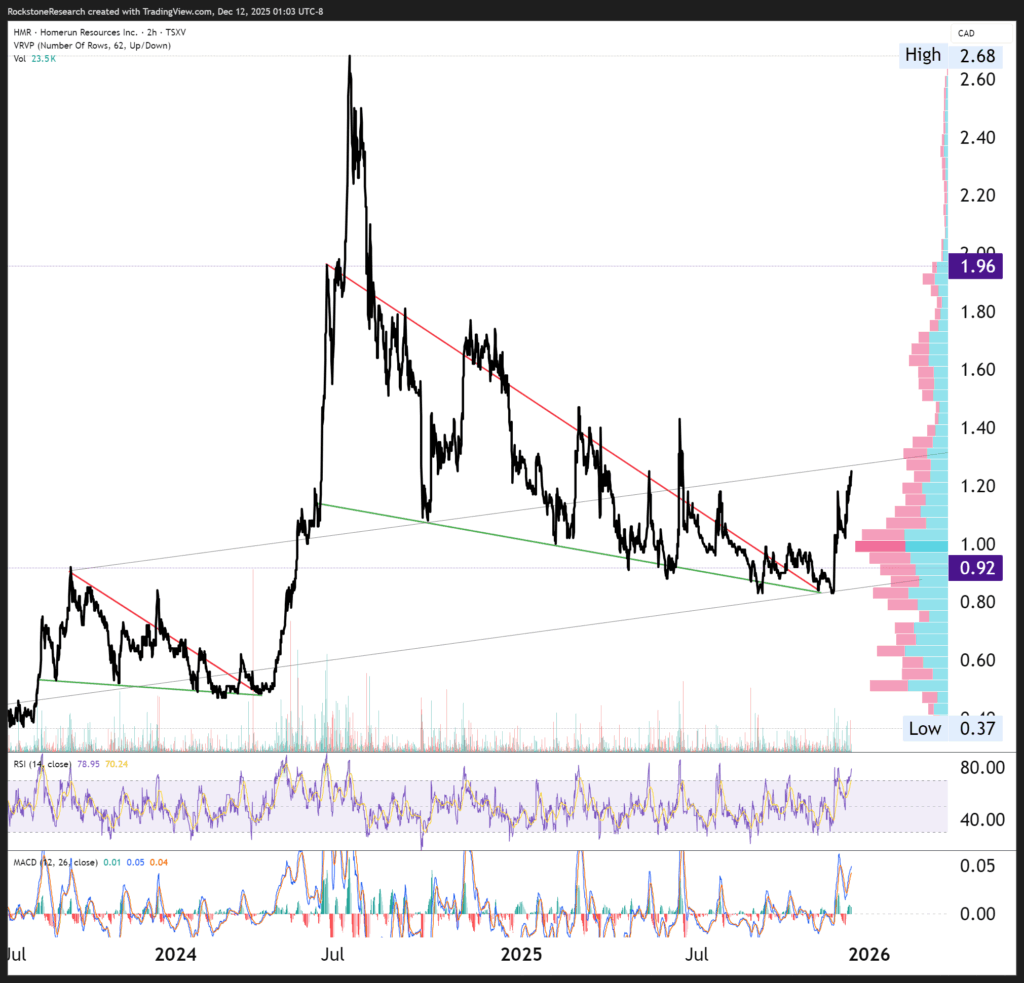

Canada Symbol (TSX.V): HMR

Current Price: 1.25 CAD (12/11/2025)

Market Capitalization: 80 Million CAD

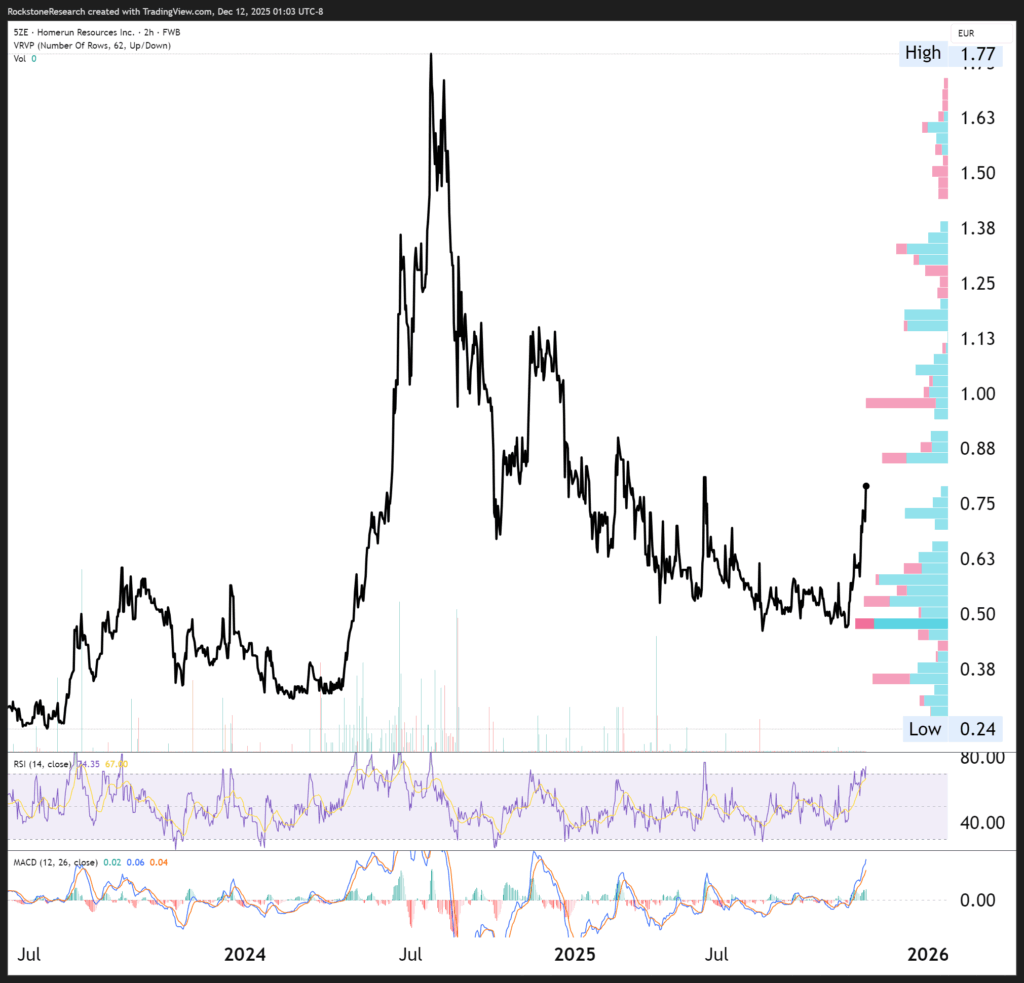

Germany Ticker / WKN: 5ZE / A3CYRW

Current Price: 0.79 EUR (12/12/2025)

Market Capitalization: 51 Million EUR

Stephan Bogner

Contact

Rockstone News & Research

Stephan Bogner (Dipl. Kfm., FH)

Müligässli 1, 8598 Bottighofen

Switzerland

Phone: +41-71-5896911

Email: info@rockstone-news.com

Disclaimer and Information on Forward Looking Statements: Rockstone and Homerun Resources Inc. (“Homerun“) caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to Homerun’s public filings for a more complete discussion of such risk factors and their potential effects, which may be accessed through its documents filed on SEDAR+ at www.sedarplus.ca. All statements in this report, other than statements of historical fact, should be considered forward-looking statements. Much of this report is comprised of statements of projection. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in these forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements include expectations related to: SME’s silica resource quality, including assumptions that future drilling, sampling, bulk testing, or independent laboratory work will continue to confirm impurity levels, grain characteristics, and SiO₂ grades consistent with the confirmation test results reported by Minerali Industriali Engineering (MIE) in December 2025. Processing performance and upgradeability, including assumptions that minimal-processing pathways demonstrated by MIE (e.g. wet screening, attrition washing, gravimetric separation, and magnetic separation) will scale effectively to pilot, demonstration, and commercial levels; that impurity reductions will remain consistent; and that process simplicity will translate into the expected operating-cost, capital-cost, and ESG advantages. Suitability for solar glass and premium glass markets, including assumptions that SME silica will continue to meet or exceed chemical and physical specifications for antimony-free solar glass and other high-purity industrial glass applications; that downstream manufacturers will accept SME material; and that additional qualification steps will validate the consistency, performance, and scalability indicated by early results. Market access and commercial adoption, including expectations that SME silica will be competitive in markets such as solar glass, PV-grade float glass, specialty glass, engineered materials, and industrial applications. These expectations rely on assumptions regarding sustained demand growth, pricing conditions, successful bulk-sample qualification, third-party validation, and the scalability of SME’s processing flowsheet. Strategic positioning within global supply chains, including assumptions that SME’s ultra-low impurity profile and minimal-processing requirements will provide durable competitive advantages; that the deposit may offer diversification benefits to solar and advanced-materials supply chains; and that customers, policymakers, and industrial partners will value lower-footprint, naturally derived silica sources. ESG, permitting, and regulatory outcomes, including assumptions that regulatory agencies will approve project development within anticipated timelines; that environmental and community-acceptance conditions will align with expectations; and that SME’s minimal-processing approach will reduce potential environmental impacts relative to more chemical-intensive silica operations. Economic and commercial outcomes, including assumptions that project capital and operating costs will align with internal projections; that premium markets such as solar glass will remain accessible and economically attractive; that Homerun can secure the partnerships, financing, and offtake agreements required for development; and that geological or metallurgical variability will not materially alter project economics or scalability. Comparisons to other silica projects, including assumptions that SME’s impurity levels, natural pre-beneficiation, and processing simplicity will continue to benchmark favorably against competing silica or glass sand deposits globally, including those in Australia, North America, or elsewhere in Brazil. Such forward-looking statements are based on assumptions that Rockstone considers reasonable, but no assurance can be given that these expectations will prove correct. Readers are cautioned not to place undue reliance on forward-looking information. Risks and uncertainties include, but are not limited to: Geological & Resource Risks: The quantity, quality, homogeneity, or distribution of silica at Santa Maria Eterna (“SME”) may differ from expectations. Future drilling, sampling, bulk testing, or independent analyses may not confirm the impurity levels, SiO₂ grades, or grain characteristics indicated by the MIE confirmation testwork. Geological variability may influence processing outcomes, recoveries, or resource classification. Processing & Scale-Up Risks: Processing performance observed at laboratory scale, including wet screening, attrition washing, gravimetric separation, and magnetic separation, may not scale as expected to pilot or commercial levels. Impurity reduction may vary across material types or operational conditions. Processing costs, energy usage, equipment performance, and circuit efficiency may differ from assumptions used in economic evaluations. Solar Glass & Product-Qualification Risks: SME silica may not consistently meet end-market specifications for solar glass, antimony-free glass, specialty glass, or related industrial applications. Additional qualification steps may require more time, capital, or technical adjustments than anticipated. Downstream customers may decline to approve SME material based on chemistry, grain morphology, stability, or long-term performance criteria. Market Access & Commercial Adoption Risks: Entry into solar glass and premium industrial markets typically requires multi-stage qualification, bulk sampling, and long-term validation. Customers may delay qualification, prefer incumbent suppliers, negotiate lower pricing, or require additional specifications not yet demonstrated. Market demand, growth rates, or pricing conditions may differ from expectations. Competitive & Industry Risks: Global silica, solar glass, and industrial glass markets are competitive. Established producers, including those in major Australian glass sand districts and other high-purity regions, may expand production, reduce prices, or secure long-term contracts with key customers. Competitors may develop alternative deposit types, purification technologies, or supply chains that diminish SME’s relative advantages. Permitting, ESG & Regulatory Risks: Development of mining areas, processing facilities, and related infrastructure requires various environmental approvals, land-use permits, and community engagement processes. Permits may be delayed, denied, modified, or conditioned on additional ESG requirements. While SME’s minimal-processing pathway is expected to reduce environmental impact, regulatory agencies may impose conditions that affect project timelines, scope, or cost. Infrastructure, Logistics & Operational Risks: Construction, commissioning, and operation of processing facilities may face technical challenges, delays, or cost overruns. Availability of specialized equipment, stable power supply, industrial water, or transport infrastructure may affect timelines and operating costs. Operational performance may differ from engineering models or early-stage testwork. Financing & Capital Market Risks: Advancing SME through additional drilling, pilot processing, feasibility studies, facility construction, and commercial scaling will require significant capital. Financing may not be available on acceptable terms due to market volatility, interest-rate environments, investor sentiment, or macroeconomic conditions. Equity or debt financing may dilute existing shareholders or impose restrictive covenants. Pricing & Economic Risks: Silica, solar glass, and industrial glass markets are subject to pricing volatility driven by supply-demand shifts, technological developments, energy costs, and global economic conditions. Assumptions regarding premium pricing for low-iron silica may not be realized. Project economics may be adversely affected by changes in labor, reagent, equipment, or energy costs, as well as foreign-exchange fluctuations. Offtake, Partnership & Counterparty Risks: Negotiations with potential customers, industrial partners, or processing counterparts may not lead to agreements. Offtake buyers may delay commitments, adjust specifications, or require additional verification steps. Counterparties may fail to meet contractual obligations or alter commercial terms. Regulatory, Trade & Policy Risks: Changes in mining regulations, environmental policy, taxation, export controls, or industrial incentives in Brazil or internationally may impact project development and market access. Trade disputes, tariffs, or reshoring initiatives may influence competitiveness in solar glass and materials markets. Macroeconomic, Commodity & Currency Risks: Inflation, recession, geopolitical instability, supply-chain disruptions, or broader commodity-market events may affect project costs, financing availability, and customer demand. Currency fluctuations between BRL, USD, CAD and EUR may materially impact capital and operating costs and revenue assumptions. Force Majeure & External Event Risks: Extreme weather, climate impacts, natural disasters, pandemics, political instability, or other external events may materially disrupt operations, construction, logistics, or scheduling. Liquidity & Trading Risks: As a small-cap issuer, Homerun’s shares may experience limited liquidity, significant price volatility, or wide bid–ask spreads. Market sentiment may diverge from project fundamentals, affecting valuation independently of operational progress. Accordingly, readers should not place undue reliance on forward-looking information. Rockstone and the author of this report do not undertake any obligation to update any statements made in this report except as required by law. Past performance and comparisons to other companies or jurisdictions are provided for illustrative purposes only and should not be considered indicative of future results.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Rockstone, its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including Rockstone’s report, especially if the investment involves a small, thinly-traded company that isn’t well known. The author of this report, Stephan Bogner, is paid by Homerun Resources Inc. On September 8, 2025, Homerun announced that the company “entered into an agreement with Rockstone Research to provide marketing services to the company”, and that “Rockstone Research is an arm’s-length marketing firm and has been engaged for an initial three-month term for total consideration of $25,000, which is payable up front. The company does not propose to issue any securities to Rockstone in consideration for the services to be provided to the company.” The author owns equity of Homerun and thus will profit from volume and price appreciation of the stock. This also represents a significant conflict of interest that may affect the objectivity of this reporting. The author may buy or sell securities of Homerun (or comparable companies) at any time without notice, which may give rise to additional conflicts of interest. Overall, multiple conflicts of interests exist. Therefore, the information provided in this report should not be construed as a financial analysis or recommendation but as an advertisement. This report should be understood as a promotional publication and does not replace individual investment advice. Rockstone’s and the author’s views and opinions regarding the companies that are featured in the reports are the author‘s own views and are based on information that was received or found in the public domain, which is assumed to be reliable. Rockstone and the author have not undertaken independent due diligence of the information received or found in the public domain. Rockstone and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, Rockstone and the author do not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons that were made to other companies may not be valid or come into effect. Please read the entire Disclaimer carefully. If you do not agree to all of the Disclaimer, do not access this website or any of its pages including this report in form of a PDF. By using this website and/or report, and whether or not you actually read the Disclaimer, you are deemed to have accepted it. Information provided is educational and general in nature. Data, tables, figures and pictures, if not labeled or hyperlinked otherwise, have been obtained from Stockwatch.com, Tradingview.com, Homerun Resources Inc. and the public domain.